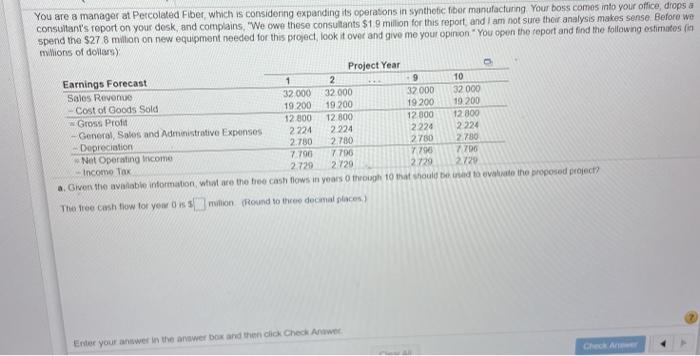

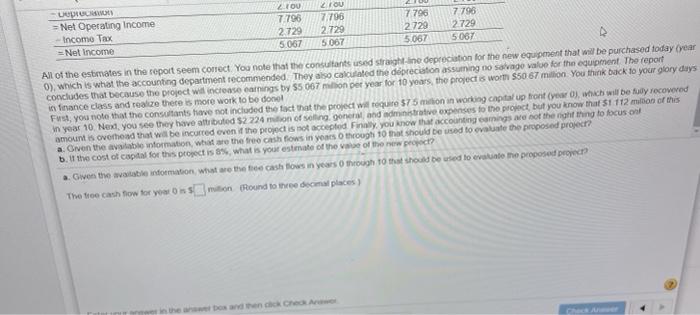

You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic for manufacturing Your boss comes into your office drops & consultant's report on your desk and complains, "We owe these consultants $19 million for this report and I am not sure thoir analysis makes sense Before we spend the $27 8 million on new equipment needed for this project, look it over and give me your opinion "You open the report and find the following estimates (in mvhions of dollars Project Year Earnings Forecast 1 2 9 10 Sales Revenge 32 000 32.000 32 000 32 000 Cost of Goods Sold 19 200 19 200 19 200 19 200 Gross Profit 12 800 12 800 12 800 12 800 - General Sales and Administrative Expenses 2224 2224 2.224 2224 Depreciation 2.780 2780 2780 2780 Net Operating income 7790 7706 7.790 7700 --Income Tax 2729 2729 2729 2720 a. Given the available information, what are the bee cash flows in years through 10 that should be used to evaluate the proposed project The tree cash flow for your smilion (Round to the docmal places) Enter your answer in the answer box and then click Check Answer LOCUS TOUZrou Net Operating Income 7.796 7/796 7.796 7.796 Income Tax 2729 2729 2.729 2729 = Net Income 5067 5.067 5.067 5067 All of the estimates in the copot seem contact you note that the consultants used straight-line depreciation for the new equipment that will be purchased today year O), which is what the accounting department recommended. They also calculated the depreciation assuming no savage value for the equipment. The report concludes that because the project will increase earnings by 55 067 million per year for 10 years, the project is worm $50 67 million you think back to your glory days in finance class and realize there is more work to be donel Fust, you note that the consultants have not included the fact that the project will require 575 milion in working capital up front years, which will be fy recovered in year 10 Ned, you see they have attributed $2 224 milion of soling, goner, and administrative expenses to the project, but you know that $1 112 million of this amount is overhead that will be incurred even the project is not accepted. Finally, you know that accounting coming we nor the night thing to focus of a. Given the avtable information, what are the tree cash flows in years through 10 that should be used to evaluate the proposed project but the cost of capital for this project is what is your estimate of the awe of the new project? . Given the stable formation, what are the free cash flows in years through to that should be used to evaluate the proposed projec The tree cash flow for your smition Round to the decimal places) en cheche