Question

You are a portfolio manager of Pinnacle Asset Management Co., a money management firm serving high net worth clients. One of your clients is Nick

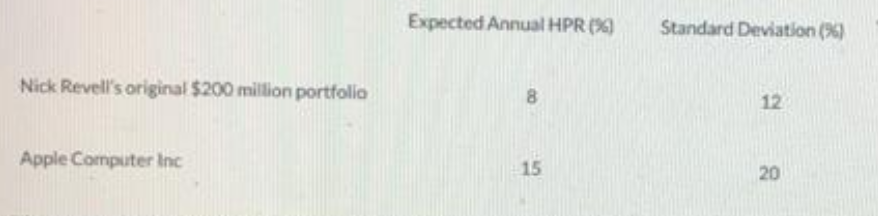

You are a portfolio manager of Pinnacle Asset Management Co., a money management firm serving high net worth clients. One of your clients is Nick Revell. His current US equity portfolio (for which you are responsible) is worth $200 million. Nick will add another $50 million to the portfolio and you are thinking of investing the entire $50 million in Apple Computer Inc. Your equity analyst has just presented you with the following information for the coming year:

The correlation between the original portfolio and Apple is 0.4.

Suppose Nick Revell agrees with your decision to invest in Apple Computer, but he wants to rebalance the new portfolio so that risk is reduced to the minimum. What is the expected return of the minimum variance portfolio?

Expected Annual HPR 1% Standard Deviation (%) Nick Revell's original $200 million portfolio Apple Computer IncStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started