Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a portfolio manager. Consider the following three investment options available in the economy: A risk-free asset with a return of 2% An

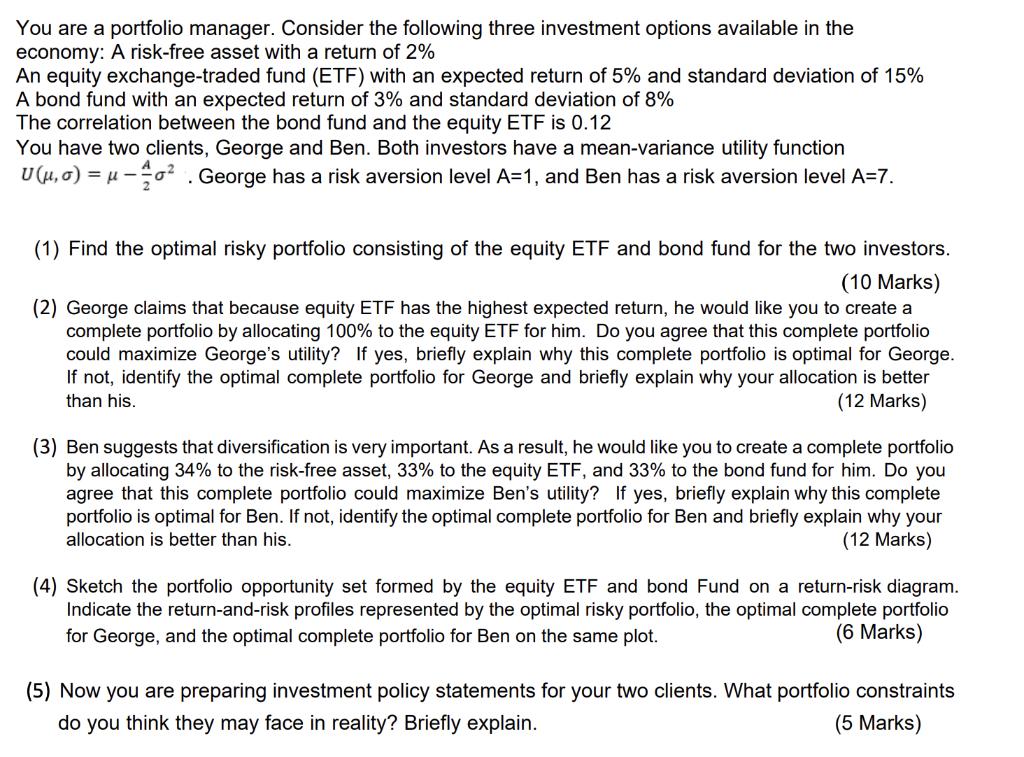

You are a portfolio manager. Consider the following three investment options available in the economy: A risk-free asset with a return of 2% An equity exchange-traded fund (ETF) with an expected return of 5% and standard deviation of 15% A bond fund with an expected return of 3% and standard deviation of 8% The correlation between the bond fund and the equity ETF is 0.12 You have two clients, George and Ben. Both investors have a mean-variance utility function U(,) =- George has a risk aversion level A=1, and Ben has a risk aversion level A=7. . (1) Find the optimal risky portfolio consisting of the equity ETF and bond fund for the two investors. (10 Marks) (2) George claims that because equity ETF has the highest expected return, he would like you to create a complete portfolio by allocating 100% to the equity ETF for him. Do you agree that this complete portfolio could maximize George's utility? If yes, briefly explain why this complete portfolio is optimal for George. If not, identify the optimal complete portfolio for George and briefly explain why your allocation is better than his. (12 Marks) (3) Ben suggests that diversification is very important. As a result, he would like you to create a complete portfolio by allocating 34% to the risk-free asset, 33% to the equity ETF, and 33% to the bond fund for him. Do you agree that this complete portfolio could maximize Ben's utility? If yes, briefly explain why this complete portfolio is optimal for Ben. If not, identify the optimal complete portfolio for Ben and briefly explain why your allocation is better than his. (12 Marks) (4) Sketch the portfolio opportunity set formed by the equity ETF and bond Fund on a return-risk diagram. Indicate the return-and-risk profiles represented by the optimal risky portfolio, the optimal complete portfolio for George, and the optimal complete portfolio for Ben on the same plot. (6 Marks) (5) Now you are preparing investment policy statements for your two clients. What portfolio constraints do you think they may face in reality? Briefly explain. (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started