Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a cow-calf operator and typically sell your calves after the first of the year in January. You like to lock in profit

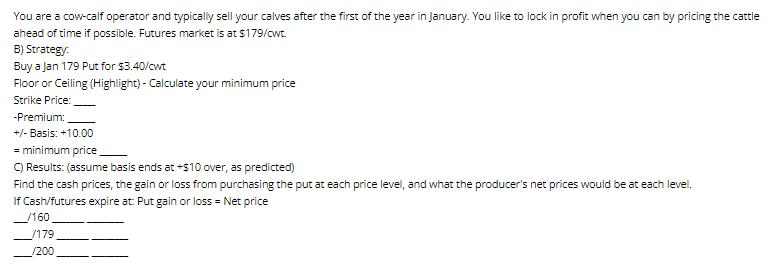

You are a cow-calf operator and typically sell your calves after the first of the year in January. You like to lock in profit when you can by pricing the cattle ahead of time if possible. Futures market is at $179/cwt. B) Strategy: Buy a Jan 179 Put for $3.40/cwt Floor or Ceiling (Highlight) - Calculate your minimum price Strike Price: -Premium: +/- Basis: +10.00 minimum price C) Results: (assume basis ends at +$10 over, as predicted) Find the cash prices, the gain or loss from purchasing the put at each price level, and what the producer's net prices would be at each level. If Cash/futures expire at: Put gain or loss = Net price /160 /179 /200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started