Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are 50 years old, having a long experience in finance, you landed a job at ENBD. Your salary is AED500,000 per year, and your

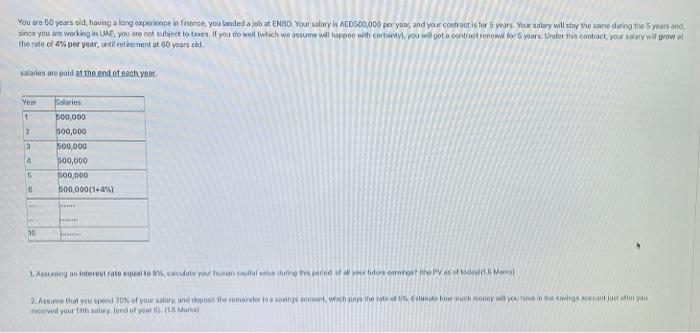

You are 50 years old, having a long experience in finance, you landed a job at ENBD. Your salary is AED500,000 per year, and your contract is for 5 years. Your salary will stay the same during the 5 years and, since you are working in UAE, you are not subject to taxes. If you do well (which we assume will happen with certainty), you will get a contract renewal for 5 years. Under this contract, your salary will grow at the rate of 4% per year, until retirement at 60 years old.

salaries are paid at the end of each year.

Year

Salaries

1

500,000

2

500,000

3

500,000

4

500,000

5

500,000

6

500,000(1+4%)

..

.

...

..

10

...

1. Assuming an interest rate equal to 5%, calculate your human capital value during this period of all your future earnings? (the PV as of today)(1.5 Marks)

2. Assume that you spend 70% of your salary, and deposit the remainder in a savings account, which pays the rate of 5%. Estimate how much money will you have in the savings account just after you received your fifth salary. (end of year 5). (1.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started