Question

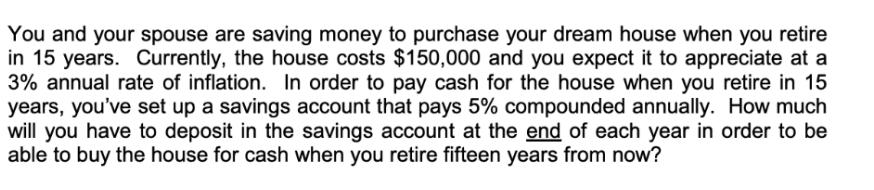

You and your spouse are saving money to purchase your dream house when you retire in 15 years. Currently, the house costs $150,000 and

You and your spouse are saving money to purchase your dream house when you retire in 15 years. Currently, the house costs $150,000 and you expect it to appreciate at a 3% annual rate of inflation. In order to pay cash for the house when you retire in 15 years, you've set up a savings account that pays 5% compounded annually. How much will you have to deposit in the savings account at the end of each year in order to be able to buy the house for cash when you retire fifteen years from now?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the amount that needs to be deposited at the end of each year we need to determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economic Analysis

Authors: Donald Newnan, Ted Eschanbach, Jerome Lavelle

9th Edition

978-0195168075, 9780195168075

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App