Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a newly appointed member to the finance team of Bricks Body Ltd. Bricks Body's main business operations are the manufacturing and selling

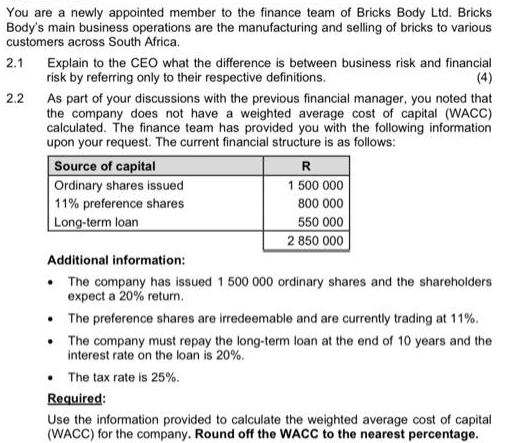

You are a newly appointed member to the finance team of Bricks Body Ltd. Bricks Body's main business operations are the manufacturing and selling of bricks to various customers across South Africa. 2.1 2.2 Explain to the CEO what the difference is between business risk and financial risk by referring only to their respective definitions. (4) As part of your discussions with the previous financial manager, you noted that the company does not have a weighted average cost of capital (WACC) calculated. The finance team has provided you with the following information upon your request. The current financial structure is as follows: Source of capital Ordinary shares issued 11% preference shares Long-term loan Additional information: The company has issued 1 500 000 ordinary shares and the shareholders expect a 20% return. R 1 500 000 800 000 550 000 2 850 000 The preference shares are irredeemable and are currently trading at 11%. The company must repay the long-term loan at the end of 10 years and the interest rate on the loan is 20%. The tax rate is 25%. Required: Use the information provided to calculate the weighted average cost of capital (WACC) for the company. Round off the WACC to the nearest percentage.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

21 Explanation of Business Risk and Financial Risk Business Risk Business risk refers to the risk associated with the companys overall operations and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started