Answered step by step

Verified Expert Solution

Question

1 Approved Answer

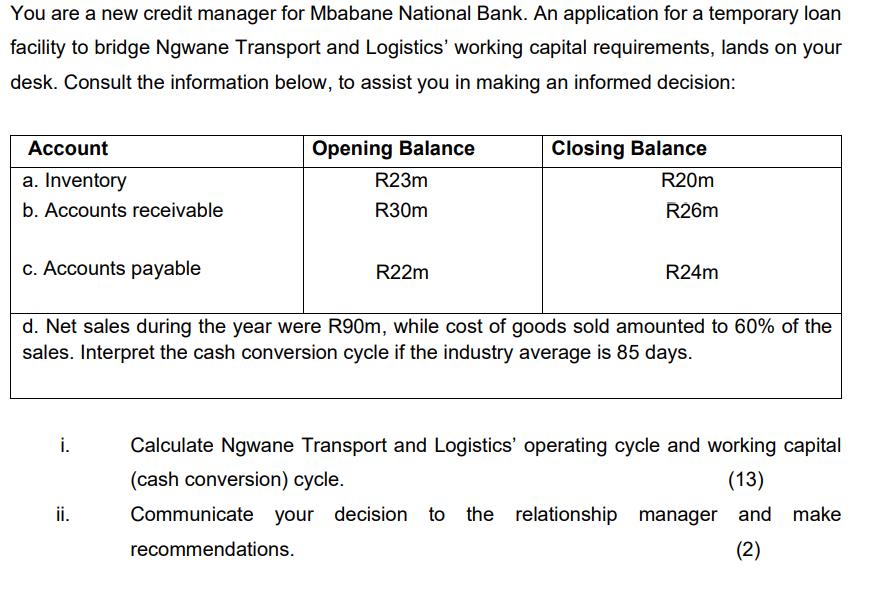

You are a new credit manager for Mbabane National Bank. An application for a temporary loan facility to bridge Ngwane Transport and Logistics' working

You are a new credit manager for Mbabane National Bank. An application for a temporary loan facility to bridge Ngwane Transport and Logistics' working capital requirements, lands on your desk. Consult the information below, to assist you in making an informed decision: Account a. Inventory b. Accounts receivable i. Opening Balance R23m R30m c. Accounts payable d. Net sales during the year were R90m, while cost of goods sold amounted to 60% of the sales. Interpret the cash conversion cycle if the industry average is 85 days. ii. R22m Closing Balance R20m R26m Communicate your decision recommendations. R24m Calculate Ngwane Transport and Logistics' operating cycle and working capital (cash conversion) cycle. (13) your decision to the relationship manager and make (2)

Step by Step Solution

★★★★★

3.41 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate Ngwane Transport and Logistics operating cycle and working capital cycle we need to u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started