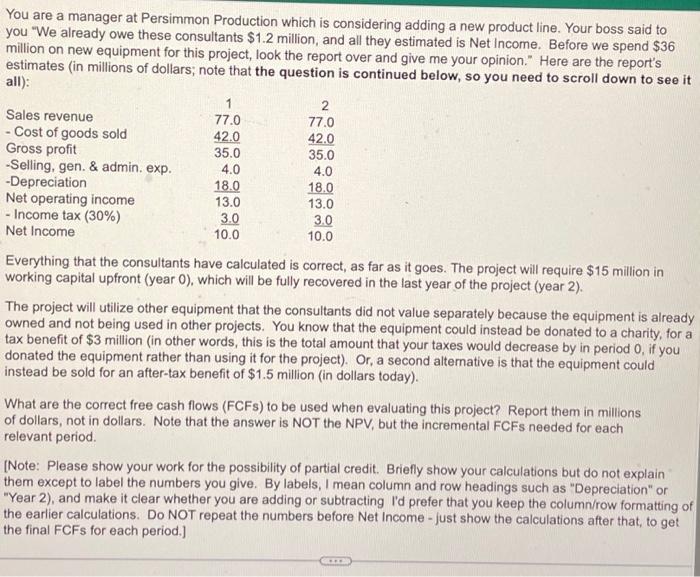

You are a manager at Persimmon Production which is considering adding a new product line. Your boss said to you "We already owe these consultants $1.2 million, and all they estimated is Net Income. Before we spend $36 million on new equipment for this project, look the report over and give me your opinion." Here are the report's estimates (in millions of dollars; note that the question is continued below, so you need to scroll down to see it all): 1 2 Sales revenue 77.0 77.0 - Cost of goods sold 42.0 42.0 Gross profit 35.0 35.0 4.0 4.0 -Selling, gen. & admin. exp. -Depreciation 18.0 18.0 Net operating income 13.0 13.0 3.0 3.0 - Income tax (30%) Net Income 10.0 10.0 Everything that the consultants have calculated is correct, as far as it goes. The project will require $15 million in working capital upfront (year 0), which will be fully recovered in the last year of the project (year 2). The project will utilize other equipment that the consultants did not value separately because the equipment is already owned and not being used in other projects. You know that the equipment could instead be donated to a charity, for a tax benefit of $3 million (in other words, this is the total amount that your taxes would decrease by in period 0, if you donated the equipment rather than using it for the project). Or, a second alternative is that the equipment could instead be sold for an after-tax benefit of $1.5 million (in dollars today). What are the correct free cash flows (FCFS) to be used when evaluating this project? Report them in millions of dollars, not in dollars. Note that the answer is NOT the NPV, but the incremental FCFS needed for each relevant period. [Note: Please show your work for the possibility of partial credit. Briefly show your calculations but do not explain them except to label the numbers you give. By labels, I mean column and row headings such as "Depreciation" or "Year 2), and make it clear whether you are adding or subtracting I'd prefer that you keep the column/row formatting of the earlier calculations. Do NOT repeat the numbers before Net Income - just show the calculations after that, to get the final FCFS for each period.] *** The first relevant period's FCF is: The second relevant period's FCF is: The third relevant period's FCF (if any) is