Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a manager at Percolated Fiber, which is considering adding a new product line. Your boss said to you We already owe these

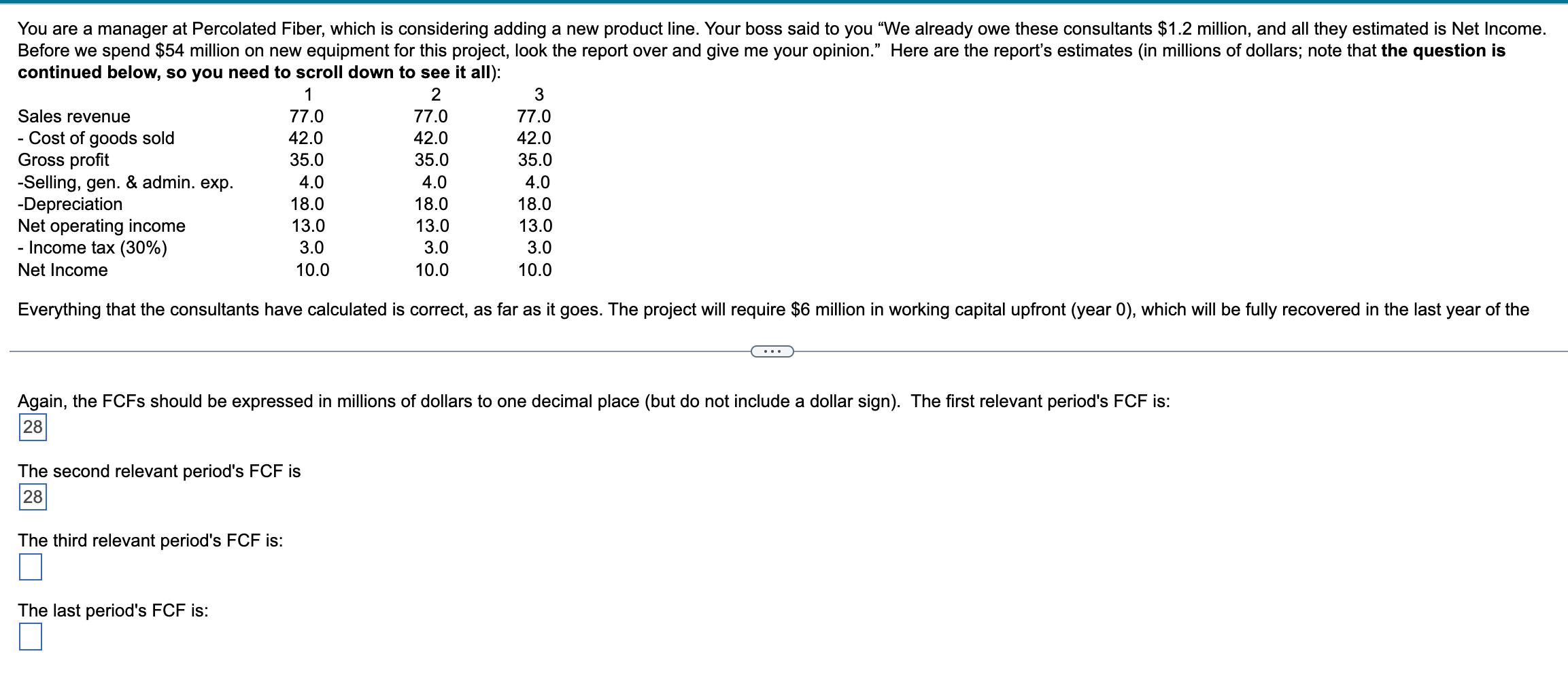

You are a manager at Percolated Fiber, which is considering adding a new product line. Your boss said to you "We already owe these consultants $1.2 million, and all they estimated is Net Income. Before we spend $54 million on new equipment for this project, look the report over and give me your opinion." Here are the report's estimates (in millions of dollars; note that the question is continued below, so you need to scroll down to see it all): 1 2 77.0 77.0 42.0 42.0 35.0 35.0 4.0 18.0 13.0 3.0 10.0 Sales revenue - Cost of goods sold Gross profit -Selling, gen. & admin. exp. -Depreciation Net operating income - Income tax (30%) Net Income 4.0 18.0 13.0 3.0 10.0 Everything that the consultants have calculated is correct, as far as it goes. The project will require $6 million in working capital upfront (year 0), which will be fully recovered in the last year of the Again, the FCFs should be expressed in millions of dollars to one decimal place (but do not include a dollar sign). The first relevant period's FCF is: 28 The second relevant period's FCF is 28 The third relevant period's FCF is: 3 77.0 42.0 35.0 4.0 18.0 13.0 3.0 10.0 The last period's FCF is:

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Free Cash Flow FCF for each period we need to consider the Net Income Depreciation and changes in Working Capital and Capital Expendi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started