Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a fund manager for high net - wealth clients. One of your clients expects shortterm interest rates to remain low over the coming

You are a fund manager for high netwealth clients. One of your clients expects shortterm interest rates to remain low over the coming year and expects equities to offer a significantly higher return. The investor wants to shift some funds from cash to equities. The investor currently holds a portfolio of money market assets.

A Detail possible solutions available to the client to achieve her aims, along with the advantagesdisadvantages associated with each method. One of these solutions should be a swap contract.

B The client decides to enter into a oneyear equity swap where the counterparty agrees to pay the investor the total return to the stock index in exchange for dollardenominated Libor on a quarterly basis. The Exhibit below summarizes the mechanics of the swap assuming that on settlement date the stock index is at dividends are index points each quarter, and current day Libor is and the notional amount of the contract is $ Each quarter contains days.

Swap Data

tableTIMELIBOR,S&P SettlementReset#Reset#Reset#Maturity

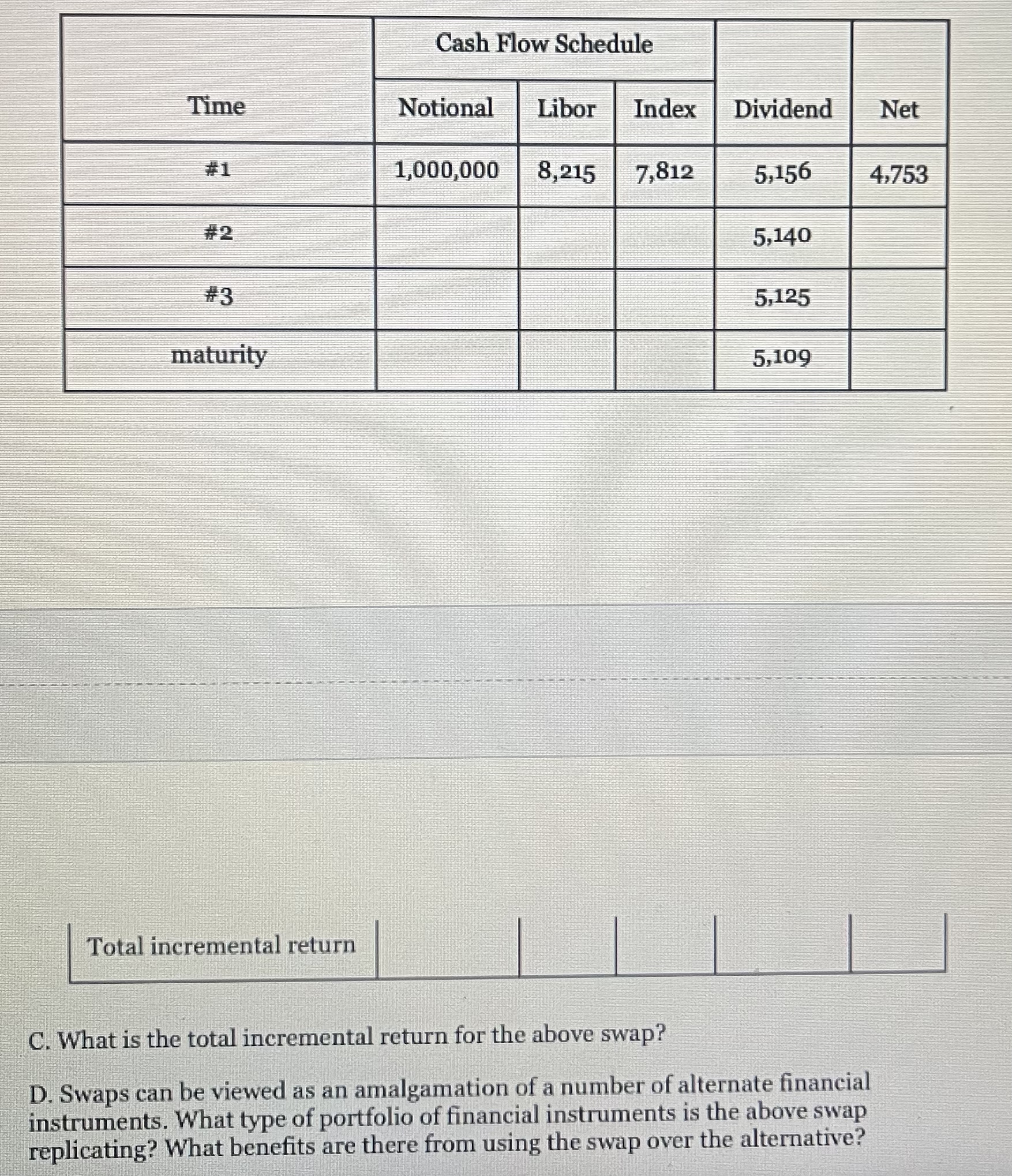

Fill in the missing values from the cash flow schedule below:

tableTimeCash Flow Schedule,,NotionalLibor,Index,Dividend,Net##tableTimeCash Flow Schedule,,NotionalLibor,Index,Dividend,Net###maturity

Total incremental return

C What is the total incremental return for the above swap?

D Swaps can be viewed as an amalgamation of a number of alternate financial instruments. What type of portfolio of financial instruments is the above swap replicating? What benefits are there from using the swap over the alternative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started