Answered step by step

Verified Expert Solution

Question

1 Approved Answer

York Industries has planned for the following purchases in the next five months. Budgeted Purchases $42,500 $38,500 $39,600 $52,800 $66,700 Month June July August

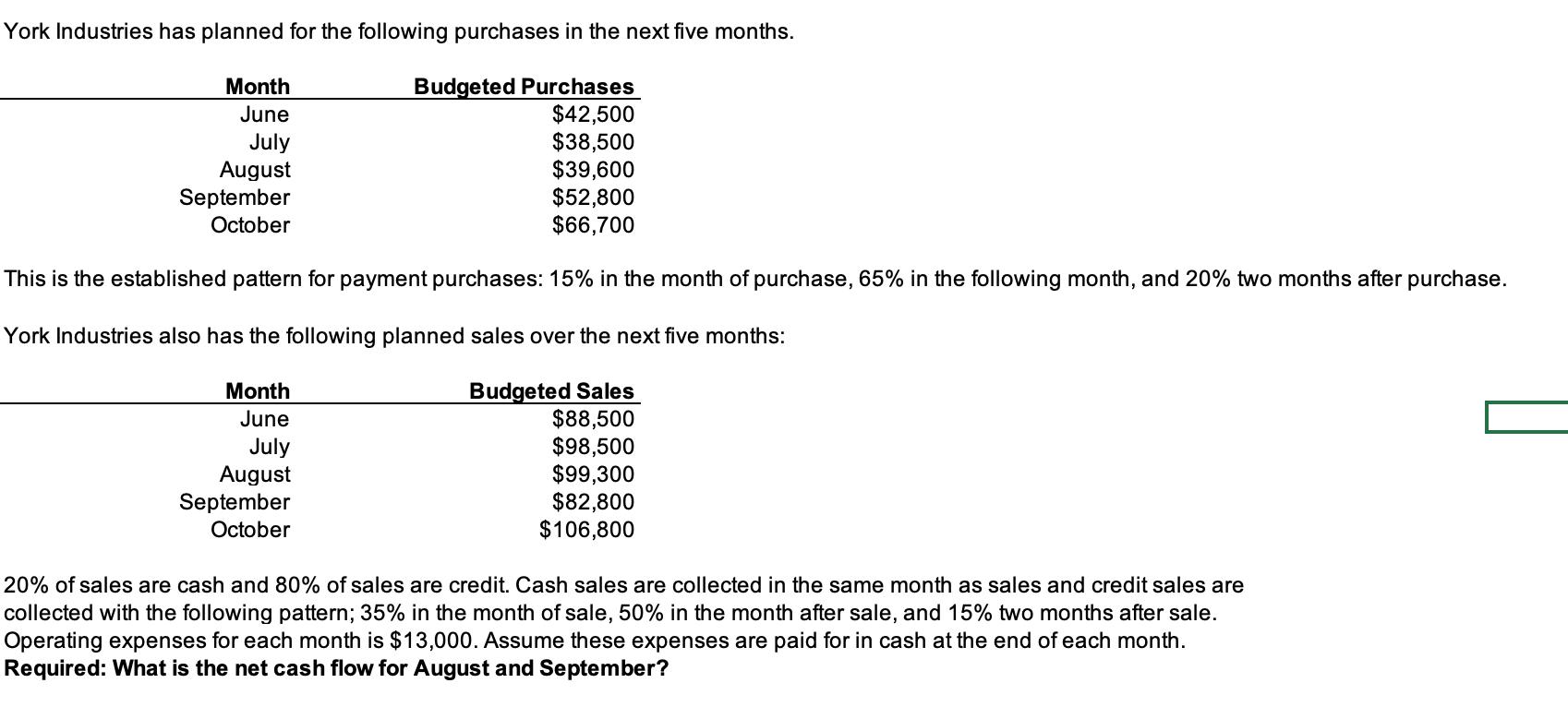

York Industries has planned for the following purchases in the next five months. Budgeted Purchases $42,500 $38,500 $39,600 $52,800 $66,700 Month June July August September October This is the established pattern for payment purchases: 15% in the month of purchase, 65% in the following month, and 20% two months after purchase. York Industries also has the following planned sales over the next five months: Budgeted Sales $88,500 $98,500 $99,300 $82,800 $106,800 Month June July August September October 20% of sales are cash and 80% of sales are credit. Cash sales are collected in the same month as sales and credit sales are collected with the following pattern; 35% in the month of sale, 50% in the month after sale, and 15% two months after sale. Operating expenses for each month is $13,000. Assume these expenses are paid for in cash at the end of each month. Required: What is the net cash flow for August and September?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

wcollection from Salen Particulara June E Julyl Augusr 4 Seprember october Budgeted Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started