Answered step by step

Verified Expert Solution

Question

1 Approved Answer

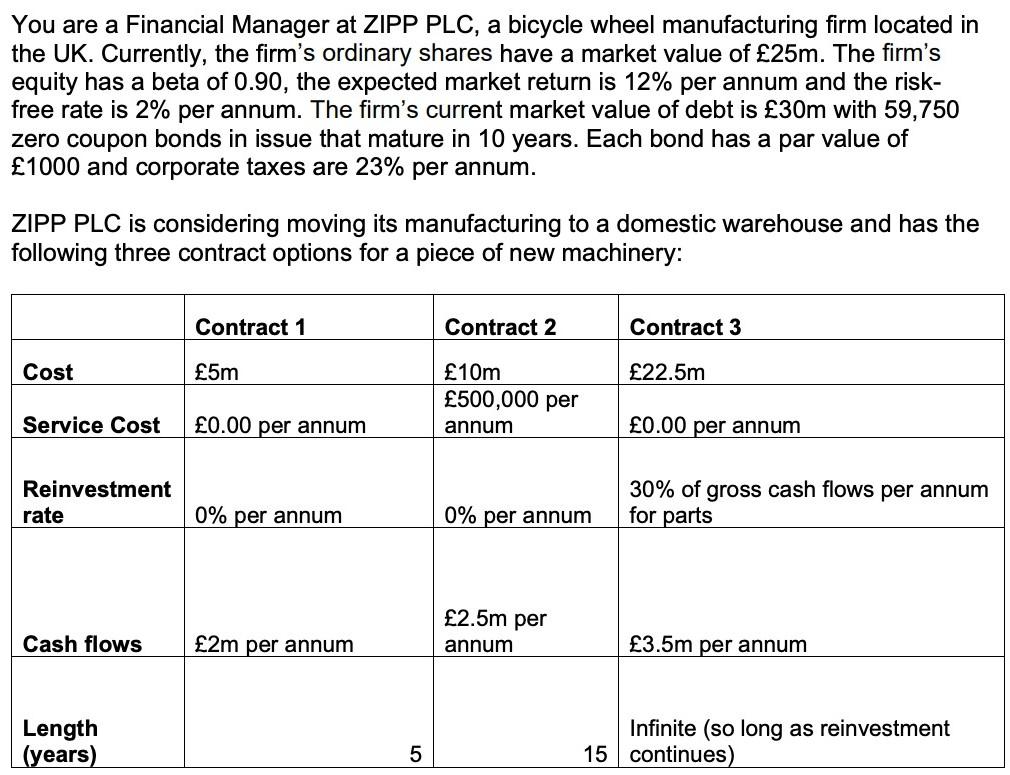

You are a Financial Manager at ZIPP PLC, a bicycle wheel manufacturing firm located in the UK. Currently, the firm's ordinary shares have a market

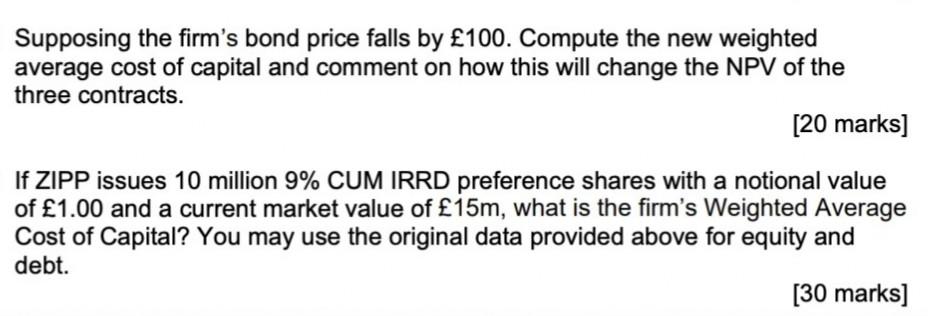

You are a Financial Manager at ZIPP PLC, a bicycle wheel manufacturing firm located in the UK. Currently, the firm's ordinary shares have a market value of 25m. The firm's equity has a beta of 0.90, the expected market return is 12% per annum and the risk- free rate is 2% per annum. The firm's current market value of debt is 30m with 59,750 zero coupon bonds in issue that mature in 10 years. Each bond has a par value of 1000 and corporate taxes are 23% per annum. ZIPP PLC is considering moving its manufacturing to a domestic warehouse and has the following three contract options for a piece of new machinery: Contract 1 Contract 2 Contract 3 Cost 5m 22.5m 10m 500,000 per annum Service Cost 0.00 per annum 0.00 per annum Reinvestment rate 30% of gross cash flows per annum for parts 0% per annum 0% per annum 2.5m per annum Cash flows 2m per annum 3.5m per annum Length (years) Infinite (so long as reinvestment 15 continues) 5 Supposing the firm's bond price falls by 100. Compute the new weighted average cost of capital and comment on how this will change the NPV of the three contracts. [20 marks] If ZIPP issues 10 million 9% CUM IRRD preference shares with a notional value of 1.00 and a current market value of 15m, what is the firm's Weighted Average Cost of Capital? You may use the original data provided above for equity and debt. [30 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started