Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yost received 300 NQOs (each option gives Yost the right to purchase 10 shares of Cutter Corporation stock for $15 per share). At the

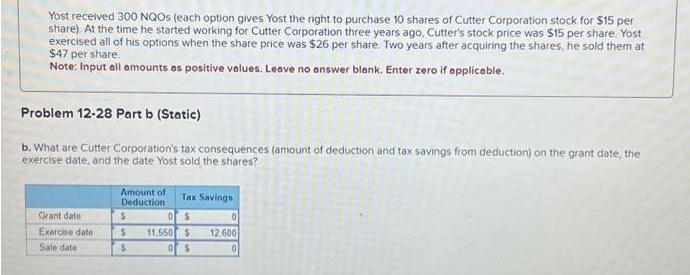

Yost received 300 NQOs (each option gives Yost the right to purchase 10 shares of Cutter Corporation stock for $15 per share). At the time he started working for Cutter Corporation three years ago, Cutter's stock price was $15 per share. Yost exercised all of his options when the share price was $26 per share. Two years after acquiring the shares, he sold them at $47 per share Note: Input all amounts as positive values. Leave no answer blank. Enter zero if applicable. Problem 12-28 Part b (Static) b. What are Cutter Corporation's tax consequences (amount of deduction and tax savings from deduction) on the grant date, the exercise date, and the date Yost sold the shares? Amount of Deduction Tax Savings Grant date S 0 $ 0 Exercise date S 11,550 $ 12 600 Sale date: $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the tax consequences for Cutter Corporation at each relevant date 1 Grant date There ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d745eccd11_966764.pdf

180 KBs PDF File

663d745eccd11_966764.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started