Question

You are a currency trader who seeks out currency arbitrage opportunities. You observe the following quotes for the spot and 183 day forward exchange

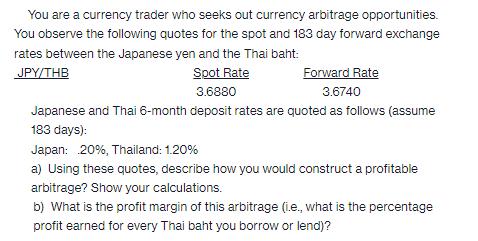

You are a currency trader who seeks out currency arbitrage opportunities. You observe the following quotes for the spot and 183 day forward exchange rates between the Japanese yen and the Thai baht: JPY/THB Spot Rate Forward Rate 3.6740 3.6880 Japanese and Thai 6-month deposit rates are quoted as follows (assume 183 days): Japan: 20%, Thailand: 1.20% a) Using these quotes, describe how you would construct a profitable arbitrage? Show your calculations. b) What is the profit margin of this arbitrage (i.e., what is the percentage profit earned for every Thai baht you borrow or lend)?

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To develop a beneficial exchange we really want to contrast the spot rate and the forward rate and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App