Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A: You and two friends started a company called Pro Gamers Inc. on January 1, 2019 to develop a new RPG game. It

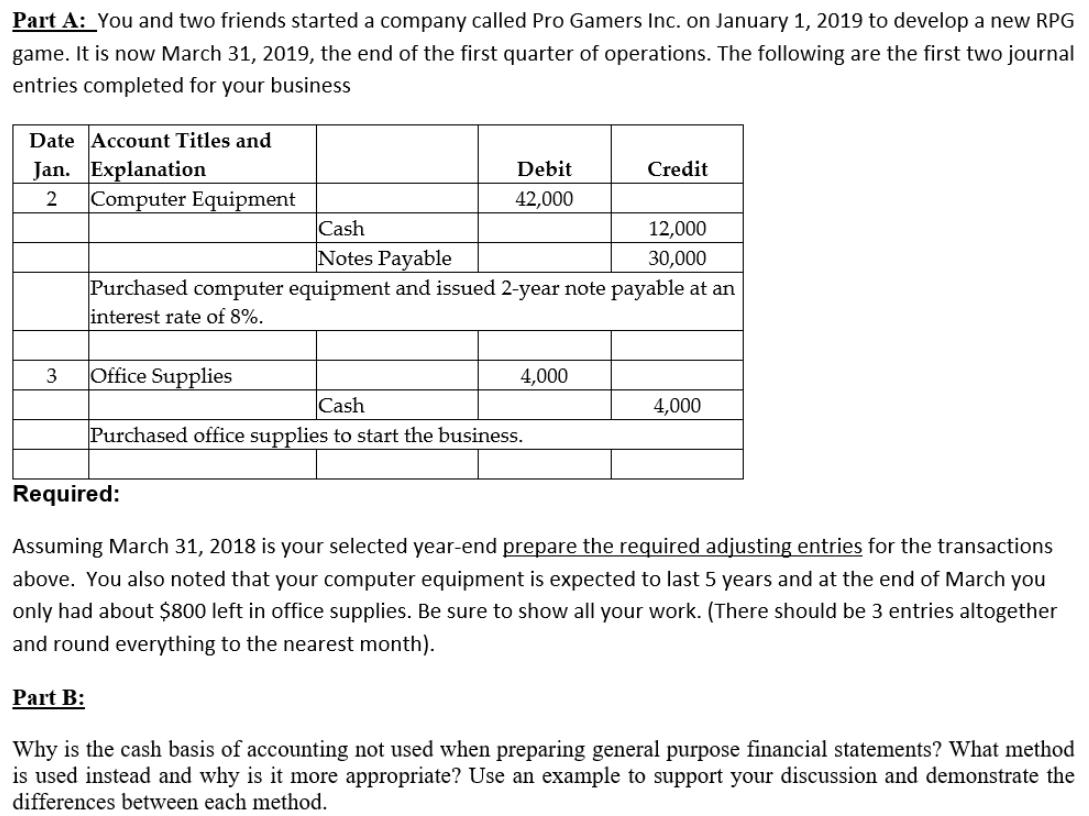

Part A: You and two friends started a company called Pro Gamers Inc. on January 1, 2019 to develop a new RPG game. It is now March 31, 2019, the end of the first quarter of operations. The following are the first two journal entries completed for your business Date Account Titles and Jan. Explanation Computer Equipment Debit Credit 42,000 Cash 12,000 Notes Payable 30,000 Purchased computer equipment and issued 2-year note payable at an interest rate of 8%. Office Supplies 4,000 Cash Purchased office supplies to start the business. 4,000 Required: Assuming March 31, 2018 is your selected year-end prepare the required adjusting entries for the transactions above. You also noted that your computer equipment is expected to last 5 years and at the end of March you only had about $800 left in office supplies. Be sure to show all your work. (There should be 3 entries altogether and round everything to the nearest month). Part B: Why is the cash basis of accounting not used when preparing general purpose financial statements? What method is used instead and why is it more appropriate? Use an example to support your discussion and demonstrate the differences between each method.

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answers PART A PART B Cash basis of accounting is an accounting method which records business transa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started