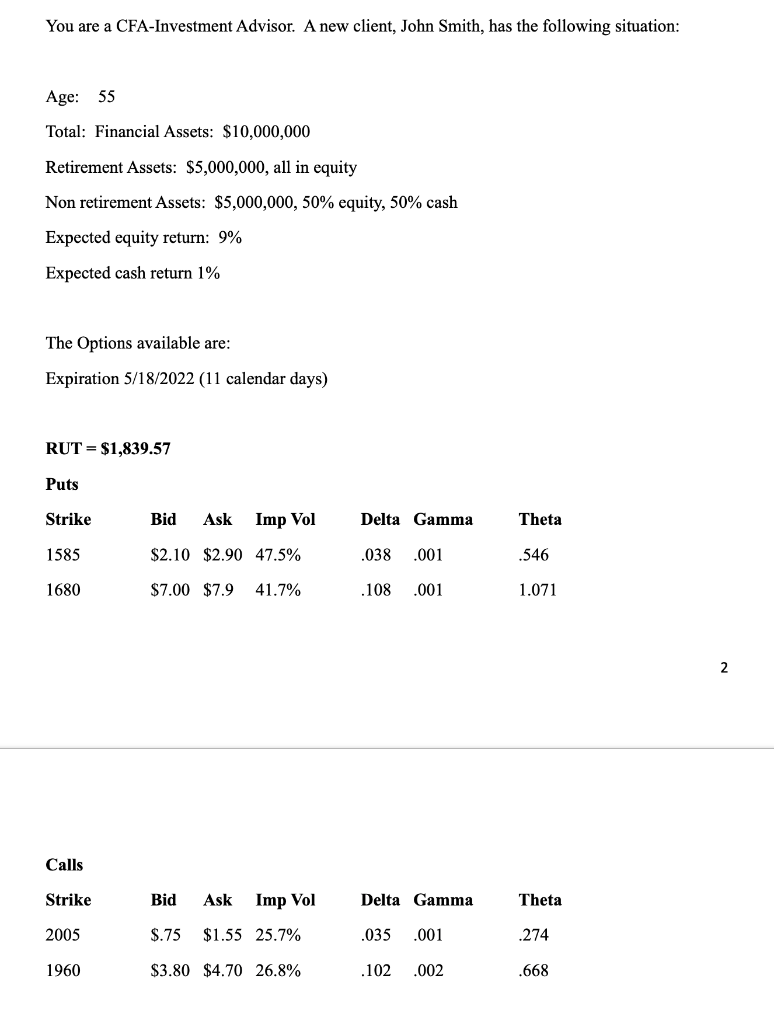

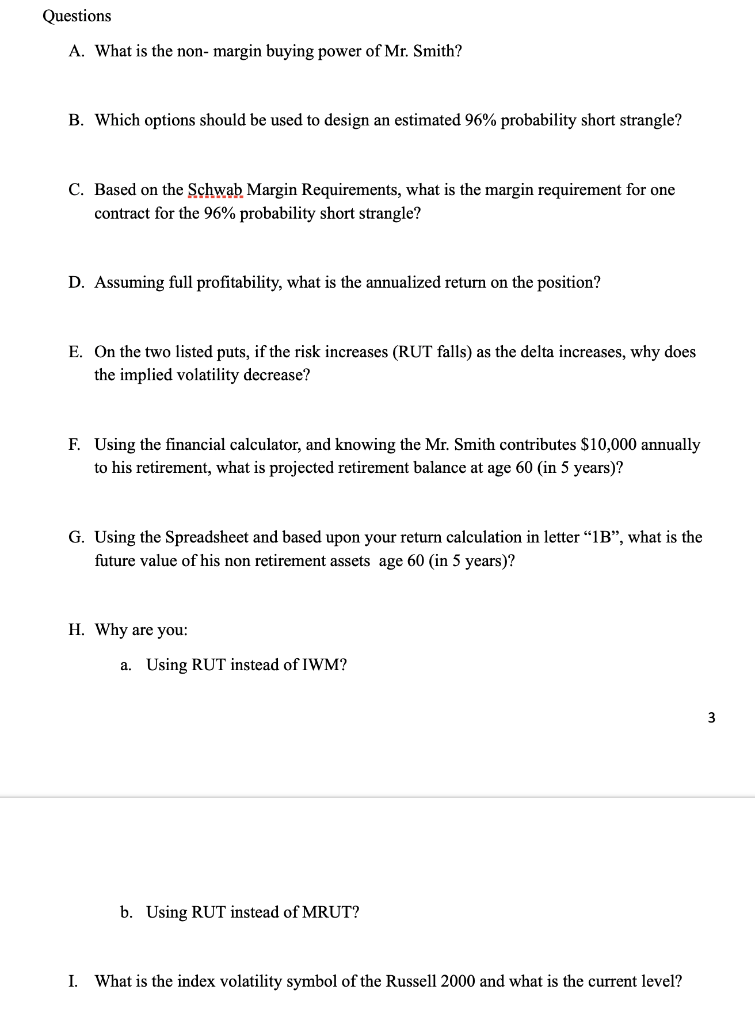

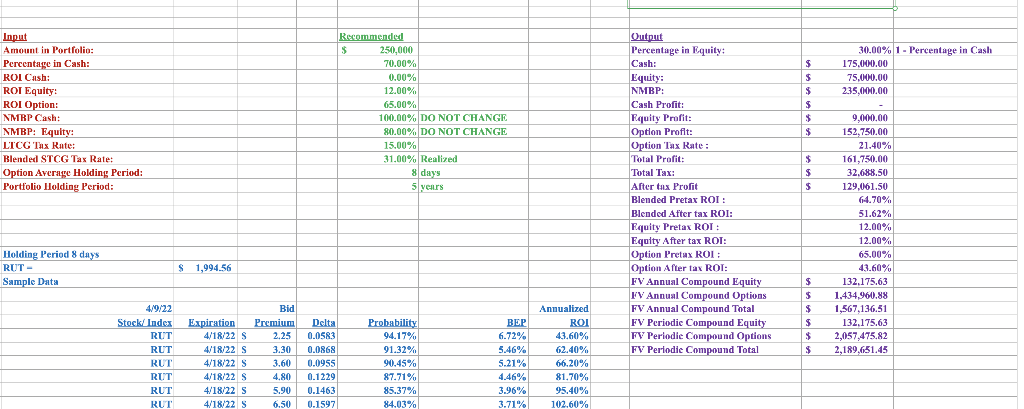

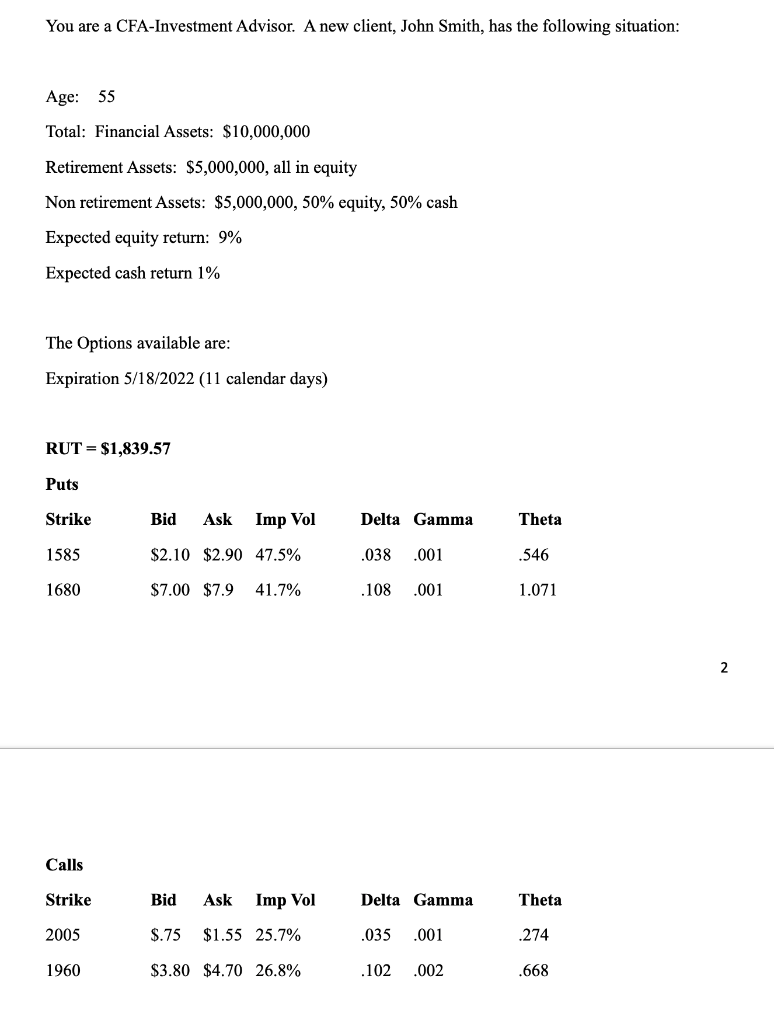

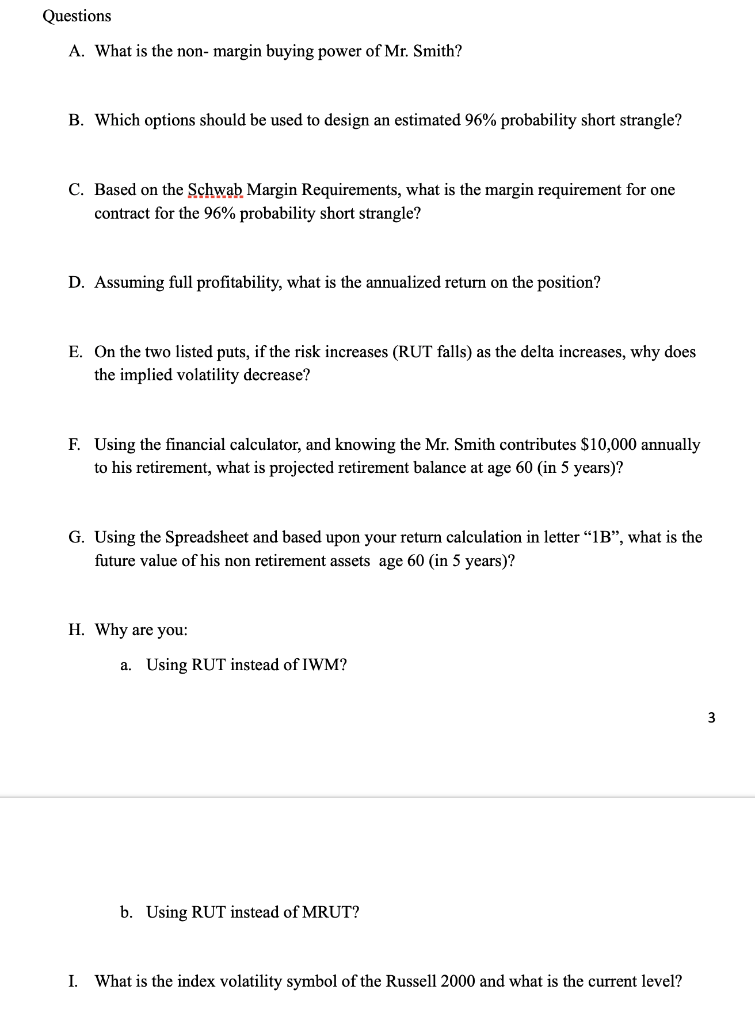

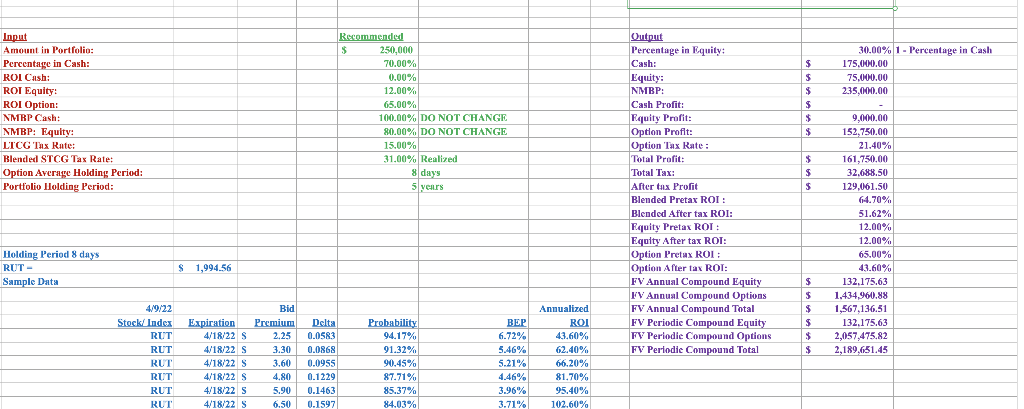

You are a CFA-Investment Advisor. A new client, John Smith, has the following situation: Age: 55 Total: Financial Assets: $10,000,000 Retirement Assets: $5,000,000, all in equity Non retirement Assets: $5,000,000, 50% equity, 50% cash Expected equity return: 9% Expected cash return 1% The Options available are: Expiration 5/18/2022 (11 calendar days) RUT = $1,839.57 Puts Strike Bid Ask Imp Vol Delta Gamma Theta 1585 $2.10 $2.90 47.5% .038 .001 546 1680 $7.00 $7.9 41.7% .108 .001 1.071 2 Calls Strike Bid Ask Imp Vol Delta Gamma Theta 2005 $.75 $1.55 25.7% .035 .001 .274 1960 $3.80 $4.70 26.8% .102 .002 .668 Questions A. What is the non-margin buying power of Mr. Smith? B. Which options should be used to design an estimated 96% probability short strangle? C. Based on the Schwab Margin Requirements, what is the margin requirement for one contract for the 96% probability short strangle? D. Assuming full profitability, what is the annualized return on the position? E. On the two listed puts, if the risk increases (RUT falls) as the delta increases, why does the implied volatility decrease? F. Using the financial calculator, and knowing the Mr. Smith contributes $10,000 annually to his retirement, what is projected retirement balance at age 60 (in 5 years)? G. Using the Spreadsheet and based upon your return calculation in letter 1B, what is the future value of his non retirement assets age 60 (in 5 years)? H. Why are you: a. Using RUT instead of IWM? 3 b. Using RUT instead of MRUT? I. What is the index volatility symbol of the Russell 2000 and what is the current level? $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60% You are a CFA-Investment Advisor. A new client, John Smith, has the following situation: Age: 55 Total: Financial Assets: $10,000,000 Retirement Assets: $5,000,000, all in equity Non retirement Assets: $5,000,000, 50% equity, 50% cash Expected equity return: 9% Expected cash return 1% The Options available are: Expiration 5/18/2022 (11 calendar days) RUT = $1,839.57 Puts Strike Bid Ask Imp Vol Delta Gamma Theta 1585 $2.10 $2.90 47.5% .038 .001 546 1680 $7.00 $7.9 41.7% .108 .001 1.071 2 Calls Strike Bid Ask Imp Vol Delta Gamma Theta 2005 $.75 $1.55 25.7% .035 .001 .274 1960 $3.80 $4.70 26.8% .102 .002 .668 Questions A. What is the non-margin buying power of Mr. Smith? B. Which options should be used to design an estimated 96% probability short strangle? C. Based on the Schwab Margin Requirements, what is the margin requirement for one contract for the 96% probability short strangle? D. Assuming full profitability, what is the annualized return on the position? E. On the two listed puts, if the risk increases (RUT falls) as the delta increases, why does the implied volatility decrease? F. Using the financial calculator, and knowing the Mr. Smith contributes $10,000 annually to his retirement, what is projected retirement balance at age 60 (in 5 years)? G. Using the Spreadsheet and based upon your return calculation in letter 1B, what is the future value of his non retirement assets age 60 (in 5 years)? H. Why are you: a. Using RUT instead of IWM? 3 b. Using RUT instead of MRUT? I. What is the index volatility symbol of the Russell 2000 and what is the current level? $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60%