Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yorks outstanding stock consists of 65,000 shares of noncumulative 7.0% preferred stock with a $5 par value and also 110,000 shares of common stock with

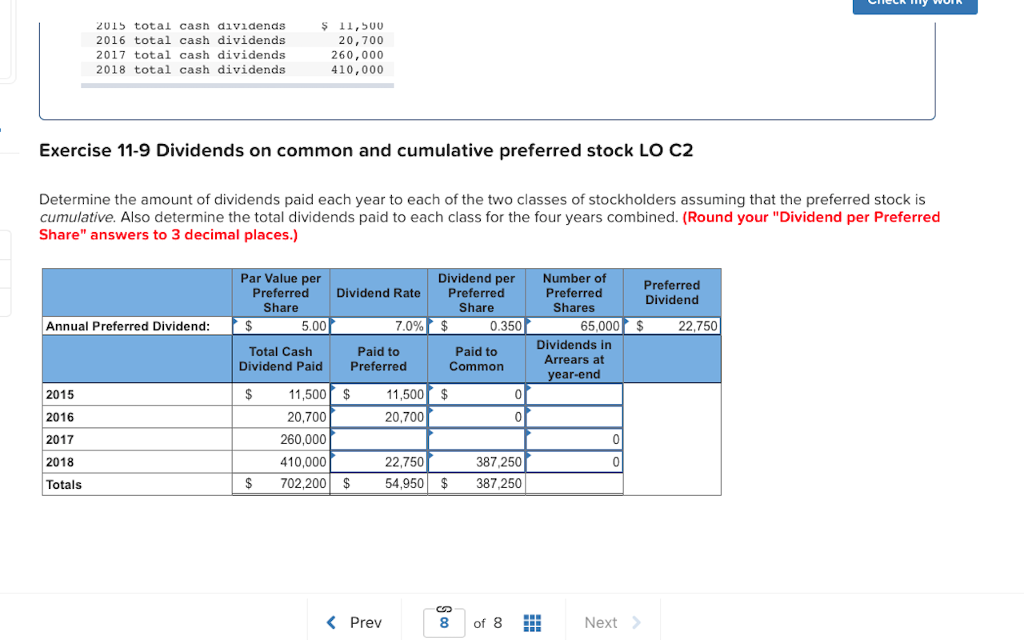

Yorks outstanding stock consists of 65,000 shares of noncumulative 7.0% preferred stock with a $5 par value and also 110,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends:

Yorks outstanding stock consists of 65,000 shares of noncumulative 7.0% preferred stock with a $5 par value and also 110,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends:

| 2015 total cash dividends | $ | 11,500 |

| 2016 total cash dividends | 20,700 | |

| 2017 total cash dividends | 260,000 | |

| 2018 total cash dividends | 410,000 | |

2015 tota cash dividends 2016 total cash dividends 2017 total cash dividends 2018 total cash dividends $ 11,500 20,700 260,000 410,000 Exercise 11-9 Dividends on common and cumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholders assuming that the preferred stock is cumulative. Also determine the total dividends paid to each class for the four years combined. (Round your "Dividend per Preferred Share" answers to 3 decimal places.) Par Value per Preferred Share Number of Preferred Shares Dividend per Preferred Dividend Dividend RatePreferred Share Annual Preferred Dividend: 5.00 7.0% $ 0.350 65,000 22,750 Dividends in Arrears at ear-end Paid to Paid to Common Total Cash Dividend Paid Preferred 11,500 20,700 11,500 $ 2015 2016 2017 2018 Totals 20,700 260,000 410,000 387,250 $702,200 54,950$387,250 22,750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started