You are a Graduate Tax Advisor, employed by Tax Advisors Pty Ltd. Your Partner has assigned you the following client file after attending a meeting with the client. Client Background Judy Somerville is employed by Ansett Airways Limited (Ansett) since 2003 as a long-haul flight attendant based in Melbourne, Australia. The nature of Judys position with Ansett sees her flying to international ports where she spends 183 days away from her home base each calendar year. The remaining days of each calendar year are spent in Australia, and Judy uses this nonflying time to organise the importation of textiles into Australia from Textiles Inc. (a company registered in the USA). Until recently, Judy was the exclusive distributor of textiles to retailers in Australia. .

Candidates must apply the IRAC principle when addressing the relevant issues (i.e. I= Identify the key issues, R= Cite the relevant legislative provisions and case law (rules) where appropriate, A = apply the relevant rules to the facts presenting arguments for and against and C = form a conclusion based on your stronger argument). Your Partner has requested that you review the file in its entirety (as below) in order to undertake the engagement work as agreed between Tax Advisors Pty Ltd and Judy Somerville, as outlined in the Required section of this document using Australian Tax Laws Judy Somerville has engaged Tax Advisors Pty Ltd to advise her of all her tax issues which will arise from the documents provided in respect of the income year ending 30 June 2020.

Your Partner has requested that you: Prepare a letter of advice to Judy Somerville which identifies all relevant tax issues that will arise out of all the documents provided, critically analyzing and applying the taxation treatment to the issues, i.e., you will need to argue and support your view and consider differing views (if applicable), and finally, indicate your recommended action based on your better view, i.e., your conclusion. Be sure to consider all issues, including but not limited to issues that may not be as obvious, for example tax accounting, tax periods, potential levies, surcharges, offsets and substantiation requirements. You must ensure that your analysis used to determine your recommended action is fully supported with relevant authority, for example, tax legislation and case law.

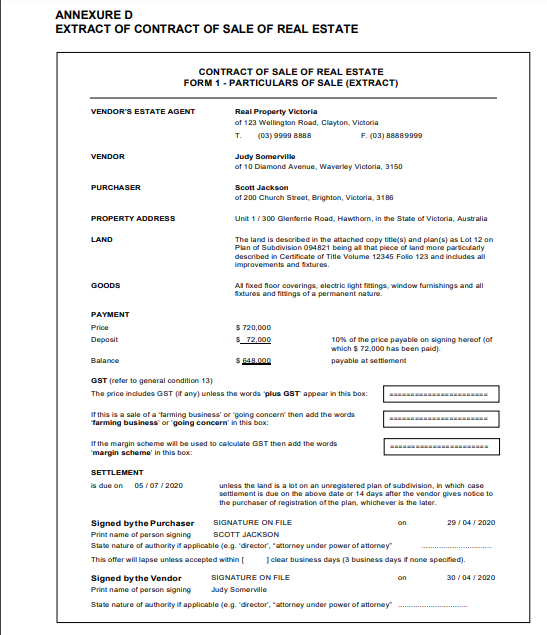

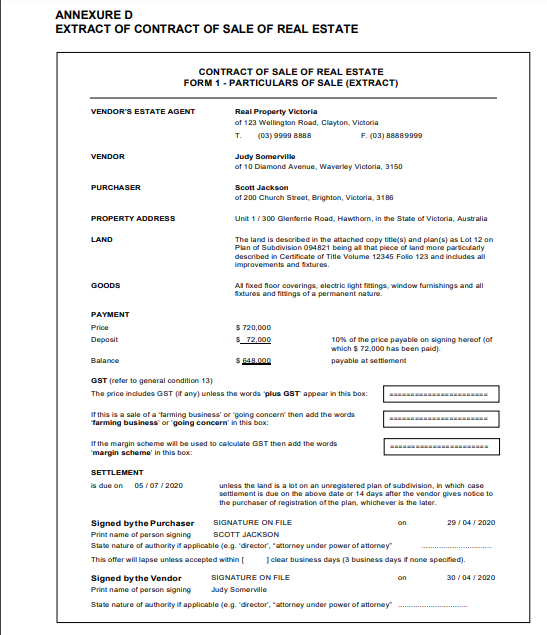

ANNEXURED EXTRACT OF CONTRACT OF SALE OF REAL ESTATE CONTRACT OF SALE OF REAL ESTATE FORM 1 - PARTICULARS OF SALE (EXTRACT) VENDOR'S ESTATE AGENT Real Property Victoria of 123 Wellington Road, Clayton, Victoria T. (03) 9999 8888 F. (03) 88889999 Judy Somerville of 10 Diamond Avenue, Waverley Victoria, 3150 VENDOR PURCHASER Scott Jackson of 200 Church Street, Brighton, Victoria, 3186 PROPERTY ADDRESS Unit 1/300 Glenferrie Road, Hawthorn, in the State of Victoria, Australia LAND The land is described in the attached copy titles) and plan(s) as Lot 12 on Plan of Subdivision 094821 being all that piece of land more particularly described in Certificate of Title Volume 12345 Folio 123 and includes all improvements and fixtures GOODS Al fixed floor coverings, electric light fittings, window furnishings and all factures and fittings of a permanent nature. PAYMENT Price Deposit $ 720,000 $_72.000 10% of the price payable on signing thereof (of which $ 72,000 has been paid). payable at settlement Balance S548.000 GST (refer to general condition 13) The price includes GST (if any) unless the words plus GST appear in this box: If this is a sale of a farming business' or 'going concern' then add the words farming business' or 'going concern' in this box If the margin scheme will be used to calculate GST then add the words "margin scheme' in this box SETTLEMENT is due on 05/07/2020 unless the land is a lot on an unregistered plan of subdivision, in which case settlement is due on the above date or 14 days after the vendor gives notice to the purchaser of registration of the plan, whichever is the later. Signed by the Purchaser SIGNATURE ON FILE on 29 / 04 / 2020 Print name of person signing SCOTT JACKSON State nature of authority if applicable (e.g. director', 'attorney under power of attorney This offer will lapse unless accepted within clear business days (3 business days if none specified). Signed by the Vendor SIGNATURE ON FILE on 30/04/2020 Print name of person signing Judy Somerville State nature of authority if applicable (e.g. director', 'attorney under power of attomey ANNEXURED EXTRACT OF CONTRACT OF SALE OF REAL ESTATE CONTRACT OF SALE OF REAL ESTATE FORM 1 - PARTICULARS OF SALE (EXTRACT) VENDOR'S ESTATE AGENT Real Property Victoria of 123 Wellington Road, Clayton, Victoria T. (03) 9999 8888 F. (03) 88889999 Judy Somerville of 10 Diamond Avenue, Waverley Victoria, 3150 VENDOR PURCHASER Scott Jackson of 200 Church Street, Brighton, Victoria, 3186 PROPERTY ADDRESS Unit 1/300 Glenferrie Road, Hawthorn, in the State of Victoria, Australia LAND The land is described in the attached copy titles) and plan(s) as Lot 12 on Plan of Subdivision 094821 being all that piece of land more particularly described in Certificate of Title Volume 12345 Folio 123 and includes all improvements and fixtures GOODS Al fixed floor coverings, electric light fittings, window furnishings and all factures and fittings of a permanent nature. PAYMENT Price Deposit $ 720,000 $_72.000 10% of the price payable on signing thereof (of which $ 72,000 has been paid). payable at settlement Balance S548.000 GST (refer to general condition 13) The price includes GST (if any) unless the words plus GST appear in this box: If this is a sale of a farming business' or 'going concern' then add the words farming business' or 'going concern' in this box If the margin scheme will be used to calculate GST then add the words "margin scheme' in this box SETTLEMENT is due on 05/07/2020 unless the land is a lot on an unregistered plan of subdivision, in which case settlement is due on the above date or 14 days after the vendor gives notice to the purchaser of registration of the plan, whichever is the later. Signed by the Purchaser SIGNATURE ON FILE on 29 / 04 / 2020 Print name of person signing SCOTT JACKSON State nature of authority if applicable (e.g. director', 'attorney under power of attorney This offer will lapse unless accepted within clear business days (3 business days if none specified). Signed by the Vendor SIGNATURE ON FILE on 30/04/2020 Print name of person signing Judy Somerville State nature of authority if applicable (e.g. director', 'attorney under power of attomey