Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a financial adviser, and the following information is an extract of data you gathered as part of fact-finding during an initial client

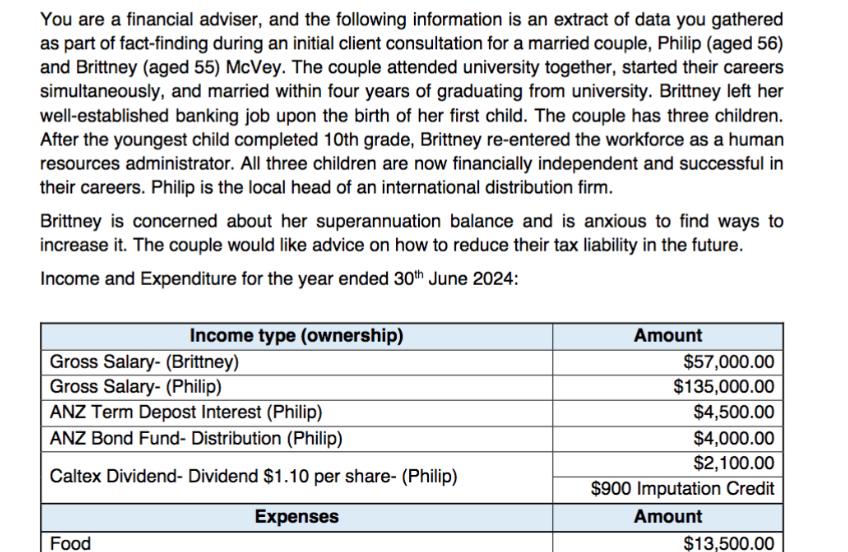

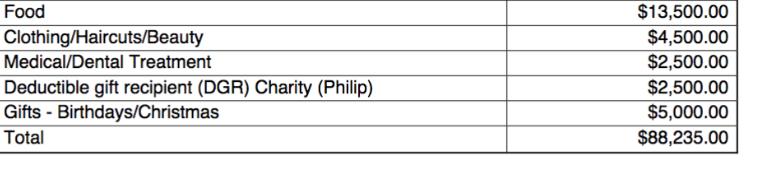

You are a financial adviser, and the following information is an extract of data you gathered as part of fact-finding during an initial client consultation for a married couple, Philip (aged 56) and Brittney (aged 55) McVey. The couple attended university together, started their careers simultaneously, and married within four years of graduating from university. Brittney left her well-established banking job upon the birth of her first child. The couple has three children. After the youngest child completed 10th grade, Brittney re-entered the workforce as a human resources administrator. All three children are now financially independent and successful in their careers. Philip is the local head of an international distribution firm. Brittney is concerned about her superannuation balance and is anxious to find ways to increase it. The couple would like advice on how to reduce their tax liability in the future. Income and Expenditure for the year ended 30th June 2024: Income type (ownership) Gross Salary- (Brittney) Gross Salary- (Philip) ANZ Term Depost Interest (Philip) ANZ Bond Fund- Distribution (Philip) Caltex Dividend- Dividend $1.10 per share- (Philip) Expenses Food Amount $57,000.00 $135,000.00 $4,500.00 $4,000.00 $2,100.00 $900 Imputation Credit Amount $13,500.00 Food $13,500.00 Clothing/Haircuts/Beauty $4,500.00 Medical/Dental Treatment $2,500.00 Deductible gift recipient (DGR) Charity (Philip) $2,500.00 Gifts - Birthdays/Christmas $5,000.00 Total $88,235.00 Asset and Liabilities as of June 30th, 2024 Assets (Ownership) Home and Contents (Joint) Cars (Two- Joint) ANZ Term Deposit (Philip) Investments: ANZ Bond Fund- (Philip) Caltex Shares - (Philip) Current valuation $850,000.00 $70,000.00 $100,000.00 $80,000.00 Superannuation- (Philip) Superannuation- (Brittney) Liability (Ownership) Mortgage (Join) Credit cards (Joint) (Includes the annual interest cost) PAYG (Philip) $31,000.00 $50,000.00 $660,000.00 $135,000.00 Current valuation $330,000.00 $6,000.00 Required: A. Calculate Philip and Brittney's after-tax income for the year ended June 30th, 2024. Explain how Philip and Brittney could reduce their tax liability by splitting their income. Show the effect this strategy would have had if they had split income for the tax year ended.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started