you are a financial planner for johnson controls. assume last years profits were $750000

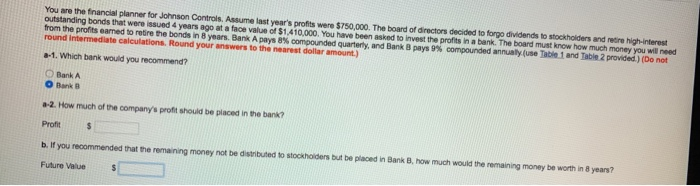

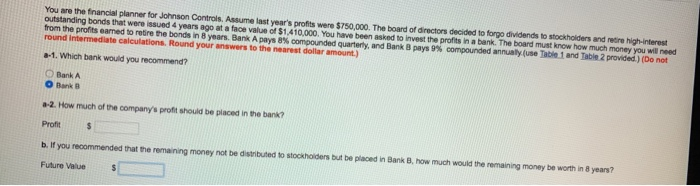

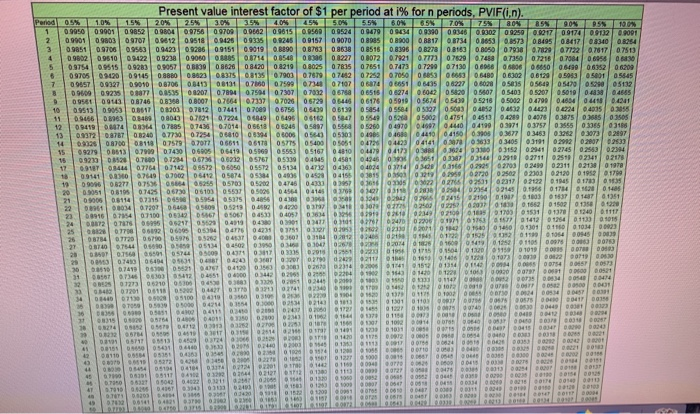

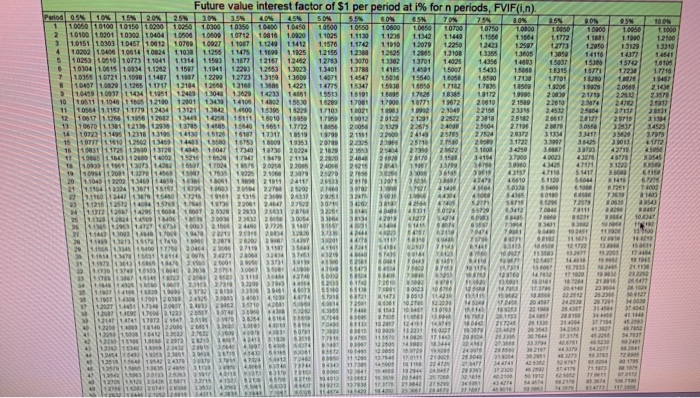

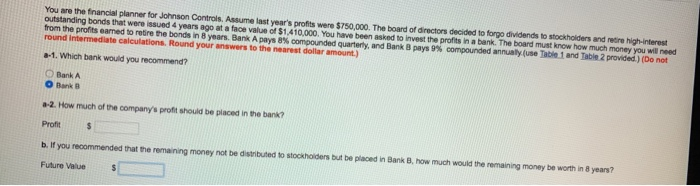

You are the financial planner for Johnson Controls. Assume last year's profits were $750,000. The board of directors decided to forge dividends to stockholders and retire high-interest outstanding bonds that were issued 4 years ago at a face value of $1.410,000. You have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire the bonds in 8 years. Bank Apays 8% compounded quarterly and Bank B pays 9% compounded annually use Table 1 and Table 2 provided.) (Do not round Intermediate calculations. Round your answers to the nearest dollar amount.) -1. Which bank would you recommend? BankA O Bank -2. How much of the company's profit should be placed in the bank Profit b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bark , how much would the remaining money be worth in 8 years? Future Values Present value interest factor of $1 per period at i% for n periods, PVIF(in). Period 0.5% 10% 15% 20% 30% 35% 40% 45% 5.0% 55% 60 G5NTO O NBON 1 0.9950099010985209804 0975609700002 09615 90 D5S 100% 000 000 09479 09390 093460.0002 0.92500 2017 09174 09122001 2 09901 0 9803 09707 090120951800425 09335 0.0245 091570 0070 08985089000 8817 0.8734 03653 0.8573 08495 0.8417 08340 0.8254 09851 09705 0.9563 0.9423 0.9286 0.9151 0.9019 0.8890 0.8763 08638 08515 0.8396 0.B273 08163 0.805007938 0,7129 077221 0.7817 0.7513 0902 0.9510 0.9422 0.9238 0.9060 0.3085 0.8714 0.8548 0.8396 0.0227 0 8072 0.7921 0.7773 0.7529 0.7458 0.735007218 070840605806830 0.9754095151 0.9283 09057 085390862808420 0.8219 08025 07835 07851 0.7473 0.7299 0.7130 08988068060 oso 06499 06352) 06209 6 0 9705091201 09165 0.8880 0.8623 0.8375 0.8135 0.7903 0.7679 0.744207252 0.7050 058530.6553 0.5480 0.6302 0.8129 0.5953 05801 05545 7 0 9857 0.9327 0.9010087060.8413 081310786007599 07348 07107068740665106435 06227 0.8028 05635 0564905470 05132 8 10 969 0.9235 0.3877 0.8535 01207 0.7094 075 070707032 667800651508274 0.00420 42008070540305207 05019 0.4338 0.4685 0.9580 0903 08746 08368 0.8007 07664 0.7337 0702005720 064 06176 050100 5674 054000 521805002 0.4790 0.460404 0.04 1009513 0.9053 0.3617 | 08203 0.7012 07441 07009 0.5756 05439 05139 0585405584051270503 04052 0453204 0.00244035 0. 25 11 10 94661 08963) 0.848008043 0.7621 0722406649 0 549606162 0 4 054 052 050020.0751 0.4513 0.4289 0.497 0.3875 0.358503505 12094194074 014 0705 074 0.7044 06618 06245 05097 0.5568052600497004902 44004190030710.375702555 03365 09188 13 072 0.8767 082400770 07254 066100994 OBOOS 0 05303 049804630044100 41503037 034600322 3073297 14 0902 08700081100757 0.707706611 06178 075 0 54000 505 01704123 04141 363 03405310201202007233 159279009130.790 0.7430 0.00 0.5419 0.50690555305167 041004190413083624 30031029410 27450254302394 150 .923 01207 7214 06735 0.0212057670533904045 04501049460463851 0387 0 29007110251002341 02178 17091 01444 07764 07142) 69572 05050 05572 051340479 04064074 3714 22 366029950203 024102311021300 1978 18091410 07449 6.7002064120587405334 000 000041631500022 .295902720020023030212001952 01709 1909096002770756 0 5258057000 5202 04746 04331 3 0501222715021023170112 0.11450 1700035 200905106105 074251 067300610305537 500 046 04145 1 2 354 02145 0. 01714 .20 0.1485 21 0905 06114 073156596 0.595405375 456 000 160 02 4 1502190107 01003 | 0143761351 22 00 0034 TOT 0 545 58005219 04142207 2 257620001030101502013501220 230091654 07100126 506 6453 0405341 0 0 149 0710010917031511130 1340 1117 24 .072 OTT 09950521705600411004300010 0 247072061 3 00 1412 0124 0.113001015 25 20 070 069 060 0534 046 047H355 0913062014 50 1450 1301 01101034 00023 26 087547720 06790 0.59760572 04637 0.40036073184 021224 1 0122100 0110010540500039 27740 T4 0 513440p 100 101 0 2034183816090125110 00 007 2000.1166591 0744 500 03 01033002015 0 195017500 1220 5150010190 0003 2 0 7430064546900434 0222111th 1501406 01073000100012207190.000 10.74100605646041200563 300 104101214115111 110 210 .2006 1 57 412 411 410005442 020 021 224 4314012209030 0 0 0 0521 1147 0 01 030 000 12110101 01100 01420170106118000 1102741741 1712 120100100 00532 000 DO 040 011090815100419 30 31 2 SO DET 22000 22001101002 4 DOM 1 00001001 102 101 1 02 103 11510140010111111011 O N 02162012313310101 0112 110 1101012 2014 OTSIO 112 OB1010101100 019 113 11 01 000 000 22 95 OS 11 0 1470 12 0.002 00000000005490410 00 0 1 51704130452904 104 00 0 00 00 15 11 0001102020 12355184000050 TORRES 30130 000 00 GOLD 31 Future value interest factor of $1 per period at i% for n periods, FVIF(in). Paris 5 10 15 20 25 30 35 40 45 50% 50 SN70 75 80415_0010 1 1000 10100 10150 1.000 1.0050 10000 10350 10400 1050 10500 2 10100102011030010404 105 106 1071210818 1.0820 11025 3 1.0151103031045710912 10700 1.0927 1.1007 1.1240 11412 1.1576 1.172 1.1910 1.2079 17250 4 10202 1.04051901410824 1.1038 1.125 11475 .100 1.1825 1.2155 1238 12695 125 13108 3 102531.051010773 11041 1.1314 1.1593 1.1677 12167 1 2482 1273 1 TO 12182 13701 6 1030410615 109341.1212 1 1597 1.1941 1 2203 12053 1.30231 1.3401 13709 7 10551 0721110901487 1197 12200 12723 1.3159 1.3609 1 4547 15006 BT11021126511717121841 12 1313138 14221 1992820599 2106 104991093711434 1951 124891 12045 13620 2171225223579 10110511 1 1 194 195 121901 12101 1 341 4100140216639 2.269 274 2472 11 1 1157 117791234 13121 1384240 V 1 102 1983 1982 2.451225104 27137 12 1091711200 1.1956 1201213440 142501511110010 1.5959 1 2012 20122 1212312022 13 106701138112131231374514685 1684015651 17722 2005 2.1329 22675 24018 14 1072311495 1.2318 3195141301512 15187 17311 18519 21151 22000 15 107771.96101250213450 14401 15600 1675 100 19353 2.235 23955 76111111720122013201414 129901 3128 141451 1 10 1100 10 1873 2024 23553 25404 11105116412001450215216 117 118 111 1 1101 11307314212 15501 170241057 2052 2015 10 15 20 38 1139 2106 2014041031413 1201 1 21911 21 111041241515 16160 220 2 160124 5 480721619151 20315 230 2433 0 11215125724084121.1517322051 245472752 2411212207 14.30 2030 2031 2014 40 25 02 7612201202414500 150 200 2322 26 2014 0 2150624450 21 122 121 2221325310 033 20726760296 20 1 61007740414227193117 I 2006 20 1 0 T 52001 7404 113 1 14 21500260012337 1 0 1 1 30 1730 4 6 20 20 30 11111 0 2310320122016 9 2 20133333 30 . 1 1.4308 1. 2000 24335 20 30 2 141111200T 2.3 2 5710 2011 01 .7000 2100 2100 24 20 18 48158650 19 1 2017 10 120 100 10140 32000 320 0 1 10 1 16516 4311023432203440 24 1 132 133 13455156101495205 11240711 474 4121482 11 4 11 3 113 1 100ml 2 012 20 1 3 20145700400 3 2014 2014 2013 2 L1144429 ES R TENO CU OUR