Question

You are a financial adviser andapproached by married couple Diane and Leo Alexander.They have limited financial knowledge and are seeking your advice about their current

You are a financial adviser andapproached by married couple Diane and Leo Alexander.They have limited financial knowledge and are seeking your advice about their current financial status.

The following information is an extract of data you gathered as part of fact-finding during an initial client consultation for this couple:

Leo and Diane have returned just before Covid-19 to Melbourne after living in New Zealand for the past 8 years. Both are 35 years old and have a 2-year old son.They have used part of their savings to fund their living expenses whilst looking for work upon their return. Luckily, Leo who is an advanced practice registered nursefound work in a local hospital and Diane has sincefound part-time work as a teacher.

The Alexander couple currently rentsan apartment at Elizabeth Streetin Melbourne. Theyintend to buy a house in the future. They are looking into savingmoney for margin money for a home loan.

The couple has informed you of investing part of saving in the managed fund (equities) and Afterpay LtdShare(ASX: APT)in the name of Leo. They intend to usethis as margin money for the purchase of the house.

The Alexander couple hasinformedyou thatSavings from their family incomewill be invested into the Leos Managed Fund (equities) at the end of each financial year. Initially,Diane wanted to invest the savings directly into equities instead of a managed fund.

The couple intendsto pay back their credit card debt before the financial year endingJune 30th, 2021. This debt they accrued during their search for a job.

The family do not have any private healthinsurance.

Assume that both Leo and Dianehave minimum employer superannuation contributions paid in addition to their salary and they do not salary sacrifice into their superannuation. Diane and Leo have limited financial knowledge and are seeking your advice about their current financial status.

Q1) Calculate the solvency ratio, liquidity ratio and savings ratio using the Alexandercouples financial information.

Q2) Suggest one improvement the Alexander couple could make

note: this isn't an incomplete question, this is all I have got from the question

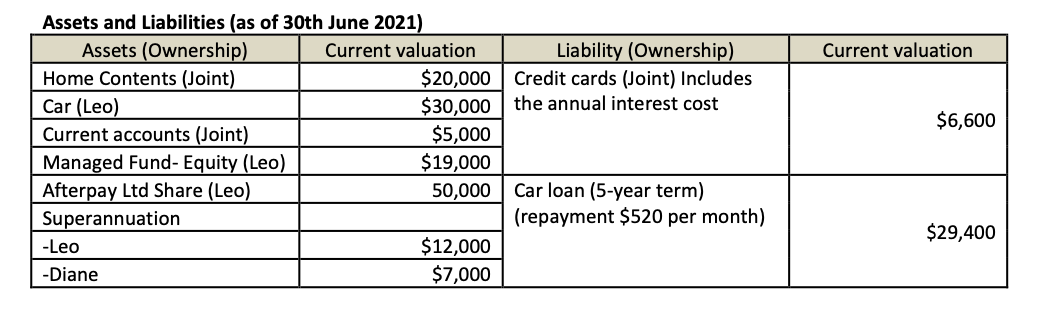

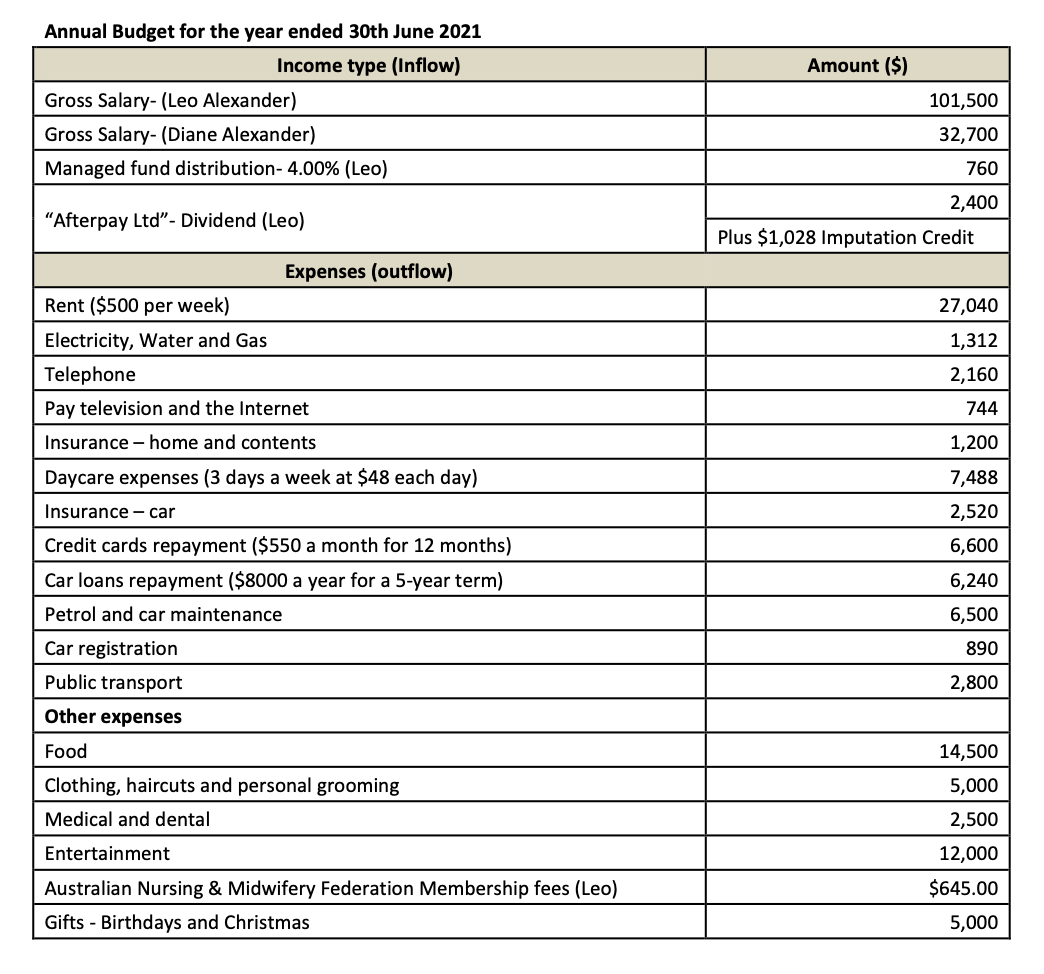

Current valuation $6,600 Assets and Liabilities (as of 30th June 2021) Assets (Ownership) Current valuation Liability (Ownership) Home Contents (Joint) $20,000 Credit cards (Joint) Includes Car (Leo) $30,000 the annual interest cost Current accounts (Joint) $5,000 Managed Fund- Equity (Leo) $19,000 Afterpay Ltd Share (Leo) 50,000 Car loan (5-year term) Superannuation (repayment $520 per month) -Leo $12,000 -Diane $7,000 $29,400 Amount ($) Annual Budget for the year ended 30th June 2021 Income type (Inflow) Gross Salary-(Leo Alexander) Gross Salary- (Diane Alexander) Managed fund distribution-4.00% (Leo) 101,500 32,700 760 2,400 "Afterpay Ltd"- Dividend (Leo) Plus $1,028 Imputation Credit Expenses (outflow) Rent ($500 per week) Electricity, Water and Gas Telephone Pay television and the Internet Insurance - home and contents 27,040 1,312 2,160 744 1,200 Daycare expenses (3 days a week at $48 each day) 7,488 Insurance - car 2,520 Credit cards repayment ($550 a month for 12 months) Car loans repayment ($8000 a year for a 5-year term) Petrol and car maintenance 6,600 6,240 6,500 890 2,800 Car registration Public transport Other expenses Food Clothing, haircuts and personal grooming Medical and dental Entertainment Australian Nursing & Midwifery Federation Membership fees (Leo) Gifts - Birthdays and Christmas 14,500 5,000 2,500 12,000 $645.00 5,000 Current valuation $6,600 Assets and Liabilities (as of 30th June 2021) Assets (Ownership) Current valuation Liability (Ownership) Home Contents (Joint) $20,000 Credit cards (Joint) Includes Car (Leo) $30,000 the annual interest cost Current accounts (Joint) $5,000 Managed Fund- Equity (Leo) $19,000 Afterpay Ltd Share (Leo) 50,000 Car loan (5-year term) Superannuation (repayment $520 per month) -Leo $12,000 -Diane $7,000 $29,400 Amount ($) Annual Budget for the year ended 30th June 2021 Income type (Inflow) Gross Salary-(Leo Alexander) Gross Salary- (Diane Alexander) Managed fund distribution-4.00% (Leo) 101,500 32,700 760 2,400 "Afterpay Ltd"- Dividend (Leo) Plus $1,028 Imputation Credit Expenses (outflow) Rent ($500 per week) Electricity, Water and Gas Telephone Pay television and the Internet Insurance - home and contents 27,040 1,312 2,160 744 1,200 Daycare expenses (3 days a week at $48 each day) 7,488 Insurance - car 2,520 Credit cards repayment ($550 a month for 12 months) Car loans repayment ($8000 a year for a 5-year term) Petrol and car maintenance 6,600 6,240 6,500 890 2,800 Car registration Public transport Other expenses Food Clothing, haircuts and personal grooming Medical and dental Entertainment Australian Nursing & Midwifery Federation Membership fees (Leo) Gifts - Birthdays and Christmas 14,500 5,000 2,500 12,000 $645.00 5,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started