Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You Answered On January 1, 2020, Marsha and Jan were each 50% shareholders of Brady Corp., a calendar-year S corporation. Correct Answer During 2020,

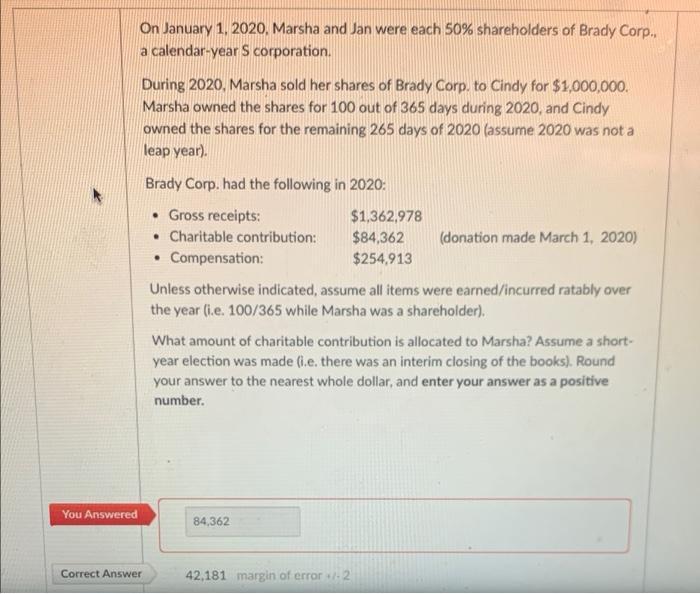

You Answered On January 1, 2020, Marsha and Jan were each 50% shareholders of Brady Corp., a calendar-year S corporation. Correct Answer During 2020, Marsha sold her shares of Brady Corp. to Cindy for $1,000,000. Marsha owned the shares for 100 out of 365 days during 2020, and Cindy owned the shares for the remaining 265 days of 2020 (assume 2020 was not a leap year). Brady Corp. had the following in 2020: Gross receipts: Charitable contribution: Compensation: $1,362,978 $84,362 $254,913 Unless otherwise indicated, assume all items were earned/incurred ratably over the year (i.e. 100/365 while Marsha was a shareholder). 84,362 (donation made March 1, 2020) What amount of charitable contribution is allocated to Marsha? Assume a short- year election was made (i.e. there was an interim closing of the books). Round your answer to the nearest whole dollar, and enter your answer as a positive number. 42,181 margin of error +/-2

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

What Charitable Is allocated to Marsha amount of Conlibuta 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started