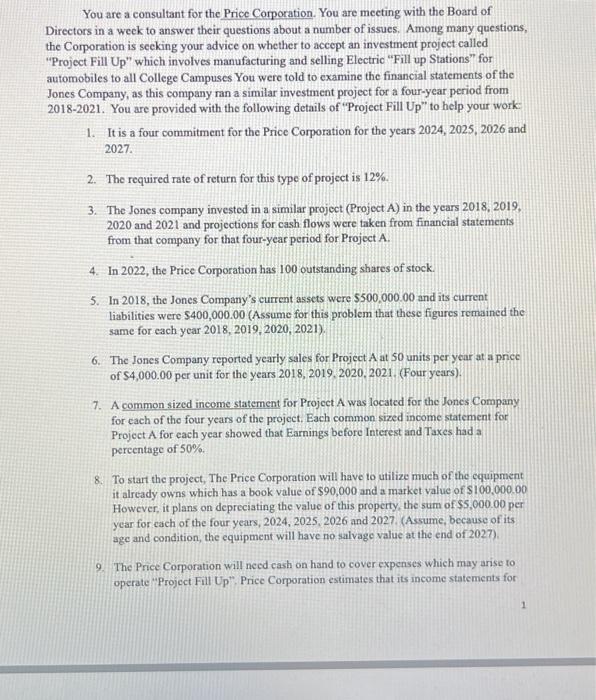

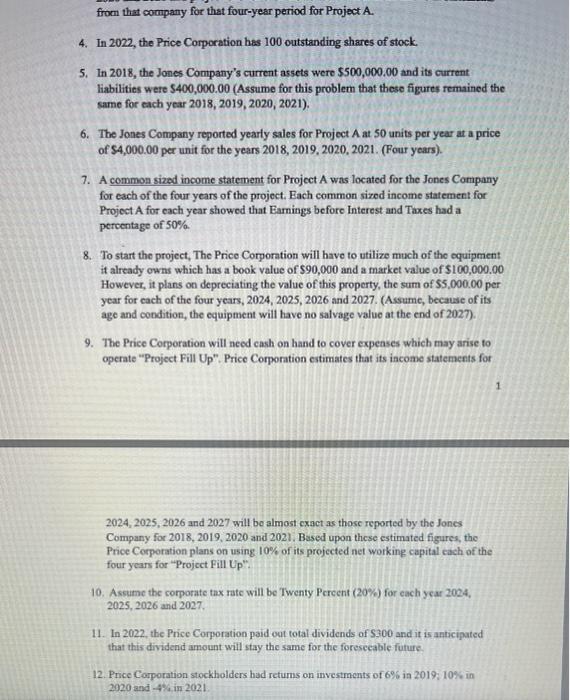

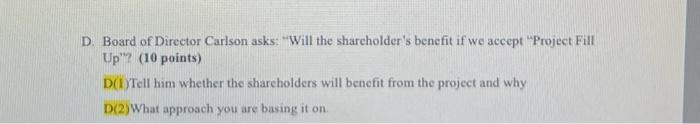

You are a consultant for the Price Corporation. You are mecting with the Board of rectors in a week to answer their questions about a number of issues. Among many questions, Corporation is secking your advice on whether to accept an investment project called roject Fill Up" which involves manufacturing and selling Electric "Fill up Stations" for tomobiles to all College Campuses You were told to examine the financial statements of the nes Company, as this company ran a similar investment project for a four-year period from 18-2021. You are provided with the following details of "Project Fill Up"t help your work: 1. It is a four commitment for the Price Corporation for the years 2024, 2025, 2026 and 2027. 2. The required rate of return for this type of project is 12%. 3. The Jones company invested in a similar project (Project A) in the years 2018, 2019. 2020 and 2021 and projections for cash flows were taken from financial statements from that company for that four-year period for Project A. 4. In 2022, the Price Corporation has 100 outstanding shares of stock. 5. In 2018, the Jones Company's current assets were $500,000.00 and its current liabilities were $400,000.00 (Assume for this problem that these figures remained the same for each year 2018,2019,2020,2021 ). 6. The Jones Company reported yearly sales for Project A at 50 units per year at a pnce of 54,000.00 per unit for the years 2018, 2019,2020,2021. (Four years). 7. A common sized income statement for Project A was located for the Jones Company for cach of the four years of the project. Each common sized income statement for Project A for each year showed that Earnings before Interest and Taxes had a pereentage of 50%. 8. To start the project, The Price Corporation will have to utilize much of the equipment it already owns which has a book value of $90,000 and a market value of $100,000.00 However, it plans on depreciating the value of this property, the sum of $5,000.00 per year for cach of the four years, 2024, 2025, 2026 and 2027. (Assume, because of its age and condition, the equipment will have no salvage value at the end of 2027). 9. The Price Corporation will need cash on hand to cover expenses which may arise to operate "Project Fill Up". Price Corporation estimates that its income statements for 1 from that company for that four-year period for Project A. 4. In 2022, the Price Corporation has 100 outstanding shares of stock. 5. In 2018, the Jones Company's current assets were $500,000.00 and its current liabilities were $400,000.00 (Assume for this problem that these figures remained the same for each year 2018,2019,2020,2021 ). 6. The Jones Compsny reported yearly sales for Project A at 50 units per year at a price of $4,000.00 per unit for the years 2018,2019,2020,2021. (Four years). 7. A common sizad income statement for Project A was located for the Jones Company for each of the four years of the project. Each common sized income statement for Project A for each year showed that Earnings before Interest and Taxes had a percentage of 50%. 8. To start the project, The Price Corporation will have to utilize much of the equipment it already owns which has a book value of $90,000 and a market value of $100,000.00 However, it plans on depreciating the value of this property, the sum of $5,000.00 per year for each of the four years, 2024, 2025, 2026 and 2027. (Assume, because of its age and condition, the equipment will have no salvage value at the end of 2027). 9. The Price Corporation will need cash on hand to cover expenses which may arise to operate "Project Fill Up". Price Corpontion estimates that its income statements for 2024, 2025, 2026 and 2027 will be almost cxact as those reported by the Jones Company for 2018, 2019, 2020 and 2021. Based upon these estimated figures, the Price Corporation plans on using 10% of its projected net working capital cach of the four years for "Projcct Fill Up". 10. Assume the corporate tax rate will be Twenty Pereent (20\%) for each ycar 2024, 2025,2026 and 2027. 11. In 2022, the Price Corporation paid oot total dividends of 5300 and it is anticipated that this dividend amount will stay the same for the foresceable future. 12. Price Corporation stockholders had retums on investments of 6% in 2019; 10\% in 2920 and -4 , in 2021 D. Board of Director Carlson asks: "Will the sharcholder's benefit if we accept "Project Fill Up"7 (10 points) D(I)Tell him whether the shareholders will benefit from the project and why D(2) What approach you are basing it on