Question

You are a conservative investor who is considering investing in Hassy, a small film company. You like the intrinsic valuation approach and want to calculate

You are a conservative investor who is considering investing in Hassy, a small film company. You like the intrinsic valuation approach and want to calculate Hassys weighted average cost of capital and then perform a discounted cash flow analysis. You note that the equity market risk premium is 5.8%. The risk free rate is 2.5% and the tax rate is 35%. You feel that Hassy is riskier than the CAPM would indicate due to its small size and believe it has a size risk premium of 1.2%. You have the following information about Hassy:

Bonds: Hassy has two bonds as outlined below:

- Bond One: six year maturity, $1,000 face value semi-annual coupon bond with a coupon of 1.73% and a yield to maturity of 4.23%. Hassy has 25,637 of these bonds outstanding.

- Bond Two: is a coupon bond that pays annually and has nine years to maturity. The coupon rate is 2.75%, its yield to maturity is 4.78% and its face value of $1,000. Hassy has 7,864 of these bonds outstanding.

Equity: Hassy has 4,125,876 common shares outstanding and its stock price is $3.56. Hassys beta is 3.1 and its Shareholders Equity from the balance sheet is $9.3mm.

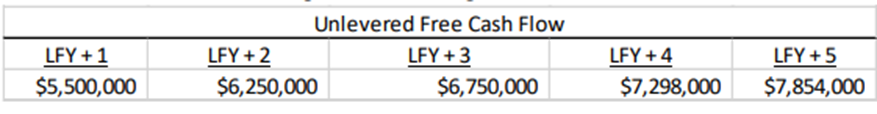

Unlevered Free Cash Flow as per the following table:

Calculate Hassys weighted average cost of capital. Perform a discounted cash flow analysis to determine what the intrinsic value of Hassy is on a per share basis. Use the above 5 years of unlevered free cash flow projections and the perpetuity growth rate method to calculate the companys terminal value. You believe Hassy will grow into perpetuity at a 1.25% growth rate. You note that Hassy has cash of $1,465,264.

Unlevered Free Cash Flow

Unlevered Free Cash Flow Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started