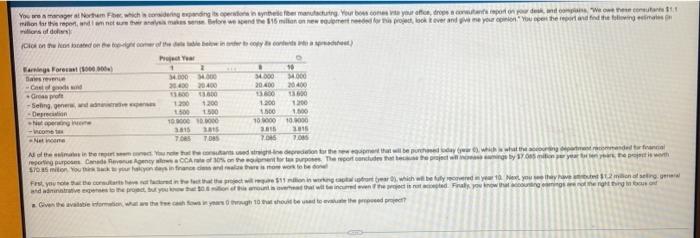

You are a manager at Northem Fibec, which is considering expanding its operations in synthese fiber manufacturing Your boss comes to your office, drops a contents report on your desk, and compass "We owe these consultants 11.1 million for this report, and I nakes sense Before we spend $16 million on new equipment needed for this project, look it ever and open the report and find the following estimates n millions of dol (Clok on the con located on the top-right comer of t Earnings Foreca (5000.000) Saves revenue -Cast of goods sind Groas profe -Seling, gener, and adve Project Year 1 1 34.000 34.000 20400 20 400 13.600 13.000 1.200 1.200 1.500 1.500 10000 100000 Depreciation hat operating income come Net income As of the estimates in the report seem conect You note that the constants used straight-ine depredation for the new equipment that will be purchased today (ywar), which is what the a ment for tes purposes. The report concludes that because the project will increassemings by 17 reporting purposes Canade Revenue Agency allowa CCA rate of 30% $70 a5 milion You the back to your halyon days in finance cless and realize there is more work to be done $11 milion in w 3815 3815 7.065 7.085 . 34.000 34.000 20.400 20.400 13800 13600 1.200 1200 1.500 1.500 10000 10.000 2015 2015 7.045 7.005 First, you that the consutarts have not factured in the fact that and administrative expenses to the project, but you know that 10. partment commended for financial the project is worth capital tront (year 0), which will be fully recovered in year 10 Next, you see they have a $1.2 million of seling general incurred even if the project is not accepted. Finally, you know that accounting eanings are not the right thing in us and a Given the available information, what are the tree cash flows in years 0 though 10 that should be used to evaluate the proposed project? You are a manager at Northem Fibec, which is considering expanding its operations in synthese fiber manufacturing Your boss comes to your office, drops a contents report on your desk, and compass "We owe these consultants 11.1 million for this report, and I nakes sense Before we spend $16 million on new equipment needed for this project, look it ever and open the report and find the following estimates n millions of dol (Clok on the con located on the top-right comer of t Earnings Foreca (5000.000) Saves revenue -Cast of goods sind Groas profe -Seling, gener, and adve Project Year 1 1 34.000 34.000 20400 20 400 13.600 13.000 1.200 1.200 1.500 1.500 10000 100000 Depreciation hat operating income come Net income As of the estimates in the report seem conect You note that the constants used straight-ine depredation for the new equipment that will be purchased today (ywar), which is what the a ment for tes purposes. The report concludes that because the project will increassemings by 17 reporting purposes Canade Revenue Agency allowa CCA rate of 30% $70 a5 milion You the back to your halyon days in finance cless and realize there is more work to be done $11 milion in w 3815 3815 7.065 7.085 . 34.000 34.000 20.400 20.400 13800 13600 1.200 1200 1.500 1.500 10000 10.000 2015 2015 7.045 7.005 First, you that the consutarts have not factured in the fact that and administrative expenses to the project, but you know that 10. partment commended for financial the project is worth capital tront (year 0), which will be fully recovered in year 10 Next, you see they have a $1.2 million of seling general incurred even if the project is not accepted. Finally, you know that accounting eanings are not the right thing in us and a Given the available information, what are the tree cash flows in years 0 though 10 that should be used to evaluate the proposed project