Answered step by step

Verified Expert Solution

Question

1 Approved Answer

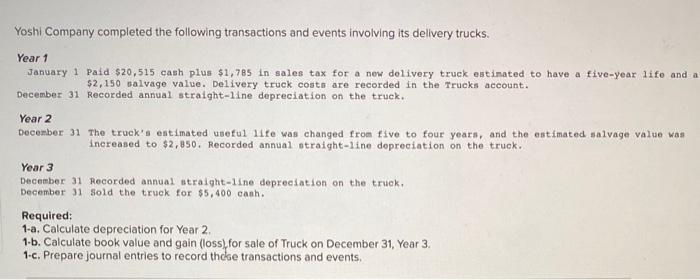

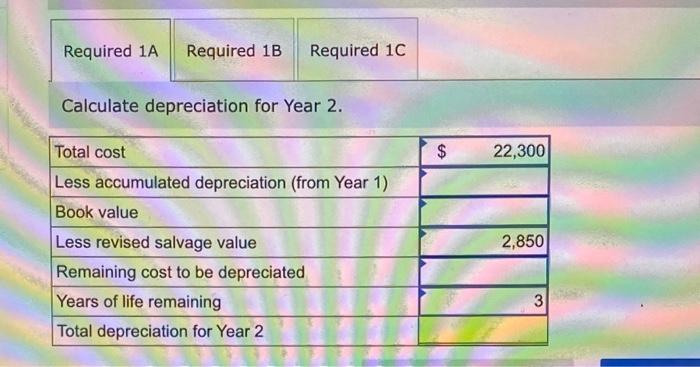

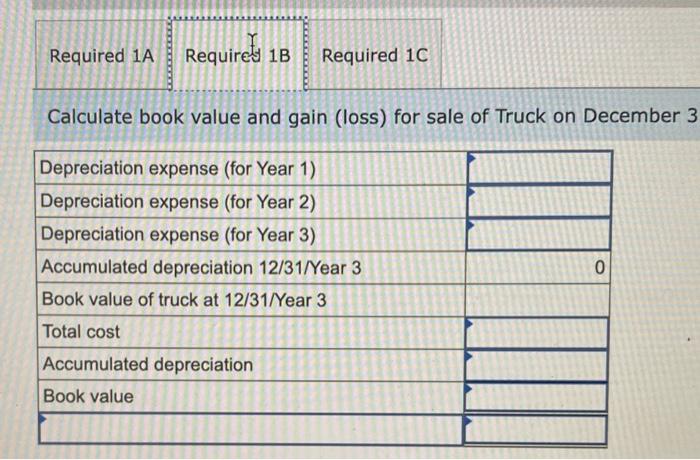

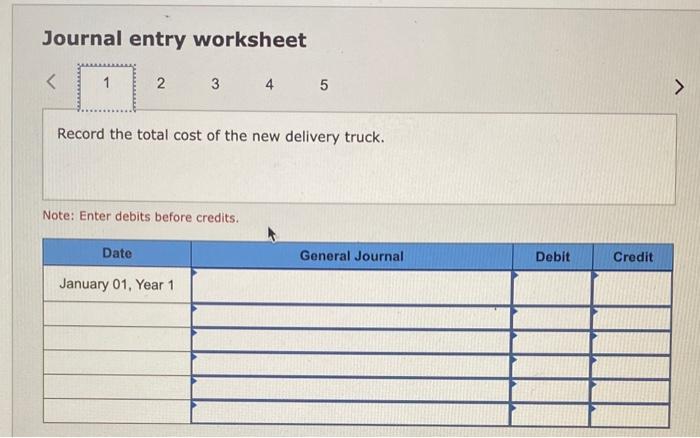

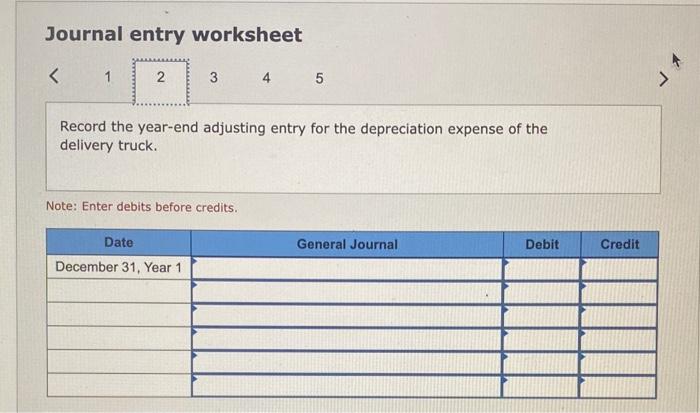

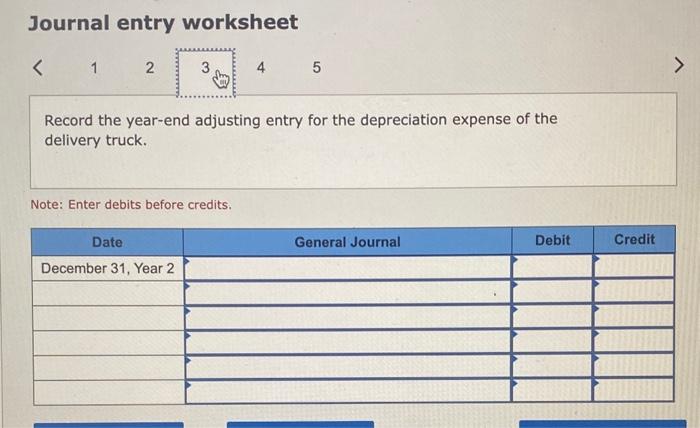

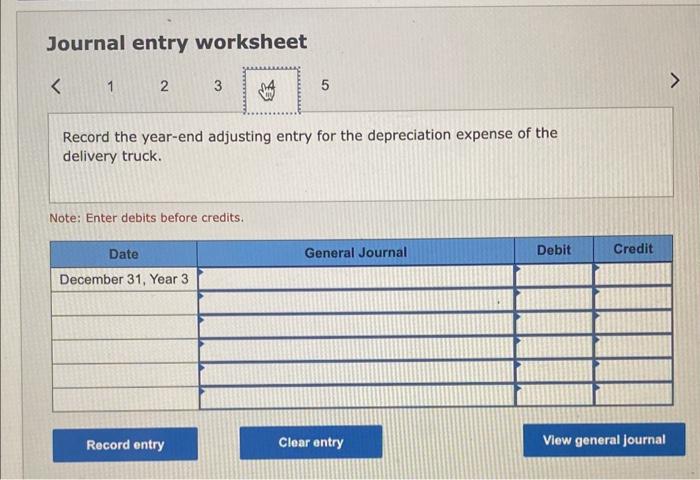

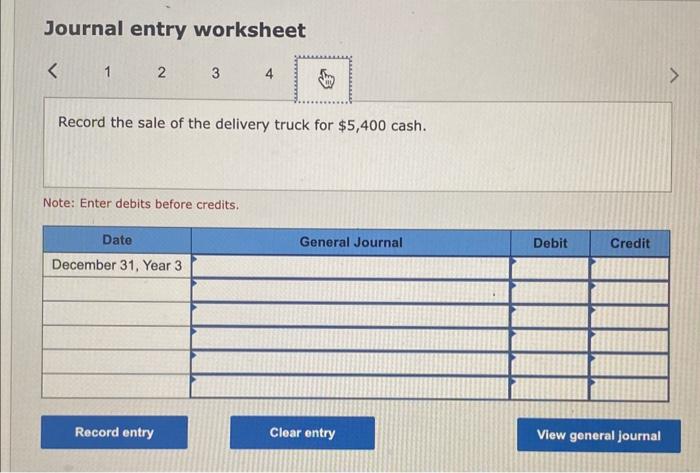

Yoshi Company completed the following transactions and events involving its dellvery trucks. Year 1 January 1 paid $20,515 cash plus $1,785 in sales tax for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started