Answered step by step

Verified Expert Solution

Question

1 Approved Answer

; You are a Credit Officer at Capital Two Bank Ltd and Zebron Ltd has applied for a loan of $1,500,000. Miss Lee, your

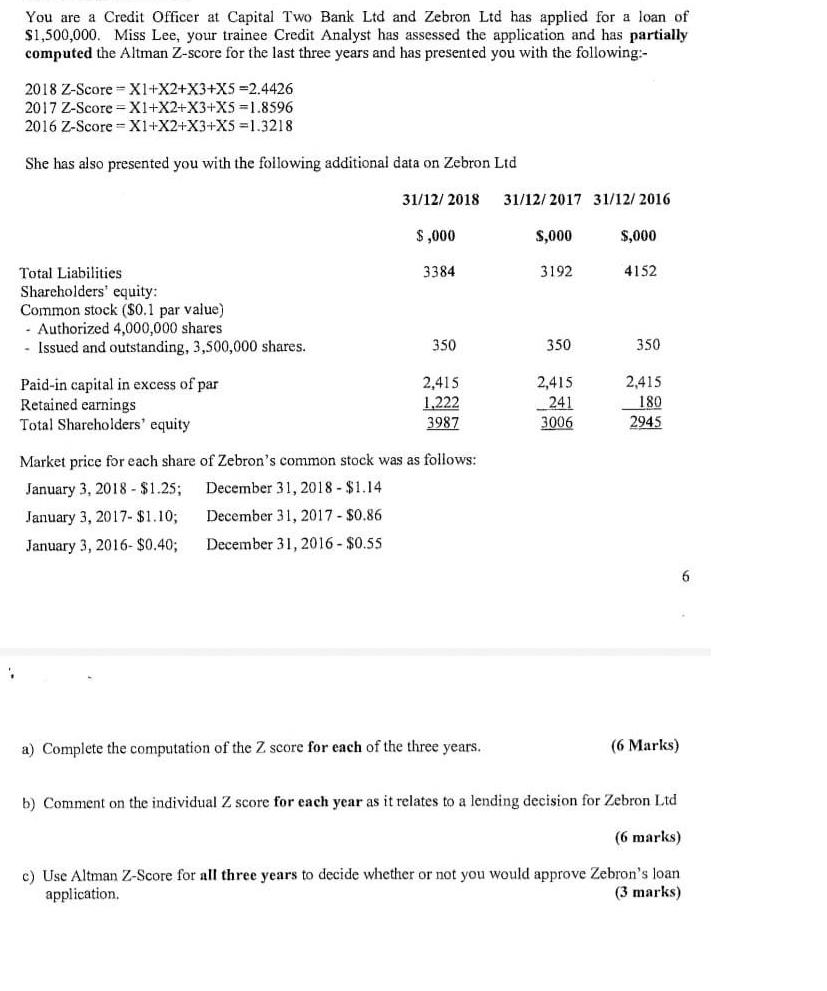

; You are a Credit Officer at Capital Two Bank Ltd and Zebron Ltd has applied for a loan of $1,500,000. Miss Lee, your trainee Credit Analyst has assessed the application and has partially computed the Altman Z-score for the last three years and has presented you with the following:- 2018 Z-Score X1+X2+X3+X5=2.4426 2017 Z-Score - X1+X2+X3+X5=1.8596 2016 Z-Score X1+X2+X3+X5=1.3218 She has also presented you with the following additional data on Zebron Ltd Total Liabilities Shareholders' equity: Common stock ($0.1 par value) - Authorized 4,000,000 shares - Issued and outstanding, 3,500,000 shares. Paid-in capital in excess of par Retained earnings Total Shareholders' equity 31/12/2018 $,000 3384 350 2,415 1,222 3987 Market price for each share of Zebron's common stock was as follows: December 31, 2018 - $1.14 January 3, 2018 - $1.25; January 3, 2017- $1.10; January 3, 2016-$0.40; December 31, 2017 - $0.86 December 31, 2016 - $0.55 a) Complete the computation of the Z. score for each of the three years. 31/12/2017 31/12/2016 $,000 3192 350 2,415 241 3006 $,000 4152 350 2,415 180 2945 (6 Marks) b) Comment on the individual Z score for each year as it relates to a lending decision for Zebron Ltd (6 marks) c) Use Altman Z-Score for all three years to decide whether or not you would approve Zebron's loan application. (3 marks) 6

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a 2018 ZScore XIX2X3X5 24426 X1 Total Assets Total Liabilities Total Assets 3384 2945 3384 01290 X2 Retained Earnings Total Assets 29453384 00868 X3 E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started