Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a client advisor working in an investment advisory firm. On a recent outing with your friends, Mary and Susan, you start to

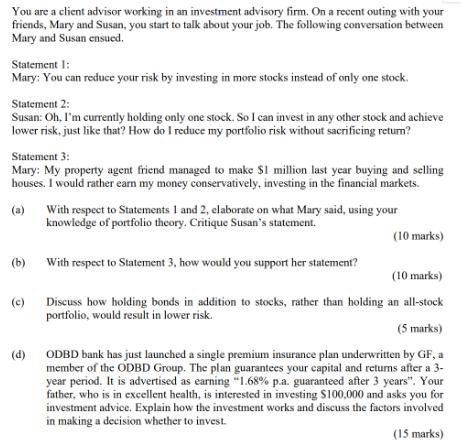

You are a client advisor working in an investment advisory firm. On a recent outing with your friends, Mary and Susan, you start to talk about your job. The following conversation between Mary and Susan ensued. Statement 1: Mary: You can reduce your risk by investing in more stocks instead of only one stock. Statement 2: Susan: Oh, I'm currently holding only one stock. So I can invest in any other stock and achieve lower risk, just like that? How do I reduce my portfolio risk without sacrificing return? Statement 3: Mary: My property agent friend managed to make $1 million last year buying and selling houses. I would rather earn my money conservatively, investing in the financial markets. (a) With respect to Statements 1 and 2, elaborate on what Mary said, using your knowledge of portfolio theory. Critique Susan's statement. (b) (c) (d) With respect to Statement 3, how would you support her statement? (10 marks) (10 marks) Discuss how holding bonds in addition to stocks, rather than holding an all-stock portfolio, would result in lower risk. (5 marks) ODBD bank has just launched a single premium insurance plan underwritten by GF, a member of the ODBD Group. The plan guarantees your capital and returns after a 3- year period. It is advertised as earning "1.68% p.a. guaranteed after 3 years". Your father, who is in excellent health, is interested in investing $100,000 and asks you for investment advice. Explain how the investment works and discuss the factors involved in making a decision whether to invest. (15 marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Marys statement is aligned with the principles of portfolio theory which suggests that by diversifying investments across multiple stocks an investor can reduce the risk associated with holding only ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started