You are a Project Engineer working for a developer company. Your company require developing a Kolej Komuniti at Tanjung Piai, Johor. There are two (2) suggested sites for the proposed project. Your task as a Project Engineer is to produce an engineering economic analysis for both sites. The information for both sites is given.

question

Benefit-Cost Ratio

- Choose one (1) Financial Institution for Business Financing.

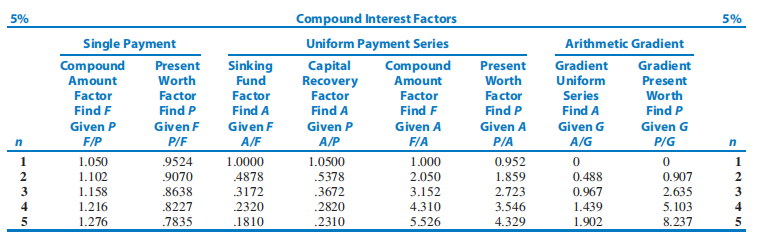

- Use the interest value offered by the Financial Institution to analyze the project using the Benefit Cost Ratio for five (5) years.

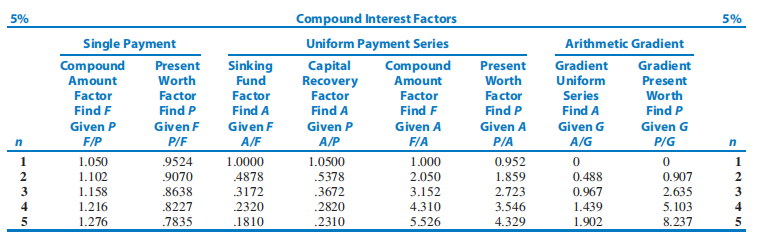

where compound interest factor of five years is

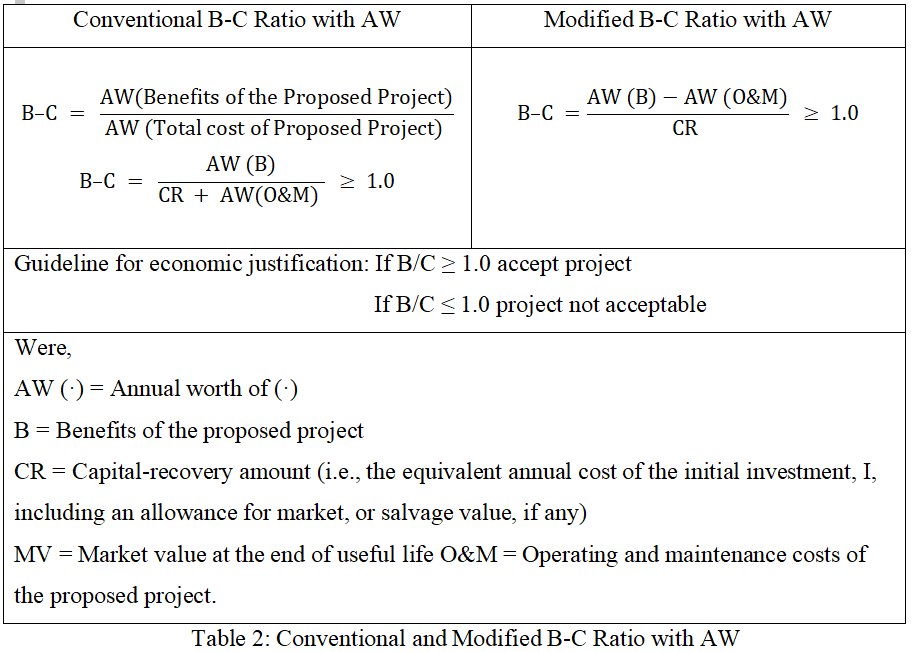

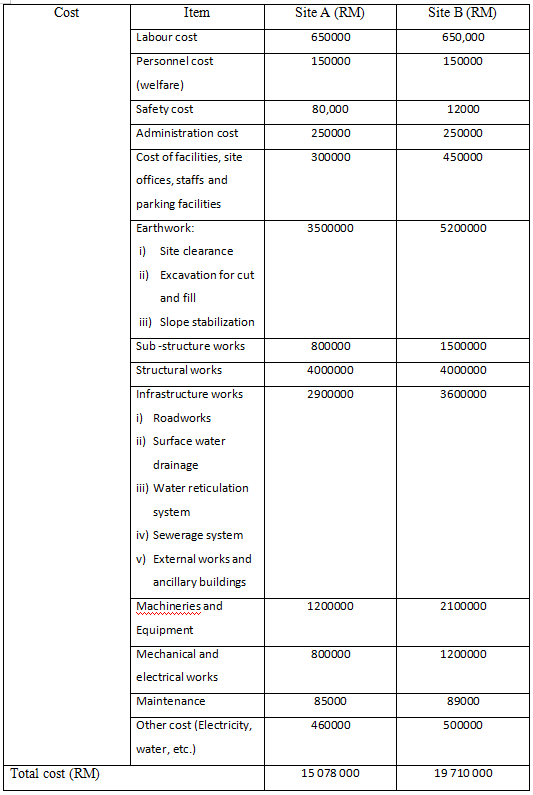

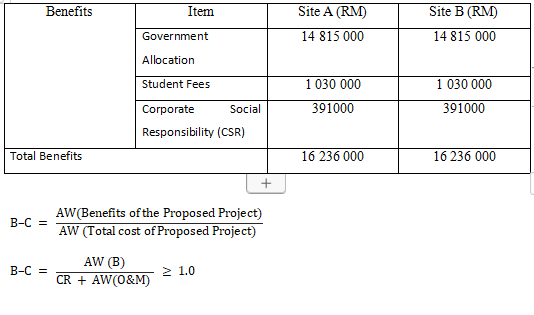

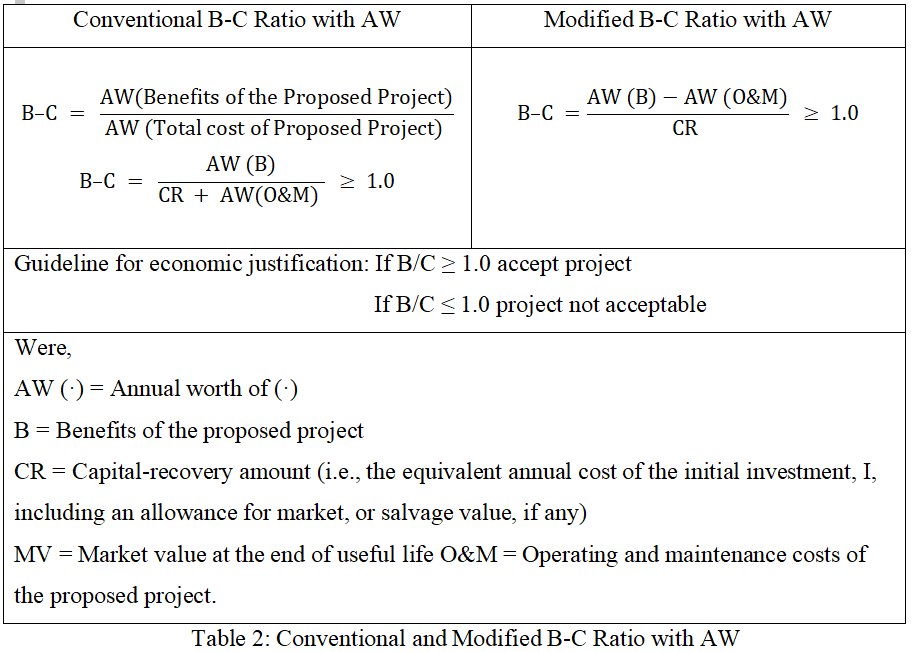

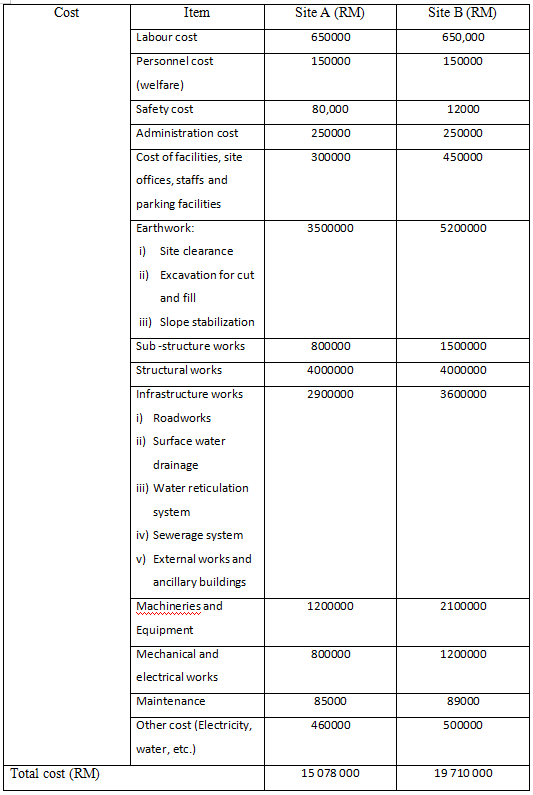

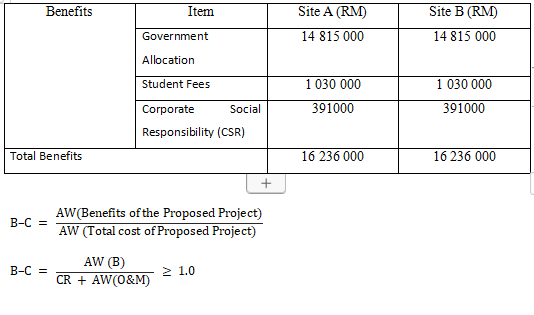

Conventional B-C Ratio with AW B-C = AW (Benefits of the Proposed Project) AW (Total cost of Proposed Project) B-C = AW (B) CR + AW(O&M) 1.0 Modified B-C Ratio with AW B-C = AW (B) - AW (O&M) CR Guideline for economic justification: If B/C 1.0 accept project If B/C 1.0 project not acceptable 1.0 Were, AW (-) = Annual worth of (-) B = Benefits of the proposed project CR = Capital-recovery amount (i.e., the equivalent annual cost of the initial investment, I, including an allowance for market, or salvage value, if any) MV = Market value at the end of useful life O&M = Operating and maintenance costs of the proposed project. Table 2: Conventional and Modified B-C Ratio with AW Cost Total cost (RM) Item Labour cost Personnel cost (welfare) Safety cost Administration cost Cost of facilities, site offices, staffs and parking facilities Earthwork: i) ii) Excavation for cut and fill iii) Slope stabilization Sub-structure works Site clearance Structural works Infrastructure works i) Roadworks ii) Surface water drainage iii) Water reticulation system iv) Sewerage system v) External works and ancillary buildings Machineries and Equipment Mechanical and electrical works Maintenance Other cost (Electricity, water, etc.) Site A (RM) 650000 150000 80,000 250000 300000 3500000 800000 4000000 2900000 1200000 800000 85000 460000 15 078 000 Site B (RM) 650,000 150000 12000 250000 450000 5200000 1500000 4000000 3600000 2100000 1200000 89000 500000 19 710 000 Benefits Total Benefits B-C = B-C = Item Government Allocation Student Fees Corporate Responsibility (CSR) AW (B) CR + AW(O&M) Social AW (Benefits of the Proposed Project) AW (Total cost of Proposed Project) 1.0 + Site A (RM) 14 815 000 1 030 000 391000 16 236 000 Site B (RM) 14 815 000 1 030 000 391000 16 236 000 5% n 1 2345n Single Payment Compound Amount Factor Find F Given P F/P 1.050 1.102 1.158 1.216 1.276 Present Worth Factor Find P Given F P/F 9524 9070 .8638 .8227 .7835 Sinking Fund Factor Find A Given F A/F 1.0000 4878 3172 2320 .1810 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0500 .5378 .3672 .2820 .2310 Compound Amount Factor Find F Given F/A 1.000 2.050 3.152 4.310 5.526 Present Worth Factor Find P Given A P/A 0.952 1.859 2.723 3.546 4.329 Arithmetic Gradient Gradient Gradient Uniform Present Series Worth Find A Find P Given G A/G 0 0.488 0.967 1.439 1.902 Given G P/G 0 0.907 2.635 5.103 8.237 5% n 1 2 SFWN- 3 4 5 Conventional B-C Ratio with AW B-C = AW (Benefits of the Proposed Project) AW (Total cost of Proposed Project) B-C = AW (B) CR + AW(O&M) 1.0 Modified B-C Ratio with AW B-C = AW (B) - AW (O&M) CR Guideline for economic justification: If B/C 1.0 accept project If B/C 1.0 project not acceptable 1.0 Were, AW (-) = Annual worth of (-) B = Benefits of the proposed project CR = Capital-recovery amount (i.e., the equivalent annual cost of the initial investment, I, including an allowance for market, or salvage value, if any) MV = Market value at the end of useful life O&M = Operating and maintenance costs of the proposed project. Table 2: Conventional and Modified B-C Ratio with AW Cost Total cost (RM) Item Labour cost Personnel cost (welfare) Safety cost Administration cost Cost of facilities, site offices, staffs and parking facilities Earthwork: i) ii) Excavation for cut and fill iii) Slope stabilization Sub-structure works Site clearance Structural works Infrastructure works i) Roadworks ii) Surface water drainage iii) Water reticulation system iv) Sewerage system v) External works and ancillary buildings Machineries and Equipment Mechanical and electrical works Maintenance Other cost (Electricity, water, etc.) Site A (RM) 650000 150000 80,000 250000 300000 3500000 800000 4000000 2900000 1200000 800000 85000 460000 15 078 000 Site B (RM) 650,000 150000 12000 250000 450000 5200000 1500000 4000000 3600000 2100000 1200000 89000 500000 19 710 000 Benefits Total Benefits B-C = B-C = Item Government Allocation Student Fees Corporate Responsibility (CSR) AW (B) CR + AW(O&M) Social AW (Benefits of the Proposed Project) AW (Total cost of Proposed Project) 1.0 + Site A (RM) 14 815 000 1 030 000 391000 16 236 000 Site B (RM) 14 815 000 1 030 000 391000 16 236 000 5% n 1 2345n Single Payment Compound Amount Factor Find F Given P F/P 1.050 1.102 1.158 1.216 1.276 Present Worth Factor Find P Given F P/F 9524 9070 .8638 .8227 .7835 Sinking Fund Factor Find A Given F A/F 1.0000 4878 3172 2320 .1810 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0500 .5378 .3672 .2820 .2310 Compound Amount Factor Find F Given F/A 1.000 2.050 3.152 4.310 5.526 Present Worth Factor Find P Given A P/A 0.952 1.859 2.723 3.546 4.329 Arithmetic Gradient Gradient Gradient Uniform Present Series Worth Find A Find P Given G A/G 0 0.488 0.967 1.439 1.902 Given G P/G 0 0.907 2.635 5.103 8.237 5% n 1 2 SFWN- 3 4 5