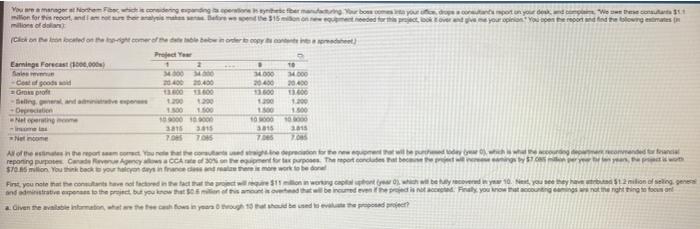

You are a manager at Northem Fiber, which is considering expanding ta operatione in synthetic fiber manufacturing Your boss s million for this report, and a sure their analysis mates senas Before millions of dolla (Click on the loncat the top-right comer of the date table below in order to copy the content) Project Year Earnings Forecast (1000.000) Sales revenue Cost of goods d Gros profe -Selling general and administrave expenses -Depreciation 2 34000 34000 20.400 20.400 13.800 13.600 1.200 1.200 1.500 1.500 10 9000 10000 3415 7.045 3815 7.085 . 10 34.000 34.000 20.400 20.400 13.600 13.400 1.200 1.500 10 000 Net operating mome inimes Net income All of the estimates in the report saam corect You note that the consultants used straightine reporting purposes Canade Revenue Agency allows a CCA a $70.85 million You think back to your halcyon days in finance class and realize there is more work have not factored in the fact that 1.200 1.500 100000 2015 7.095 3815 7.065 pment needed for this project, s to your office drops a consultants sporti depreciation for the new equipment that will b purposes. The report e $11 million in working capital spont (rear 0 today First, you note that the and administrative expenses to the project, but you k a. Given the available information, what are the the cash flows in years 0 through 10 that should be used to evaluate the proposed project? e fully recovered in year that will be incurred even if the project is not accepted. Finally, you know that We owe these consultants $11 find the t wing estimates francia is wh y have tributed $1.2 milion of selling general the right thing to focus on You are a manager at Northem Fiber, which is considering expanding ta operatione in synthetic fiber manufacturing Your boss s million for this report, and a sure their analysis mates senas Before millions of dolla (Click on the loncat the top-right comer of the date table below in order to copy the content) Project Year Earnings Forecast (1000.000) Sales revenue Cost of goods d Gros profe -Selling general and administrave expenses -Depreciation 2 34000 34000 20.400 20.400 13.800 13.600 1.200 1.200 1.500 1.500 10 9000 10000 3415 7.045 3815 7.085 . 10 34.000 34.000 20.400 20.400 13.600 13.400 1.200 1.500 10 000 Net operating mome inimes Net income All of the estimates in the report saam corect You note that the consultants used straightine reporting purposes Canade Revenue Agency allows a CCA a $70.85 million You think back to your halcyon days in finance class and realize there is more work have not factored in the fact that 1.200 1.500 100000 2015 7.095 3815 7.065 pment needed for this project, s to your office drops a consultants sporti depreciation for the new equipment that will b purposes. The report e $11 million in working capital spont (rear 0 today First, you note that the and administrative expenses to the project, but you k a. Given the available information, what are the the cash flows in years 0 through 10 that should be used to evaluate the proposed project? e fully recovered in year that will be incurred even if the project is not accepted. Finally, you know that We owe these consultants $11 find the t wing estimates francia is wh y have tributed $1.2 milion of selling general the right thing to focus on