Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a consultant for Kathmandu and have been asked to calculate the appropriate discount rate to use in the evaluation of the purchase of

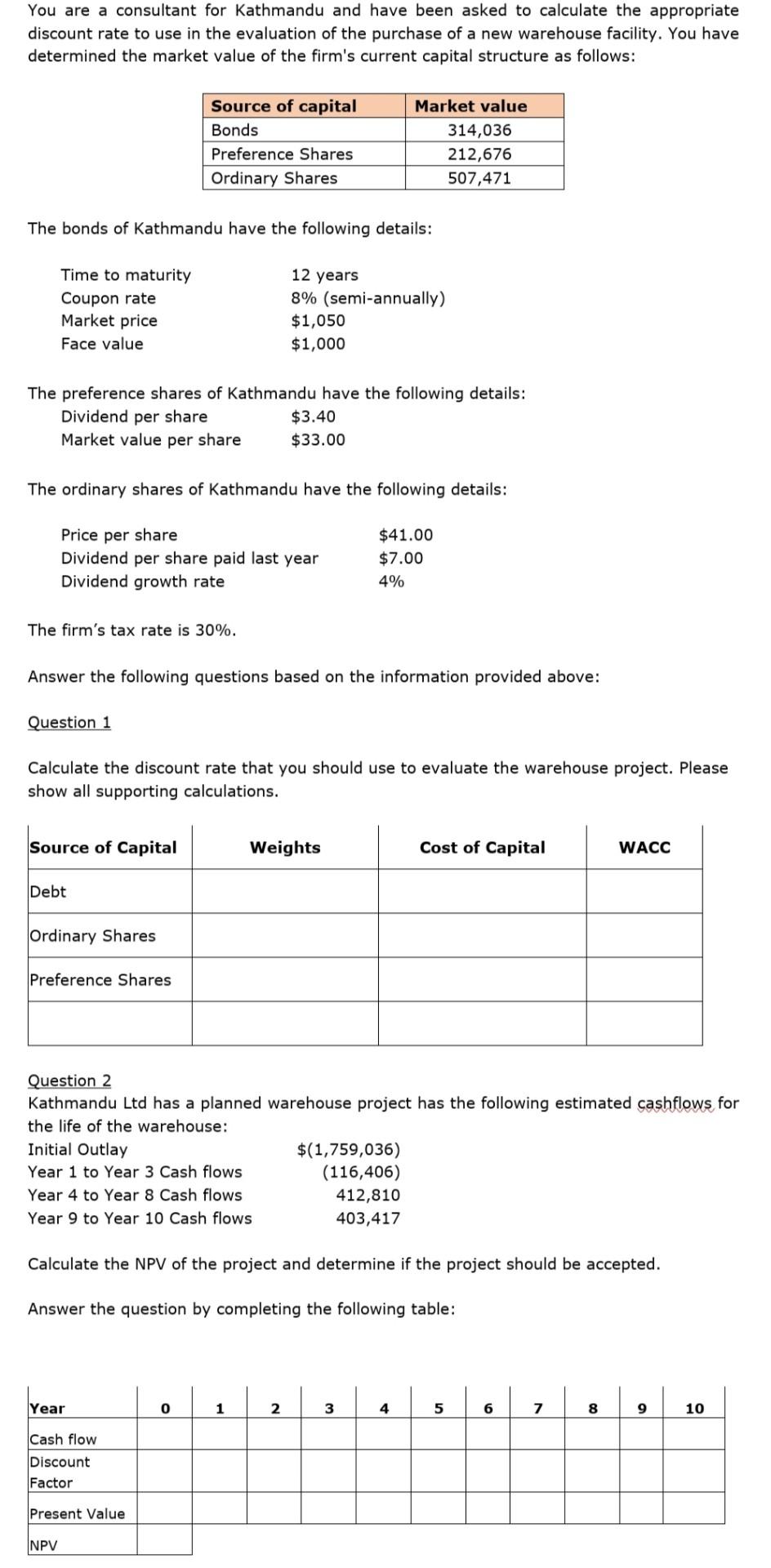

You are a consultant for Kathmandu and have been asked to calculate the appropriate discount rate to use in the evaluation of the purchase of a new warehouse facility. You have determined the market value of the firm's current capital structure as follows: Market value Source of capital Bonds 314,036 Preference Shares 212,676 Ordinary Shares 507,471 The bonds of Kathmandu have the following details: Time to maturity 12 years Coupon rate 8% (semi-annually) Market price $1,050 Face value $1,000 The preference shares of Kathmandu have the following details: Dividend per share $3.40 Market value per share $33.00 The ordinary shares of Kathmandu have the following details: Price per share $41.00 Dividend per share paid last year $7.00 Dividend growth rate 4% The firm's tax rate is 30%. Answer the following questions based on the information provided above: Question 1 Calculate the discount rate that you should use to evaluate the warehouse project. Please show all supporting calculations. Source of Capital Weights Cost of Capital WACC Debt Ordinary Shares Preference Shares Question 2 Kathmandu Ltd has a planned warehouse project has the following estimated cashflows for the life of the warehouse: Initial Outlay $(1,759,036) (116,406) Year 1 to Year 3 Cash flows Year 4 to Year 8 Cash flows 412,810 Year 9 to Year 10 Cash flows 403,417 Calculate the NPV of the project and determine if the project should be accepted. Answer the question by completing the following table: Year 0 1 2 3 4 5 6 7 8 9 10 Cash flow Discount Factor Present Value NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started