Answered step by step

Verified Expert Solution

Question

1 Approved Answer

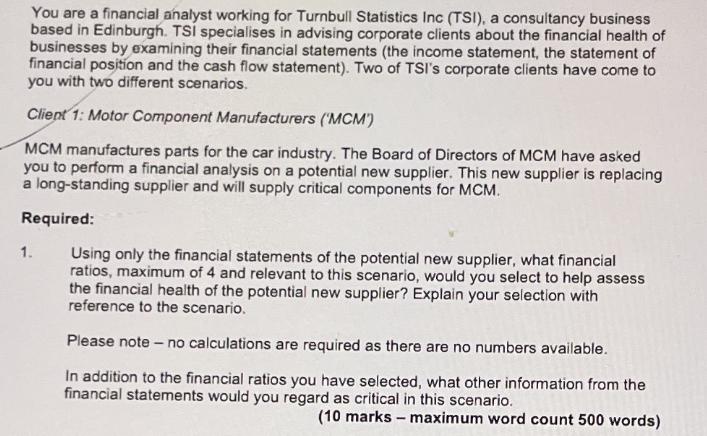

You are a financial analyst working for Turnbull Statistics Inc (TSI), a consultancy business based in Edinburgh. TSI specialises in advising corporate clients about

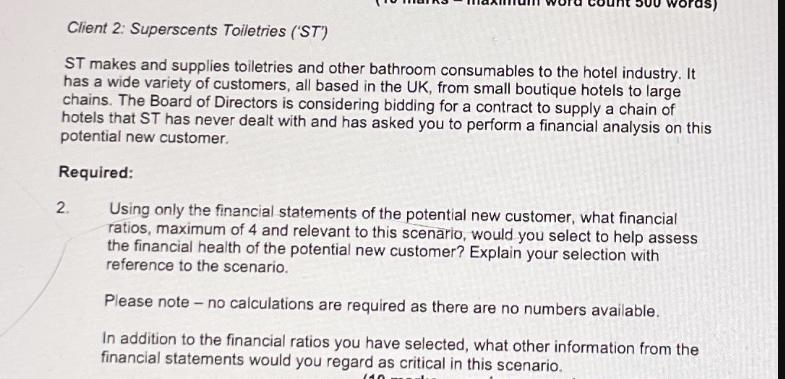

You are a financial analyst working for Turnbull Statistics Inc (TSI), a consultancy business based in Edinburgh. TSI specialises in advising corporate clients about the financial health of businesses by examining their financial statements (the income statement, the statement of financial position and the cash flow statement). Two of TSI's corporate clients have come to you with two different scenarios. Client 1: Motor Component Manufacturers (MCM") MCM manufactures parts for the car industry. The Board of Directors of MCM have asked you to perform a financial analysis on a potential new supplier. This new supplier is replacing a long-standing supplier and will supply critical components for MCM. Required: 1. Using only the financial statements of the potential new supplier, what financial ratios, maximum of 4 and relevant to this scenario, would you select to help assess the financial health of the potential new supplier? Explain your selection with reference to the scenario. Please note - no calculations are required as there are no numbers available. In addition to the financial ratios you have selected, what other information from the financial statements would you regard as critical in this scenario. (10 marks - maximum word count 500 words) Client 2: Superscents Toiletries ('ST'") ST makes and supplies toiletries and other bathroom consumables to the hotel industry. It has a wide variety of customers, all based in the UK, from small boutique hotels to large chains. The Board of Directors is considering bidding for a contract to supply a chain of hotels that ST has never dealt with and has asked you to perform a financial analysis on this potential new customer. Required: 2. Using only the financial statements of the potential new customer, what financial ratios, maximum of 4 and relevant to this scenario, would you select to help assess the financial health of the potential new customer? Explain your selection with reference to the scenario. Please note - no calculations are required as there are no numbers available. In addition to the financial ratios you have selected, what other information from the financial statements would you regard as critical in this scenario.

Step by Step Solution

★★★★★

3.32 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Client 1 Motor Component Manufacturers MCM Financial Ratios 1 Current Ratio Explanation The current ratio assesses the potential new suppliers shortterm liquidity and ability to meet its immediate obl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started