Question

You are a CPA, employed at the firm of Amira and Co, CPA. On June 20, 2021, David Smith, a partner in your firm, calls

You are a CPA, employed at the firm of Amira and Co, CPA. On June 20, 2021, David Smith, a partner in your firm, calls you into his office for a meeting about your client Cookies Limited (CL). You have been reappointed auditors for the year ending May 31, 2021. He met with the president of CL, Sarah Cooke, last week, and toured the Toronto warehouse and head office. He prepared some background information on CL for you to review, including the Companys May 31, 2021, internal non-consolidated financial statements (Exhibit I). He also met with Claudia Ramiro, the controller, and made notes from that meeting, enclosed in Exhibit II. He is requesting for you to review the material provided and to draft a memo identifying and discussing the accounting issues for the 2021 audit in preparation for his meeting next week to discuss them with the client. All companies involved have a 35% tax rate. You are to draft the memo needed.

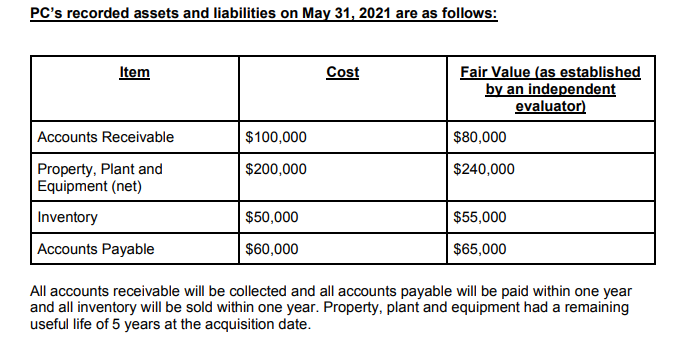

Exhibit I: Background Information of Cookies Limited CL, a small public company listed on a Canadian stock exchange, is a wholesaler of cookies, brownies and other baked goods with two warehouses located in Ontario and Quebec. It imports the ingredients required for the baking from the United States, in Canadian dollars. CL employees prepare and do the baking of the goods for sale in Canada to grocery stores and other retailers. CL was incorporated in 2008 and for the first three fiscal years, sales grew at approximately 30% per year, and CL expanded to meet the demand. However, increased competition resulted in declining sales and operating losses over the next six years. Sarah Cooke took over running the company in 2011 and was very excited about becoming involved in the business. The fiscal year ended May 31, 2021, brought a return to higher sales levels and a modest net income. On March 15, 2021, when shares of CL were trading at $4 each, CL announced an agreement with the shareholders of Pies Corporation (PC) where CL would acquire 100% of the voting shares of PC by issuing 150,000 CL common shares. The acquisition of PC was completed on May 31, 2021 when the CL shares were trading at $3.00 each. In addition, if sales of PC exceed $175,000 in the first year an additional payment of $50,000 cash will be made by CL to the selling shareholders. As at the acquisition date, this had a probability of occurring of 60%. PC, a small private Canadian corporation, sells fresh pies to grocery stores across Canada. In addition, PC has exclusivity agreements signed with two chains of grocery stores, whereby PC is their only supplier of pies. PC has never been audited and its year end is November 30. As at May 31, 2021 the recorded equity of PC was $290,000 ($100,000 for share capital and $190,000 for retained earnings).

EXHIBIT III: NOTES FROM DAVID SMITHS CONVERSATION WITH CLAUDIA RAMIRO:

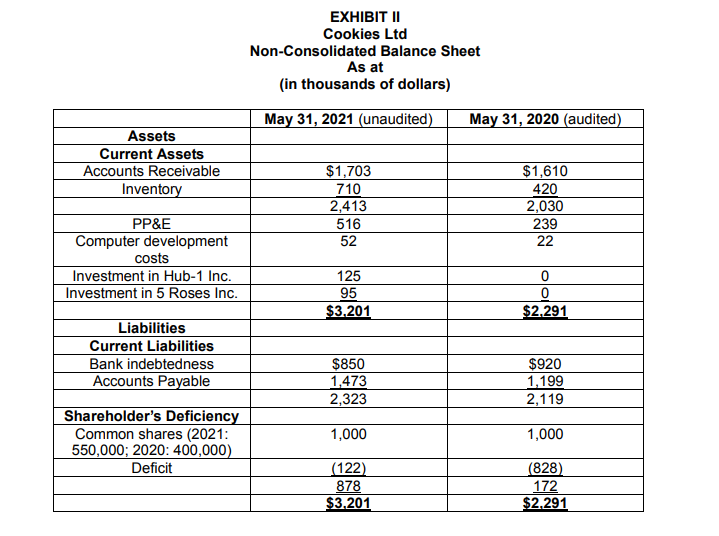

During the fiscal year, management negotiated an operating line of credit with a new financial institution. The line of credit is subject to a covenant whereby total debt to total equity must be under 2.5. Under this agreement, CL is required to provide audited financial statements within 90 days of its fiscal year end. The controller did not record anything related to the investment in PC, since the only change was in the number of common shares issued. CL also made two other investments during fiscal 2021. The first, an investment in Hub-1 Inc. was one made to invest excess cash on hand that CL had. The cost at the time of the 5% purchase of Hub-1 Inc.s outstanding shares was $125,000. This was a short-term investment and when the cash is needed in fiscal 2022 it will be sold. As at May 31, 2021, the fair value of the investment was $185,000 and net income of Hub-1 Inc. was $39,000 for 2021. The second investment made during fiscal 2021, was one made to acquire ownership of one of CLs suppliers of flour and other baking ingredients, 5 Roses Inc. CL acquired 15% ownership interest in exchange for $95,000 cash, in addition to having 1 of the 5 board of directors seats. CL will be able to purchase annually 15% of the output of 5 Roses Inc. before other competitors. As at May 31, 2021, the fair value of CLs investment in 5 Roses Inc. was $115,000. Net income since the acquisition of 5 Roses Inc. was $100,000 and no dividends were declared by 5 Roses Inc in 2021.

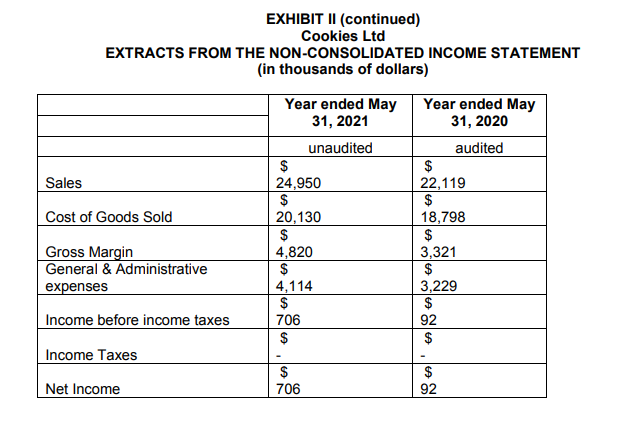

PC's recorded assets and liabilities on May 31, 2021 are as follows: Item Cost Fair Value (as established by an independent evaluator) Accounts Receivable $100,000 $80,000 $200,000 $240,000 Property, Plant and Equipment (net) Inventory $50,000 $55,000 Accounts Payable $60,000 $65,000 All accounts receivable will be collected and all accounts payable will be paid within one year and all inventory will be sold within one year. Property, plant and equipment had a remaining useful life of 5 years at the acquisition date. EXHIBIT II Cookies Ltd Non-Consolidated Balance Sheet As at (in thousands of dollars) May 31, 2021 (unaudited) May 31, 2020 (audited) Assets Current Assets Accounts Receivable Inventory $1,703 710 2,413 516 52 $1,610 420 2,030 239 22 PP&E Computer development costs Investment in Hub-1 Inc. Investment in 5 Roses Inc. 125 95 $3.201 0 0 $2.291 Liabilities Current Liabilities Bank indebtedness Accounts Payable $850 1,473 2,323 $920 1,199 2,119 Shareholder's Deficiency Common shares (2021: 550,000; 2020: 400,000) Deficit 1,000 1,000 (122) 878 $3.201 (828) 172 $2.291 EXHIBIT II (continued) Cookies Ltd EXTRACTS FROM THE NON-CONSOLIDATED INCOME STATEMENT (in thousands of dollars) Year ended May Year ended May 31, 2021 31, 2020 unaudited audited $ $ Sales 24,950 22,119 $ $ Cost of Goods Sold 20,130 18,798 $ $ Gross Margin 4,820 3,321 General & Administrative $ $ expenses 4,114 3,229 $ $ Income before income taxes 706 92 $ $ Income Taxes $ $ Net Income 706 92 PC's recorded assets and liabilities on May 31, 2021 are as follows: Item Cost Fair Value (as established by an independent evaluator) Accounts Receivable $100,000 $80,000 $200,000 $240,000 Property, Plant and Equipment (net) Inventory $50,000 $55,000 Accounts Payable $60,000 $65,000 All accounts receivable will be collected and all accounts payable will be paid within one year and all inventory will be sold within one year. Property, plant and equipment had a remaining useful life of 5 years at the acquisition date. EXHIBIT II Cookies Ltd Non-Consolidated Balance Sheet As at (in thousands of dollars) May 31, 2021 (unaudited) May 31, 2020 (audited) Assets Current Assets Accounts Receivable Inventory $1,703 710 2,413 516 52 $1,610 420 2,030 239 22 PP&E Computer development costs Investment in Hub-1 Inc. Investment in 5 Roses Inc. 125 95 $3.201 0 0 $2.291 Liabilities Current Liabilities Bank indebtedness Accounts Payable $850 1,473 2,323 $920 1,199 2,119 Shareholder's Deficiency Common shares (2021: 550,000; 2020: 400,000) Deficit 1,000 1,000 (122) 878 $3.201 (828) 172 $2.291 EXHIBIT II (continued) Cookies Ltd EXTRACTS FROM THE NON-CONSOLIDATED INCOME STATEMENT (in thousands of dollars) Year ended May Year ended May 31, 2021 31, 2020 unaudited audited $ $ Sales 24,950 22,119 $ $ Cost of Goods Sold 20,130 18,798 $ $ Gross Margin 4,820 3,321 General & Administrative $ $ expenses 4,114 3,229 $ $ Income before income taxes 706 92 $ $ Income Taxes $ $ Net Income 706 92

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started