Answered step by step

Verified Expert Solution

Question

1 Approved Answer

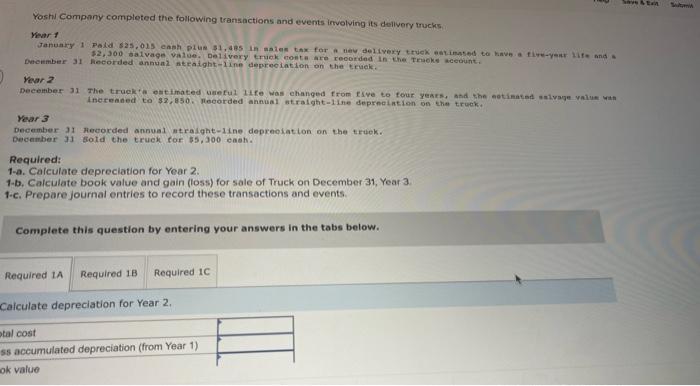

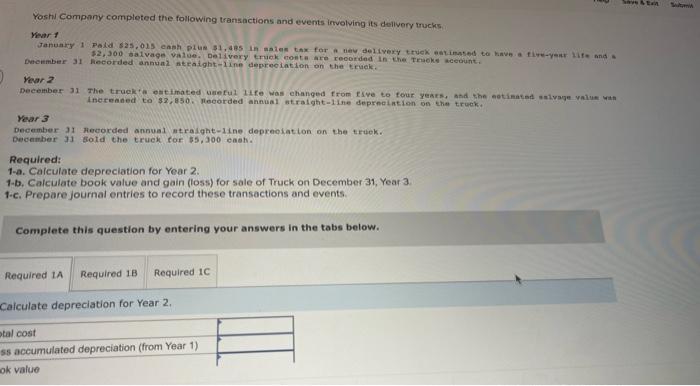

Yoshl Compony completed the following tranisactions and events irvolving its dellvery truckis. Yevar 1 $2, 300 dalvage value. Delivery truek cont a are reoorded in-the

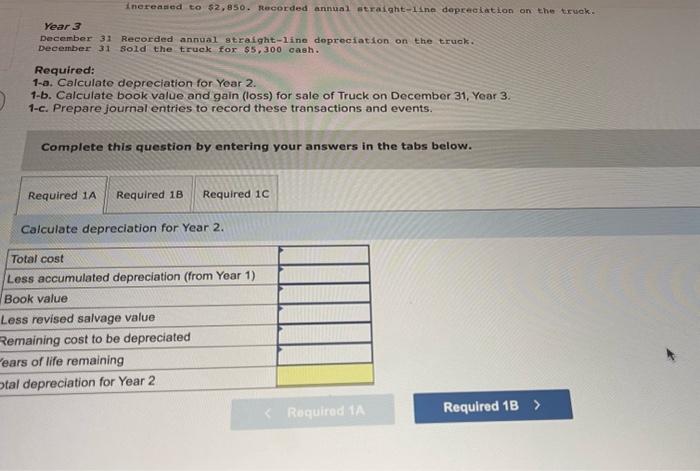

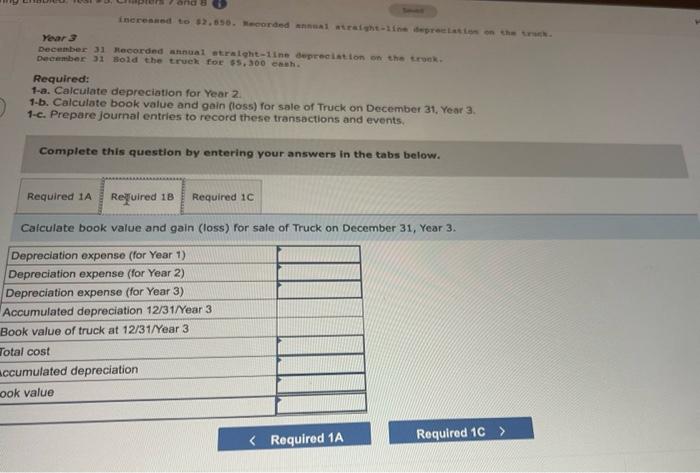

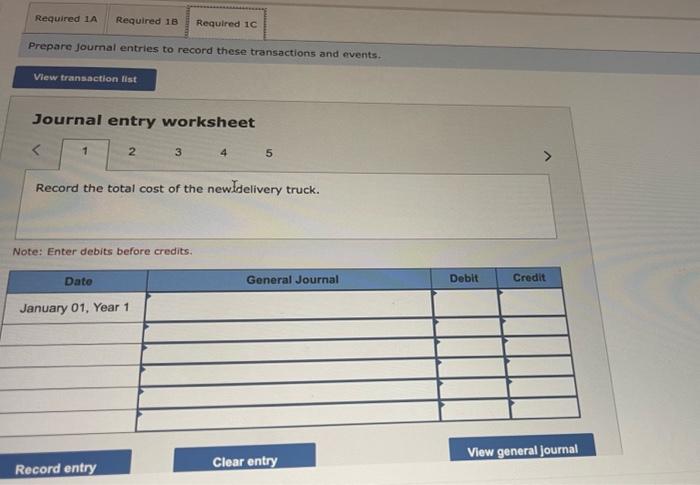

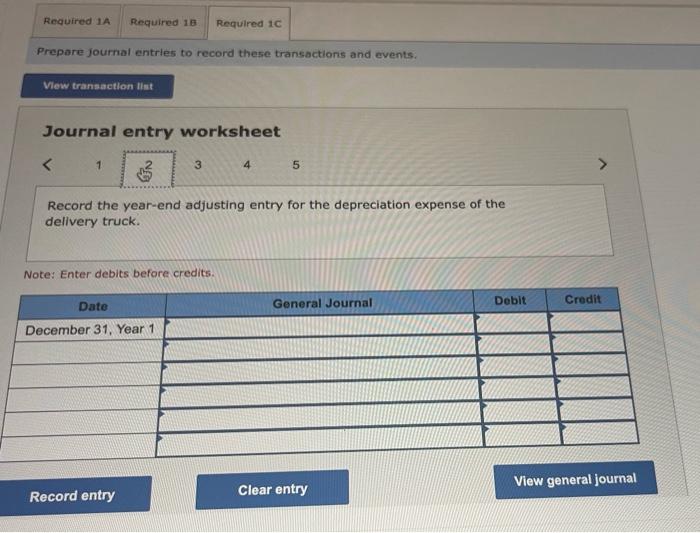

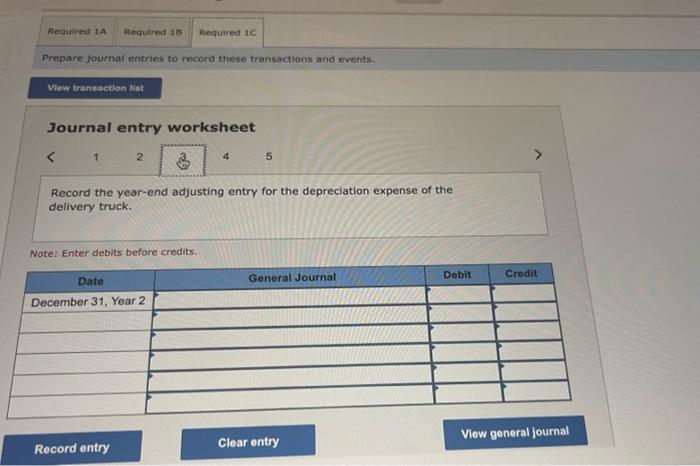

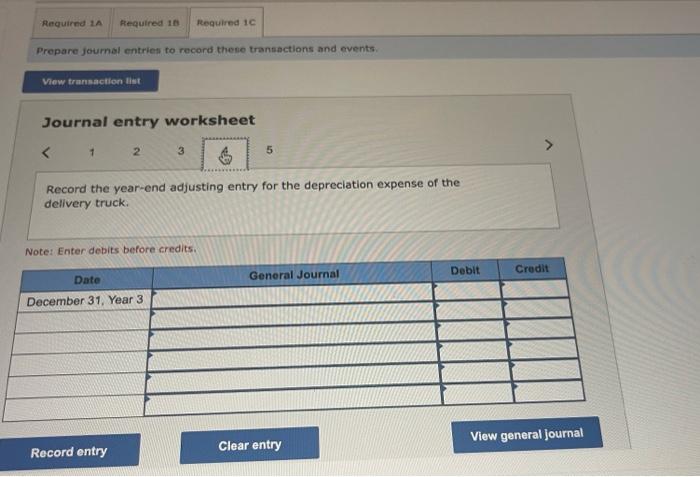

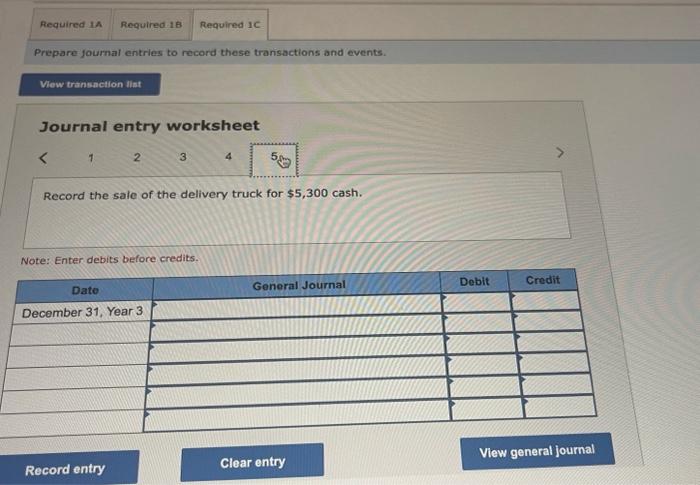

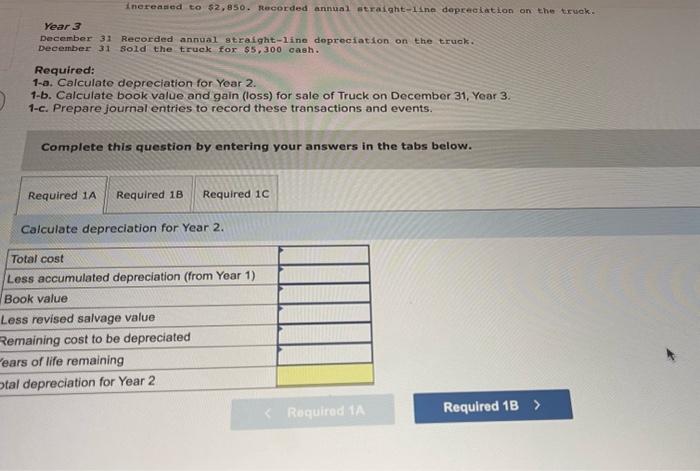

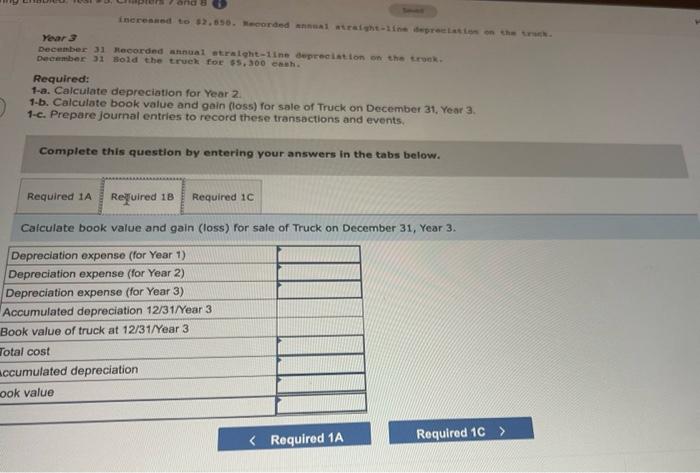

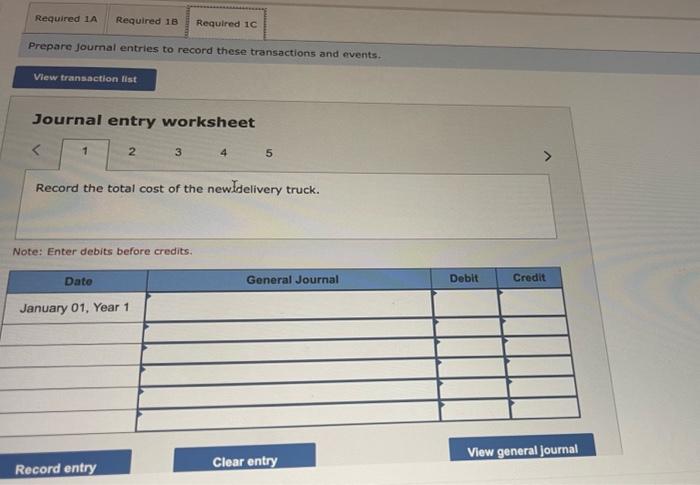

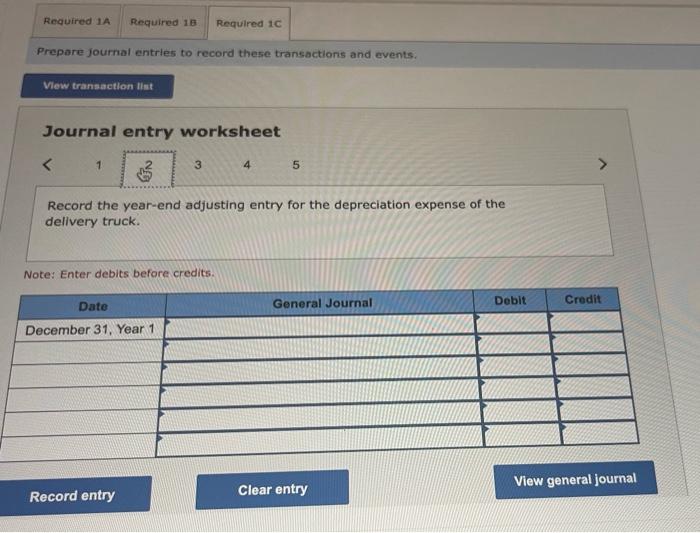

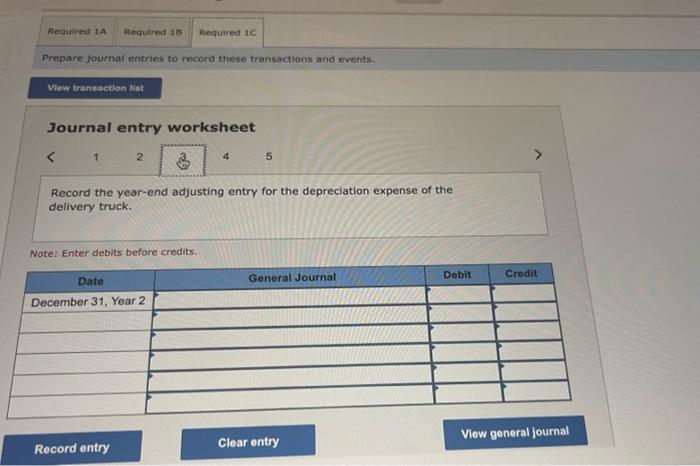

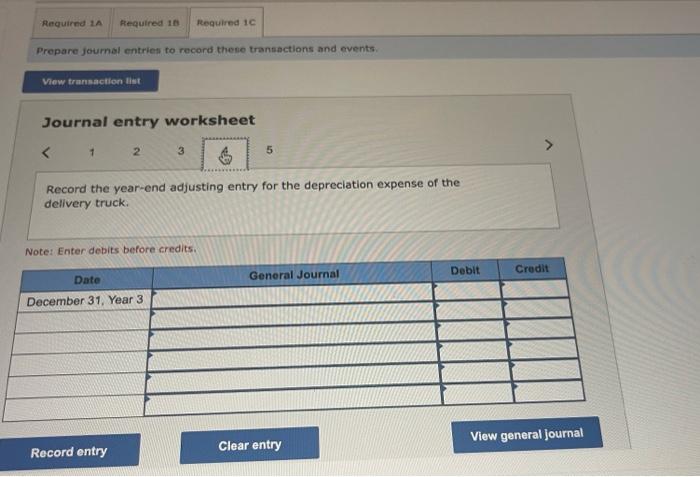

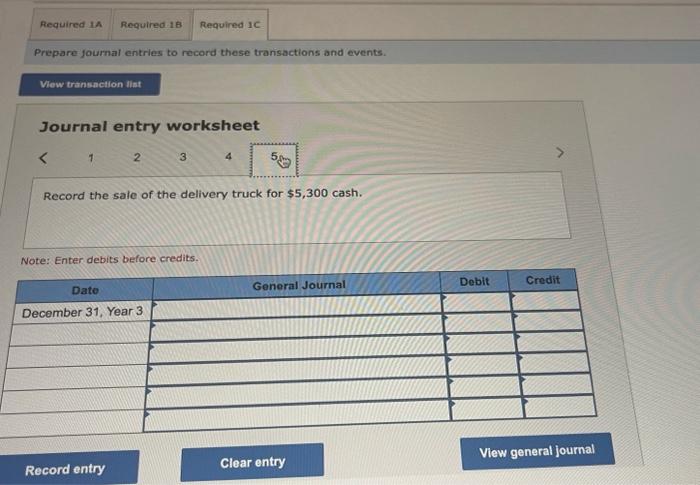

Yoshl Compony completed the following tranisactions and events irvolving its dellvery truckis. Yevar 1 \$2, 300 dalvage value. Delivery truek cont a are reoorded in-the tracke weecuht. Daenmber 31 hecorded annual ntraight-iine depreolation on the tracik. revar 3 December 31 The truel tie estimated uneful life was ehanged from five to four. Years, aha she natinated onlvage valus wat inereaned to $2,850, poeorded annual ntralght-1ine deprneintion on the truok. Yevar 3 December 31 Hecorded annual intralght-1ine depreolation on the truek. December 31 sotd the trueh for 55,300 eash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare joumal entries to record these transactions and ovents. Complete this question by entering your answers in the tabs below. Galculate depreciation for Year 2. Inereased to $2,850. Recorded anmuel straight-1ine depreckation on the truok. Vear3 December 31 Recorded annual gtraight-line dopreciation on the truok. December 31 sold the truek for $5,300 cash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Calculate depreciation for Year 2. Required: 1-a. Calculate depreciation for Year 2 . 1.b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Cafculate book value and gain (loss) for sale of Truck on December 31 , Year 3. Prepare joumal entries to record these transactions and events. Journal entry worksheet 5 Record the total cost of the newidelivery truck. Note: Enter debits before credits. Prepare journal entries to record these transactions and events. Journal entry worksheet 5 Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare fournal entries to recond these transactions and events. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare journal entries to record thene transactions and events. Journal entry worksheet 5 Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare fournal entries to record these tranisactions and events. Journal entry worksheet Record the sale of the delivery truck for $5,300 cash. Note: Enter debits before credits

Yoshl Compony completed the following tranisactions and events irvolving its dellvery truckis. Yevar 1 \$2, 300 dalvage value. Delivery truek cont a are reoorded in-the tracke weecuht. Daenmber 31 hecorded annual ntraight-iine depreolation on the tracik. revar 3 December 31 The truel tie estimated uneful life was ehanged from five to four. Years, aha she natinated onlvage valus wat inereaned to $2,850, poeorded annual ntralght-1ine deprneintion on the truok. Yevar 3 December 31 Hecorded annual intralght-1ine depreolation on the truek. December 31 sotd the trueh for 55,300 eash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare joumal entries to record these transactions and ovents. Complete this question by entering your answers in the tabs below. Galculate depreciation for Year 2. Inereased to $2,850. Recorded anmuel straight-1ine depreckation on the truok. Vear3 December 31 Recorded annual gtraight-line dopreciation on the truok. December 31 sold the truek for $5,300 cash. Required: 1-a. Calculate depreciation for Year 2. 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Calculate depreciation for Year 2. Required: 1-a. Calculate depreciation for Year 2 . 1.b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events. Complete this question by entering your answers in the tabs below. Cafculate book value and gain (loss) for sale of Truck on December 31 , Year 3. Prepare joumal entries to record these transactions and events. Journal entry worksheet 5 Record the total cost of the newidelivery truck. Note: Enter debits before credits. Prepare journal entries to record these transactions and events. Journal entry worksheet 5 Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare fournal entries to recond these transactions and events. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare journal entries to record thene transactions and events. Journal entry worksheet 5 Record the year-end adjusting entry for the depreciation expense of the dellvery truck. Note: Enter debits before credits. Prepare fournal entries to record these tranisactions and events. Journal entry worksheet Record the sale of the delivery truck for $5,300 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started