Question

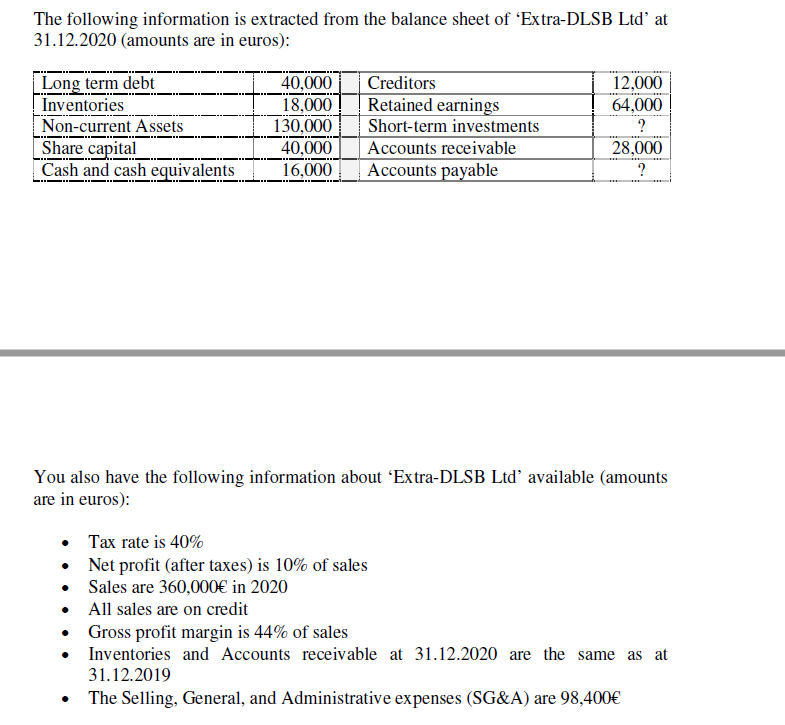

You also have the following information about Extra-DLSB Ltd available (amounts are in euros): Tax rate is 40% Net profit (after taxes) is 10% of

You also have the following information about Extra-DLSB Ltd available (amounts are in euros): Tax rate is 40% Net profit (after taxes) is 10% of sales Sales are 360,000 in 2020 All sales are on credit Gross profit margin is 44% of sales Inventories and Accounts receivable at 31.12.2020 are the same as at 31.12.2019 The Selling, General, and Administrative expenses (SG&A) are 98,400

Moreover, the financial ratios are calculated as follows: - Receivables turnover ratio= Sales (on credit) / Average Accounts receivable - Inventories turnover ratio = Cost of goods sold / Average Inventories - Current ratio = Current assets / Current Liabilities - Quick ratio = (Current assets - Inventories) / Current Liabilities

Using this information, you are required for the year 2020 to calculate:

b. Receivables turnover ratio

The following information is extracted from the balance sheet of 'Extra-DLSB Ltd' at 31.12.2020 (amounts are in euros): Long term debt Inventories Non-current Assets Share capital Cash and cash equivalents 40,000 18,000 130,000 40,000 16,000 Creditors Retained earnings Short-term investments Accounts receivable Accounts payable 12,000 64,000 ? 28,000 ? II. You also have the following information about 'Extra-DLSB Ltd' available (amounts are in euros): Tax rate is 40% Net profit (after taxes) is 10% of sales Sales are 360,000 in 2020 All sales are on credit Gross profit margin is 44% of sales Inventories and Accounts receivable at 31.12.2020 are the same as at 31.12.2019 The Selling, General, and Administrative expenses (SG&A) are 98,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started