Answered step by step

Verified Expert Solution

Question

1 Approved Answer

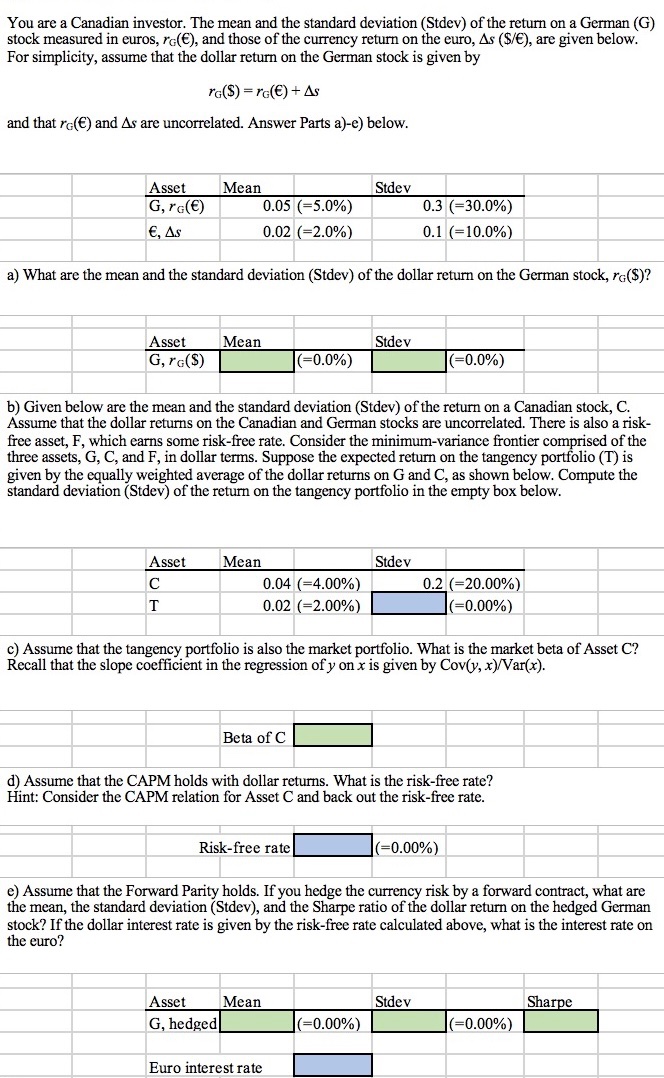

You are a Canadian investor. The mean and the standard deviation (Stdev) of the return on a German (G) stock measured in euros, rc(),

You are a Canadian investor. The mean and the standard deviation (Stdev) of the return on a German (G) stock measured in euros, rc(), and those of the currency return on the euro, As ($/), are given below. For simplicity, assume that the dollar return on the German stock is given by rG(S)=rG(E) + As and that r() and As are uncorrelated. Answer Parts a)-e) below. Asset G, rG() , As Asset G, rG(S) Mean Asset T a) What are the mean and the standard deviation (Stdev) of the dollar return on the German stock, r($)? Mean Mean 0.05 (-5.0%) 0.02 (-2.0%) Asset G, hedged b) Given below are the mean and the standard deviation (Stdev) of the return on a Canadian stock, C. Assume that the dollar returns on the Canadian and German stocks are uncorrelated. There is also a risk- free asset, F, which earns some risk-free rate. Consider the minimum-variance frontier comprised of the three assets, G, C, and F, in dollar terms. Suppose the expected return on the tangency portfolio (T) is given by the equally weighted average of the dollar returns on G and C, as shown below. Compute the standard deviation (Stdev) of the return on the tangency portfolio in the empty box below. 0.04 (=4.00%) 0.02 (-2.00%) Beta of C (-0.0%) Risk-free rate Stdev Mean Euro interest rate Stdev c) Assume that the tangency portfolio is also the market portfolio. What is the market beta of Asset C? Recall that the slope coefficient in the regression of y on x is given by Cov(y, x)/Var(x). 0.3 (-30.0%) 0.1 (-10.0%) Stdev d) Assume that the CAPM holds with dollar returns. What is the risk-free rate? Hint: Consider the CAPM relation for Asset C and back out the risk-free rate. (-0.00%) (-0.0%) e) Assume that the Forward Parity holds. If you hedge the currency risk by a forward contract, what are the mean, the standard deviation (Stdev), and the Sharpe ratio of the dollar return on the hedged German stock? If the dollar interest rate is given by the risk-free rate calculated above, what is the interest rate on the euro? 0.2 (-20.00%) (=0.00%) (-0.00%) Stdev (-0.00%) Sharpe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The mean of the dollar return on the German stock is given by rg rg As 005 002 007 The standard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started