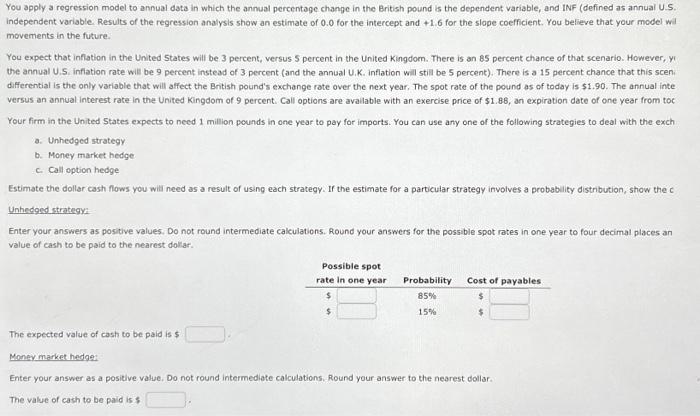

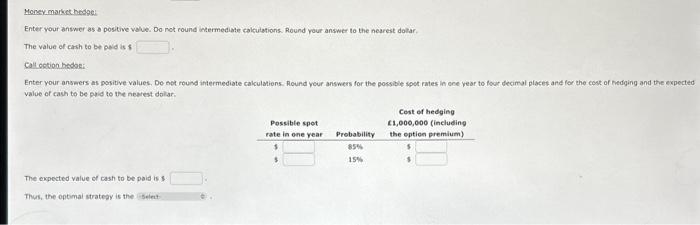

You apply a regression model to annual data in which the annual percentage chanpe in the British pound is the dependent variable, and INF (defined as annual U.S. independent variable. Results of the regression analysis show an estimate of 0.0 for the intercept and +1.6 for the slope coefficient. You believe that your model wil movements in the future. You expect that inflation in the United States will be 3 percent, versus 5 percent in the United Kingdorn. There is an 85 percent chance of that scenario. However, Y i the annual U.S. infiation rate will be 9 percent instead of 3 percent (and the annual U.K. inflation will still be 5 percent). There is a 15 percent chance that this scen. differential is the only variable that will affect the Bnish pound's exchange rate over the next year, The spot rate of the pound as of today is $1.90. The annual inte versus an annual interest rate in the United Kingdom of 9 percent. Call options are avallable with an exercise price of $1.88, an expiration date of one year from toc Your firm in the United States expects to need 1 million pounds in one year to pay for imports. You can use any one of the following strategies to deal with the exch a. Unhedged strategy b. Money market hedge c. Call option hedge Estimate the dollar cash flows you will need as a result of using each strategy. If the estimate for a particular strategy involves a probabulity distribution, show the c Unhedged strategy: Enter your answers as positive values, Do not round intermediate calculations. Round your answers for the possible spot rates in one year to four decimal places an value of cash to be paid to the nearest dollar. The expected value of cash to be paid is $ Monev market hedoe: Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest dollar. The value of cash to be paid is s Enter your answer as a postive value. Do not round intermediate calculations. Round your answer to the nearest dolar. The value of erih te be pold is $ Calloction heboes: value of cauh to be prid to the newest dolar. The expected value of cash to be paid is s Thes, the entimal stratesy is the