Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a foreign exchange dealer. You see the following quote on your Bloomberg screen You are a foreign exchange dealer. You see the following

You are a foreign exchange dealer. You see the following quote on your Bloomberg screen

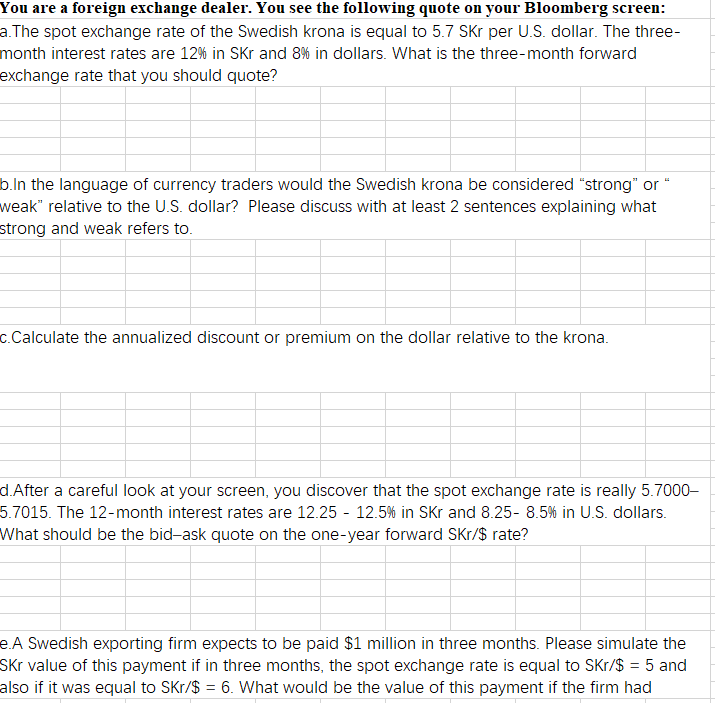

You are a foreign exchange dealer. You see the following quote on your Bloomberg screen: a. The spot exchange rate of the Swedish krona is equal to 5.7 SKr per U.S. dollar. The three- month interest rates are 12% in SKr and 8% in dollars. What is the three-month forward exchange rate that you should quote? b.In the language of currency traders would the Swedish krona be considered "strong" or " weak" relative to the U.S. dollar? Please discuss with at least 2 sentences explaining what strong and weak refers to. c.Calculate the annualized discount or premium on the dollar relative to the krona. d.After a careful look at your screen, you discover that the spot exchange rate is really 5.7000- 5.7015. The 12-month interest rates are 12.25 - 12.5% in SKr and 8.25- 8.5% in U.S. dollars. What should be the bid-ask quote on the one-year forward Skr/$ rate? e.A Swedish exporting firm expects to be paid $1 million in three months. Please simulate the SKr value of this payment if in three months, the spot exchange rate is equal to Skr/$ = 5 and also if it was equal to Skr/$ = 6. What would be the value of this payment if the firm had

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The three month forward exchange rate is equal to F 57 1 124 1 84 F 57559 Skr b Since the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started