Question

You are a private banker, recently assigned to advise pop music superstar Taylor Quick on her investments. She has just switched her account to your

You are a private banker, recently assigned to advise pop music superstar Taylor Quick on her investments. She has just switched her account to your firm, and so already has a portfolio of assets in place. Eager to impress your new client, you decide to conduct a comprehensive review of her existing portfolio in order to come up with ways to improve its performance. Earlier in the day you had asked a junior analyst to compile a spreadsheet listing all her investments.

Taylor's existing portfolio consists entirely of cheap ETFs (exchange-traded funds) tracking the S&P 500, the Russell 2000 (a popular small-cap index), and the Russell 1000 Value (a popular value index). The analyst also mentions that she had checked whether Taylor's actual portfolio weights were optimal (mean-variance efficient) across these three ETFs, and the answer was yes.

Studying the list of investments, you think back to your Capital Markets class at CBS, recalling two other factor portfolios that had historically outperformed the market: Momentum (UMD) and Betting Against Beta (BAB).

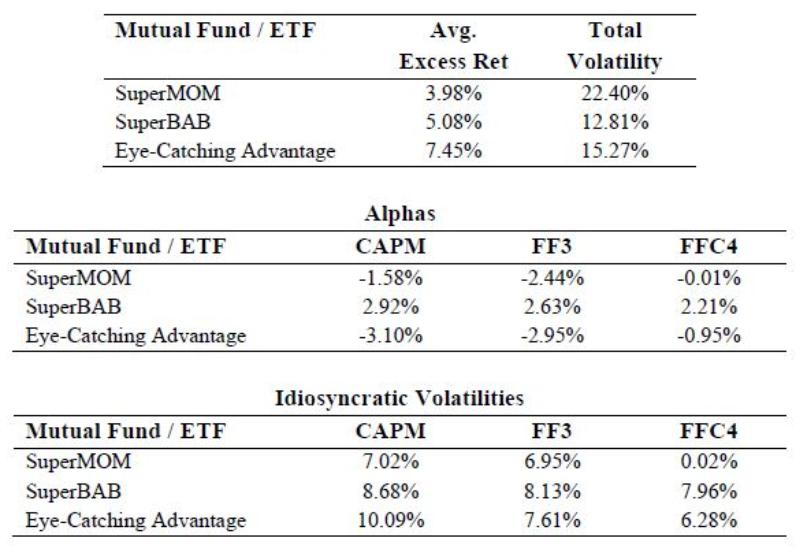

You instruct your analyst to compute historical returns, total volatilities, alphas, and idiosyncratic volatilities for two ETFs that attempt to mimic these factor portfolios (SuperMOM and SuperBAB, respectively) and for an actively-managed (open-ended) mutual fund that had recently caught your eye, the Eye-Catching Advantage Fund. You ask to see results for the CAPM, the Fama-French 3 Factor model (FF3) and the Fama-French-Carhart 4 Factor model (FFC4). The results (all annualized) are reported in the tables below.

Suppose that you believe that the future will resemble the past, and therefore that the historical performance of these funds is an indication of their future performance.

a) (5 points) If you were to move Taylor's entire portfolio into just one of these three funds, which would you choose? Explain the criterion you used and show how it is calculated.

(b) (5 points) More realistically, you might consider adding one of these funds to Taylor's existing portfolio. In this case, which factor model is most appropriate when assessing the new investments, and why?

(c) (5 points) Compute the information ratio for each fund according to all three factor models. If you could choose only one of these funds to add to Taylor's existing portfolio, which would it be? Assume that you cannot short open-ended mutual funds but can short ETFs.

(d) (5 points) Compute the improvement in Taylor's maximum Sharpe ratio if she adds the investment you chose in part (c) and re-optimizes the combined portfolio. The Sharpe ratio of her existing portfolio is 0.39.

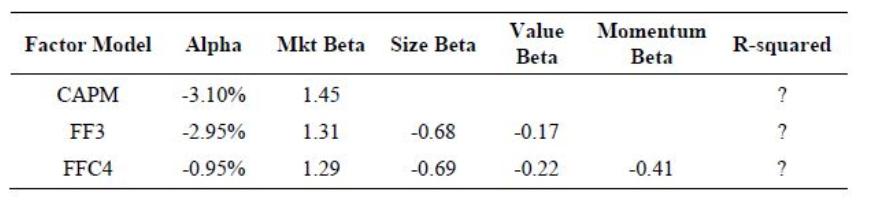

You are surprised to find that the alphas of the Eye-Catching Advantage Fund are negative, but seem to become less negative as you add risk factors to the model. To gain additional insight, you ask your analyst for the full "Security Characteristic Line" (SCL) regression output. The results are shown in the table below.

(e) (5 points) Interpret the factor loadings (betas) for the Fama-French-Carhart 4 Factor model. What types of stocks does the fund tend to hold?

(f) (5 points) Explain why the fund's negative CAPM alpha becomes less negative when we add the size and value factors, and less negative still when we add the momentum factor.

(g) (5 points) Compute the regression R-squares for each factor model. Interpret the results.

(h) (5 points) Based on the evidence in Carhart (1997), which of the factor model alphas do you expect to show persistence in both positive and negative performance? Why is this?

Mutual Fund / ETF Avg. Total Excess Ret Volatility SuperMOM SuperBAB 3.98% 22.40% 5.08% 12.81% Eye-Catching Advantage 7.45% 15.27% Alphas Mutual Fund / ETF CAPM FF3 FFC4 SuperMOM -1.58% -2.44% -0.01% SuperBAB 2.92% 2.63% 2.21% Eye-Catching Advantage -3.10% -2.95% -0.95% Idiosyncratic Volatilities Mutual Fund / ETF CAPM FF3 FFC4 SuperMOM 7.02% 6.95% 0.02% SuperBAB 8.68% 8.13% 7.96% Eye-Catching Advantage 10.09% 7.61% 6.28%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To choose the best fund to move Taylors entire portfolio into we need to consider the criterion of higher expected returns with lower total volatility Looking at the average excess returns and total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started