Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a clerical worker with an accounting background and a close friend of Chris, who owns a vineyard. Chris produces his own wine

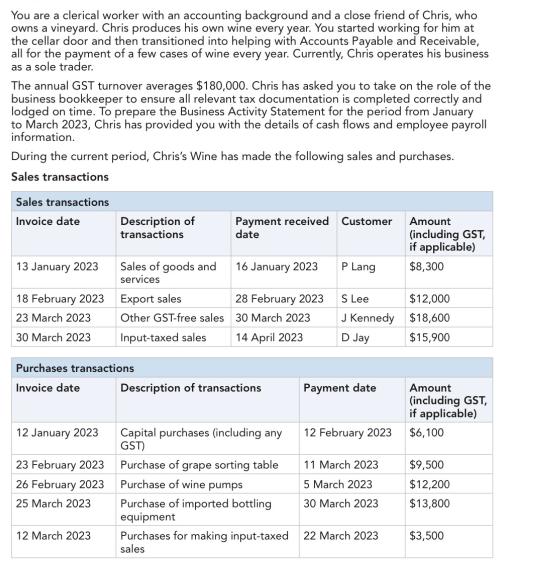

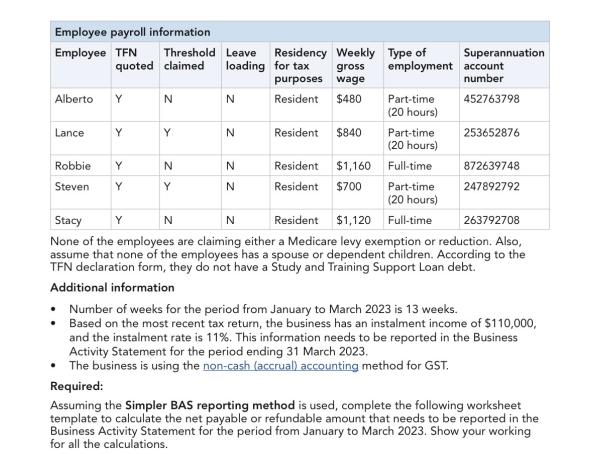

You are a clerical worker with an accounting background and a close friend of Chris, who owns a vineyard. Chris produces his own wine every year. You started working for him at the cellar door and then transitioned into helping with Accounts Payable and Receivable, all for the payment of a few cases of wine every year. Currently, Chris operates his business as a sole trader. The annual GST turnover averages $180,000. Chris has asked you to take on the role of the business bookkeeper to ensure all relevant tax documentation is completed correctly and lodged on time. To prepare the Business Activity Statement for the period from January to March 2023, Chris has provided you with the details of cash flows and employee payroll information. During the current period, Chris's Wine has made the following sales and purchases. Sales transactions Sales transactions Invoice date 13 January 2023 18 February 2023 23 March 2023 30 March 2023 Description of transactions 12 January 2023 23 February 2023 26 February 2023 25 March 2023 12 March 2023 Sales of goods and 16 January 2023 services Export sales Other GST-free sales Input-taxed sales Purchases transactions Invoice date Payment received Customer Amount date 28 February 2023 30 March 2023 14 April 2023 Description of transactions Capital purchases (including any GST) Purchase of grape sorting table Purchase of wine pumps Purchase of imported bottling equipment Purchases for making input-taxed sales P Lang S Lee J Kennedy D Jay Payment date 12 February 2023 11 March 2023 5 March 2023 30 March 2023 22 March 2023 (including GST, if applicable) $8,300 $12,000 $18,600 $15,900 Amount (including GST, if applicable) $6,100 $9,500 $12,200 $13,800 $3,500 Employee payroll information Employee TFN Alberto Y Threshold Leave quoted claimed loading Lance Y Robbie Y Steven Y N Y Part-time (20 hours) Full-time Part-time (20 hours) Stacy Y N Resident $1,120 Full-time 263792708 None of the employees are claiming either a Medicare levy exemption or reduction. Also, assume that none of the employees has a spouse or dependent children. According to the TFN declaration form, they do not have a Study and Training Support Loan debt. Additional information N Y N N N N Z Z Residency Weekly for tax N gross purposes wage Resident $480 Resident $840 Type of Superannuation employment account number 452763798 Resident $1,160 Resident $700 Part-time (20 hours) 253652876 872639748 247892792 Number of weeks for the period from January to March 2023 is 13 weeks. Based on the most recent tax return, the business has an instalment income of $110,000, and the instalment rate is 11%. This information needs to be reported in the Business Activity Statement for the period ending 31 March 2023. The business is using the non-cash (accrual) accounting method for GST. Required: Assuming the Simpler BAS reporting method is used, complete the following worksheet template to calculate the net payable or refundable amount that needs to be reported in the Business Activity Statement for the period from January to March 2023. Show your working for all the calculations.

Step by Step Solution

★★★★★

3.50 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net payable or refundable amount for the Business Activity Statement for the period from January to March 2023 we need to breakdown t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started