Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a firm believer in the Capital Asset Pricing Model (CAPM). You collected the following information for Firm A and B stocks: -

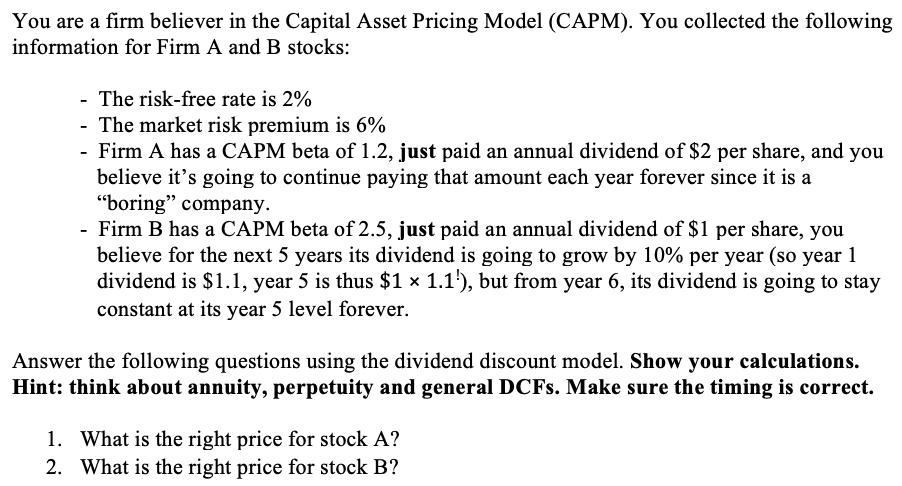

You are a firm believer in the Capital Asset Pricing Model (CAPM). You collected the following information for Firm A and B stocks: - The risk-free rate is 2% - The market risk premium is 6% - Firm A has a CAPM beta of 1.2, just paid an annual dividend of $2 per share, and you believe it's going to continue paying that amount each year forever since it is a "boring" company. - Firm B has a CAPM beta of 2.5, just paid an annual dividend of $1 per share, you believe for the next 5 years its dividend is going to grow by 10% per year (so year 1 dividend is $1.1, year 5 is thus $1 1.1'), but from year 6, its dividend is going to stay constant at its year 5 level forever. Answer the following questions using the dividend discount model. Show your calculations. Hint: think about annuity, perpetuity and general DCFs. Make sure the timing is correct. 1. What is the right price for stock A? 2. What is the right price for stock B?

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started