Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a bank loan officer. Dan has approached you for a loan for his business. He has two mutually exclusive proposals with different

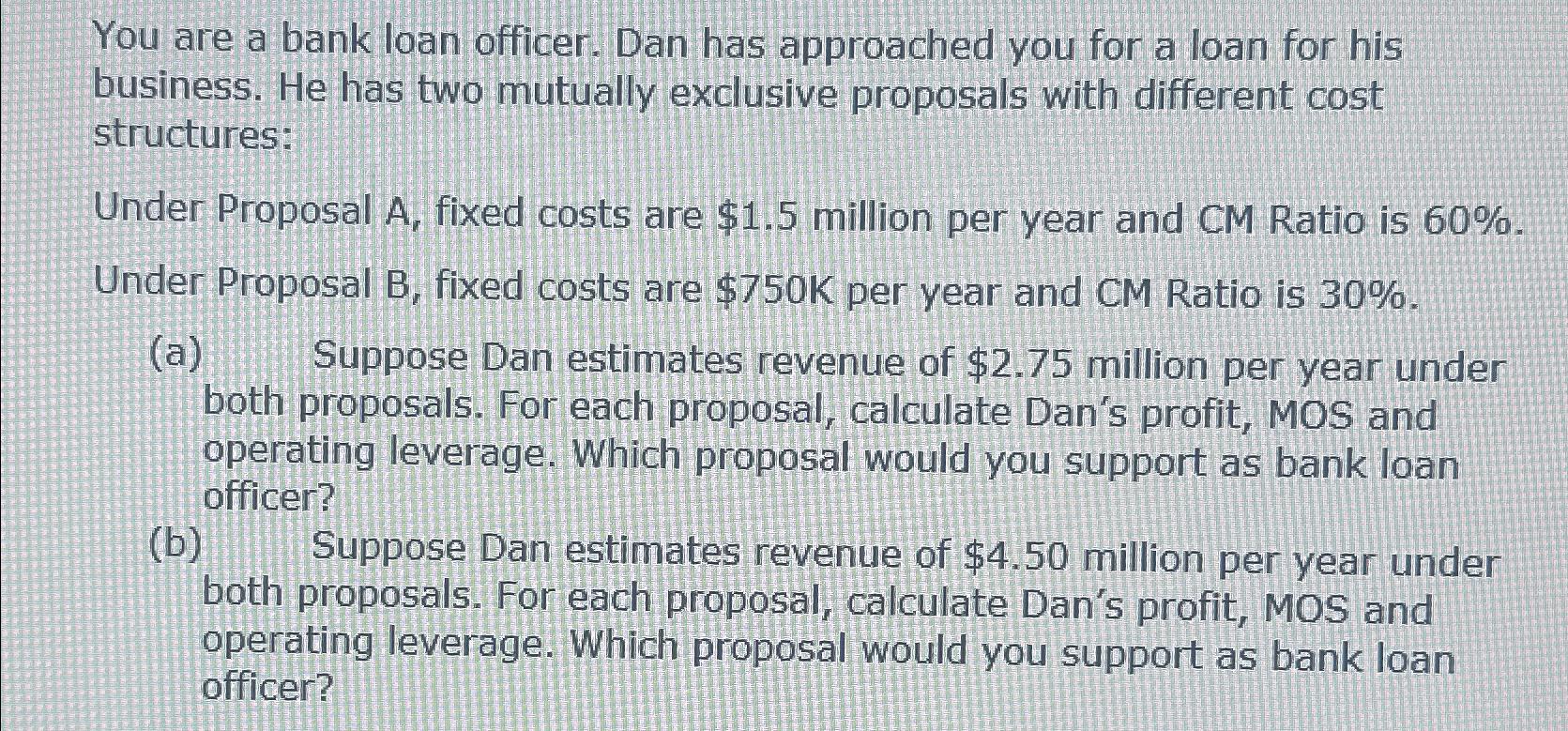

You are a bank loan officer. Dan has approached you for a loan for his business. He has two mutually exclusive proposals with different cost structures: Under Proposal A, fixed costs are $1.5 million per year and CM Ratio is 60%. Under Proposal B, fixed costs are $750K per year and CM Ratio is 30%. (a) (b) Suppose Dan estimates revenue of $2.75 million per year under both proposals. For each proposal, calculate Dan's profit, MOS and operating leverage. Which proposal would you support as bank loan officer? Suppose Dan estimates revenue of $4.50 million per year under both proposals. For each proposal, calculate Dan's profit, MOS and operating leverage. Which proposal would you support as bank loan officer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate Dans profit sales and operating leverage for each proposal we can us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started