Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a financial advisor and a portfolio manager. You are going to help your client, Anna, to find an optimal portfolio for her

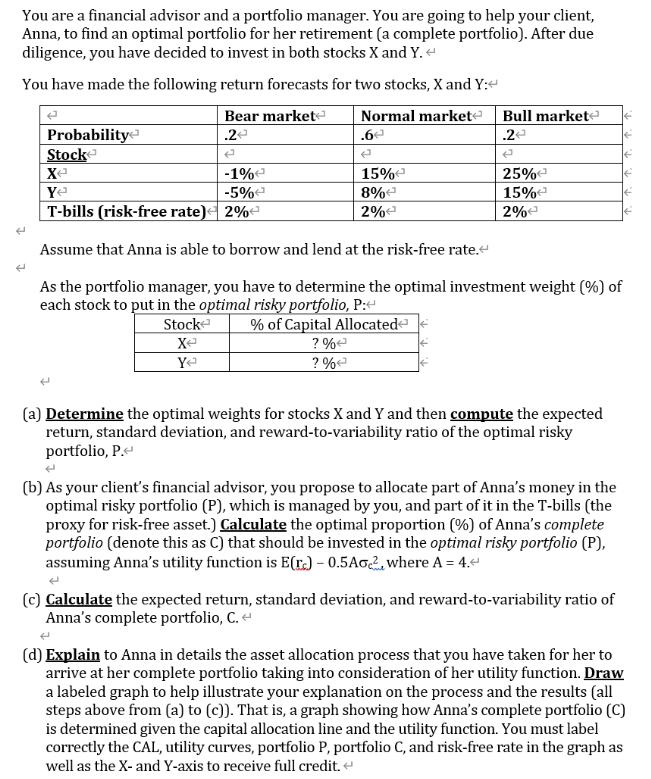

You are a financial advisor and a portfolio manager. You are going to help your client, Anna, to find an optimal portfolio for her retirement (a complete portfolio). After due diligence, you have decided to invest in both stocks X and Y. < You have made the following return forecasts for two stocks, X and Y: Probability Stock Xe Ye Bear market .2 Normal market .6 P Bull markete .2 P -1% 15% -5% 8% T-bills (risk-free rate) 2% 2% Assume that Anna is able to borrow and lend at the risk-free rate. < As the portfolio manager, you have to determine the optimal investment weight (%) of each stock to put in the optimal risky portfolio, P: Stock % of Capital Allocated Xe ? % ?% < Ye 25% 15% 2% (a) Determine the optimal weights for stocks X and Y and then compute the expected return, standard deviation, and reward-to-variability ratio of the optimal risky portfolio, P. (b) As your client's financial advisor, you propose to allocate part of Anna's money in the optimal risky portfolio (P), which is managed by you, and part of it in the T-bills (the proxy for risk-free asset.) Calculate the optimal proportion (%) of Anna's complete portfolio (denote this as C) that should be invested in the optimal risky portfolio (P), assuming Anna's utility function is E(r.) - 0.5A02, where A = 4. < (c) Calculate the expected return, standard deviation, and reward-to-variability ratio of Anna's complete portfolio, C. < (d) Explain to Anna in details the asset allocation process that you have taken for her to arrive at her complete portfolio taking into consideration of her utility function. Draw a labeled graph to help illustrate your explanation on the process and the results (all steps above from (a) to (c)). That is, a graph showing how Anna's complete portfolio (C) is determined given the capital allocation line and the utility function. You must label correctly the CAL, utility curves, portfolio P, portfolio C, and risk-free rate in the graph as well as the X- and Y-axis to receive full credit.

Step by Step Solution

★★★★★

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

a To find the optimal weights we set up the optimization problem Maximize ErP 05AP2 Subject to wX wY ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started