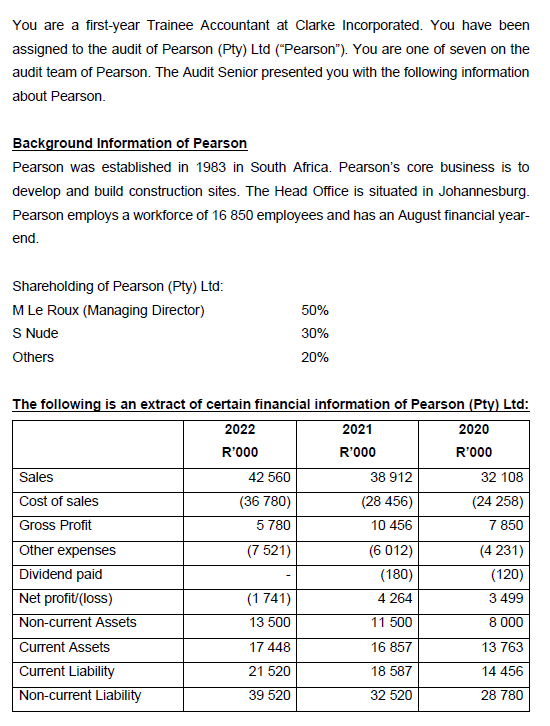

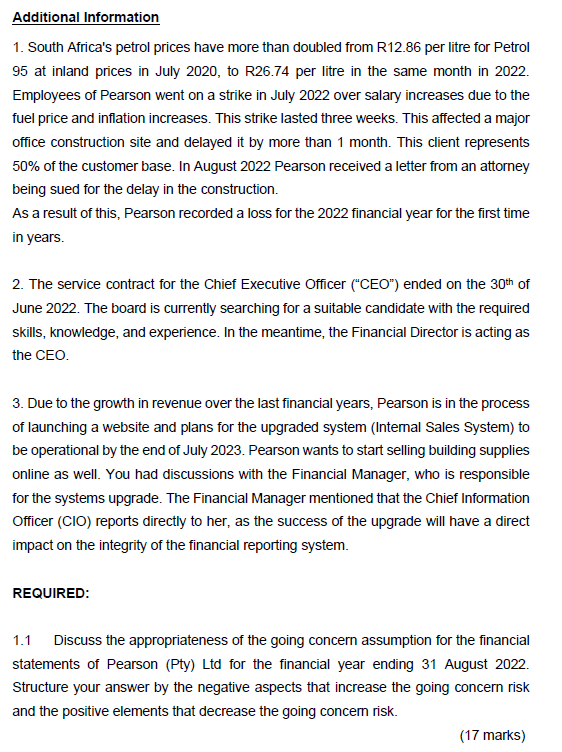

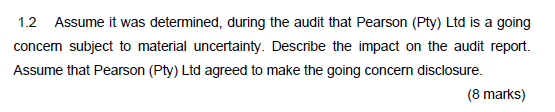

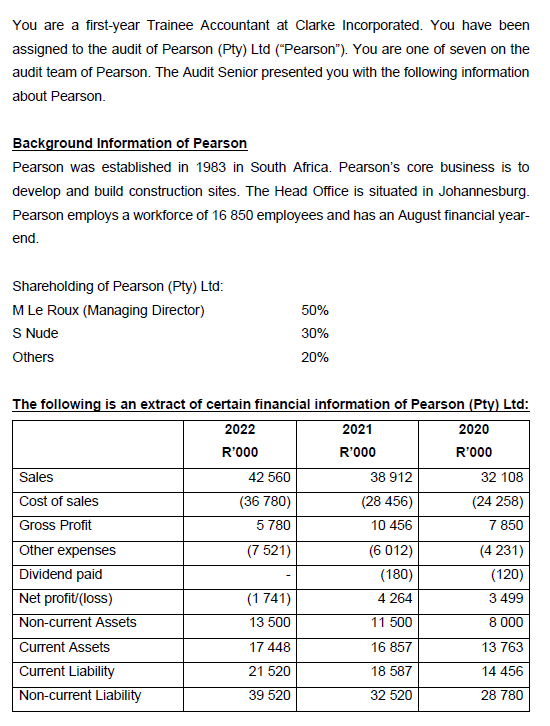

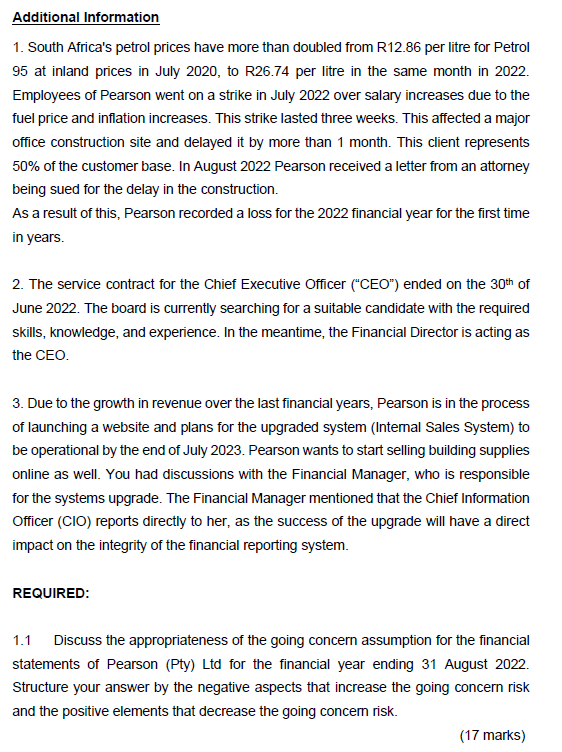

You are a first-year Trainee Accountant at Clarke Incorporated. You have been assigned to the audit of Pearson (Pty) Ltd ("Pearson"). You are one of seven on the audit team of Pearson. The Audit Senior presented you with the following information about Pearson. Background Information of Pearson Pearson was established in 1983 in South Africa. Pearson's core business is to develop and build construction sites. The Head Office is situated in Johannesburg. Pearson employs a workforce of 16850 employees and has an August financial yearend. The following is an extract of certain financial information of Pearson (Pty) Ltd: Additional Information 1. South Africa's petrol prices have more than doubled from R12.86 per litre for Petrol 95 at inland prices in July 2020, to R26.74 per litre in the same month in 2022. Employees of Pearson went on a strike in July 2022 over salary increases due to the fuel price and inflation increases. This strike lasted three weeks. This affected a major office construction site and delayed it by more than 1 month. This client represents 50% of the customer base. In August 2022 Pearson received a letter from an attorney being sued for the delay in the construction. As a result of this, Pearson recorded a loss for the 2022 financial year for the first time in years. 2. The service contract for the Chief Executive Officer ("CEO") ended on the 30th of June 2022. The board is currently searching for a suitable candidate with the required skills, knowledge, and experience. In the meantime, the Financial Director is acting as the CEO. 3. Due to the growth in revenue over the last financial years, Pearson is in the process of launching a website and plans for the upgraded system (Internal Sales System) to be operational by the end of July 2023. Pearson wants to start selling building supplies online as well. You had discussions with the Financial Manager, who is responsible for the systems upgrade. The Financial Manager mentioned that the Chief Information Officer (CIO) reports directly to her, as the success of the upgrade will have a direct impact on the integrity of the financial reporting system. REQUIRED: 1.1 Discuss the appropriateness of the going concern assumption for the financial statements of Pearson (Pty) Ltd for the financial year ending 31 August 2022. Structure your answer by the negative aspects that increase the going concern risk and the positive elements that decrease the going concern risk. 1.2 Assume it was determined, during the audit that Pearson (Pty) Ltd is a going concern subject to material uncertainty. Describe the impact on the audit report. Assume that Pearson (Pty) Ltd agreed to make the going concern disclosure. You are a first-year Trainee Accountant at Clarke Incorporated. You have been assigned to the audit of Pearson (Pty) Ltd ("Pearson"). You are one of seven on the audit team of Pearson. The Audit Senior presented you with the following information about Pearson. Background Information of Pearson Pearson was established in 1983 in South Africa. Pearson's core business is to develop and build construction sites. The Head Office is situated in Johannesburg. Pearson employs a workforce of 16850 employees and has an August financial yearend. The following is an extract of certain financial information of Pearson (Pty) Ltd: Additional Information 1. South Africa's petrol prices have more than doubled from R12.86 per litre for Petrol 95 at inland prices in July 2020, to R26.74 per litre in the same month in 2022. Employees of Pearson went on a strike in July 2022 over salary increases due to the fuel price and inflation increases. This strike lasted three weeks. This affected a major office construction site and delayed it by more than 1 month. This client represents 50% of the customer base. In August 2022 Pearson received a letter from an attorney being sued for the delay in the construction. As a result of this, Pearson recorded a loss for the 2022 financial year for the first time in years. 2. The service contract for the Chief Executive Officer ("CEO") ended on the 30th of June 2022. The board is currently searching for a suitable candidate with the required skills, knowledge, and experience. In the meantime, the Financial Director is acting as the CEO. 3. Due to the growth in revenue over the last financial years, Pearson is in the process of launching a website and plans for the upgraded system (Internal Sales System) to be operational by the end of July 2023. Pearson wants to start selling building supplies online as well. You had discussions with the Financial Manager, who is responsible for the systems upgrade. The Financial Manager mentioned that the Chief Information Officer (CIO) reports directly to her, as the success of the upgrade will have a direct impact on the integrity of the financial reporting system. REQUIRED: 1.1 Discuss the appropriateness of the going concern assumption for the financial statements of Pearson (Pty) Ltd for the financial year ending 31 August 2022. Structure your answer by the negative aspects that increase the going concern risk and the positive elements that decrease the going concern risk. 1.2 Assume it was determined, during the audit that Pearson (Pty) Ltd is a going concern subject to material uncertainty. Describe the impact on the audit report. Assume that Pearson (Pty) Ltd agreed to make the going concern disclosure