Answered step by step

Verified Expert Solution

Question

1 Approved Answer

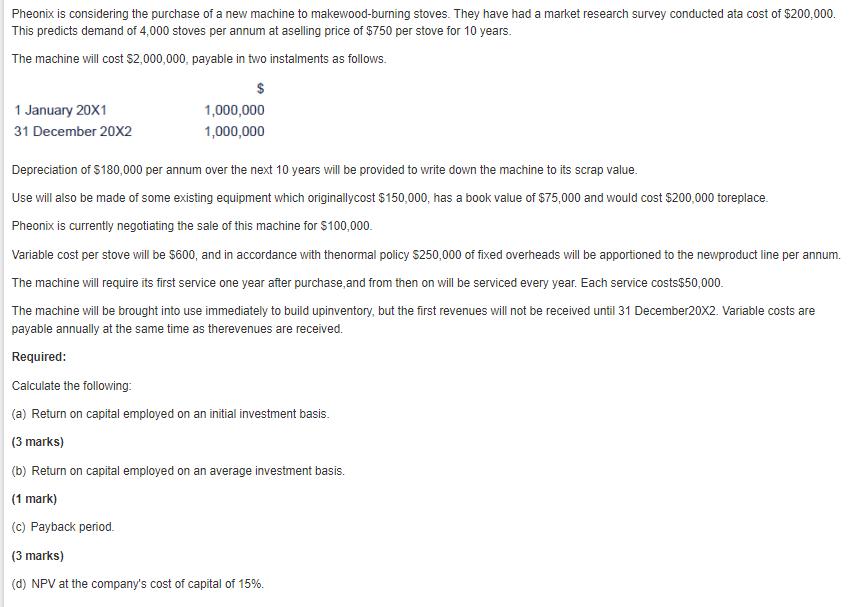

Pheonix is considering the purchase of a new machine to makewood-burning stoves. They have had a market research survey conducted ata cost of $200,000.

Pheonix is considering the purchase of a new machine to makewood-burning stoves. They have had a market research survey conducted ata cost of $200,000. This predicts demand of 4,000 stoves per annum at aselling price of $750 per stove for 10 years. The machine will cost $2,000,000, payable in two instalments as follows. $ 1 January 20X1 31 December 20X2 1,000,000 1,000,000 Depreciation of $180,000 per annum over the next 10 years will be provided to write down the machine to its scrap value. Use will also be made of some existing equipment which originallycost $150,000, has a book value of $75,000 and would cost $200,000 toreplace. Pheonix is currently negotiating the sale of this machine for $100,000. Variable cost per stove will be $600, and in accordance with thenormal policy $250,000 of fixed overheads will be apportioned to the newproduct line per annum. The machine will require its first service one year after purchase, and from then on will be serviced every year. Each service costs$50,000. The machine will be brought into use immediately to build upinventory, but the first revenues will not be received until 31 December20X2. Variable costs are payable annually at the same time as therevenues are received. Required: Calculate the following: (a) Return on capital employed on an initial investment basis. (3 marks) (b) Return on capital employed on an average investment basis. (1 mark) (c) Payback period. (3 marks) (d) NPV at the company's cost of capital of 15%.

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Initial investment basis 2000000 100000 1900000 2 Average capital employed 1900000 1800000 2 185...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started