You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year

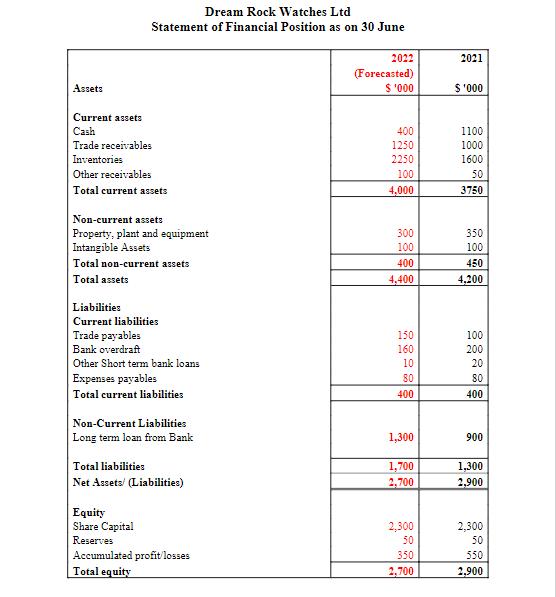

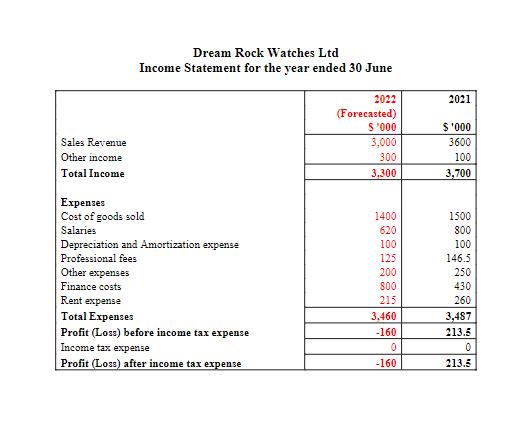

You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year ended 30 June 2022. The audit partner has asked you to assist in the planning of the audit. You gather the following information about DRW. DRW is a manufacturer of fine watches, specializing in gold pocket watches and wristwatches made with precious stones. Diamond engraved gold pocket watches are the most popular sales items. While some of the precious stones are purchased from Australian suppliers, others are purchased from overseas suppliers. All stones are purchased in US dollars regardless of the suppliers location. Due to environmental concerns, some of the African governments are considering closing down the diamond mines in their countries. The company employs two watchmakers who design and manufacture all the watches sold by DRW. The two watchmakers are nearing retirement age. The younger generation is less interested in learning the watchmaker trade and there are few watchmakers with the current employees' skill base. DRW manufacture classic watches and do not follow the latest trends. DRW's experience is that their inventory does not become obsolete. DRW operates a retail store in the heart of Melbourne's shopping district and employs two full- time and four part-time sales staff. The part-time sales staff are university students. Staff are nervous as there have been a number of recent violent thefts on high-end stores throughout Melbourne. As a preventative measure against theft, the store is kept locked. Customers now need to knock on the glass door to be admitted into the store. The watches are kept in locked display cases. Each of the sales staff has a copy of the keys, and a spare copy is kept in the back storeroom. DRW usually has two security guards, but one security guard has left the company and has not been replaced. At night all watches are removed from the display cases and locked in the safe. The store has a security alarm direct to the police station which is switched on at night when the last employee leaves. DRW maintains a point of sale (POS) computer system and therefore uses the perpetual inventory recording method. Most sales are made by credit, but some customers choose to pay by cash. As there is no bank nearby, DRW staff deposit cash into bank once a week, usually on Thursday afternoon. In the past, the manager of the retail store has conducted regular monthly stocktakes of the jewelry. However, the manager has been on intermittent sick leave during the past year, so stocktakes have become less frequent. DRW tries to provide good facilities for its staff. It provides a staffroom with tea and coffee supplies and biscuits. When the company runs low on these supplies, the staff take cash from the DRW register and purchase more tea, coffee and biscuits from the small supermarket nearby. In the past, the company has been very profitable. However, over the last few years, as the influence of Covid pandemic and the fact that the cost of living has increased, people have been less inclined to buy expensive watches and sales and profitability have fallen. This year for the first time, the company has recorded a loss. Key information from the financial statements on 30 June 2022 and 2021 are: Assets Dream Rock Watches Ltd Statement of Financial Position as on 30 June Current assets Cash Trade receivables Inventories Other receivables Total current assets Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets Liabilities Current liabilities Trade payables Bank overdraft Other Short term bank loans Expenses payables Total current liabilities Non-Current Liabilities Long term loan from Bank Total liabilities Net Assets/ (Liabilities) Equity Share Capital Reserves Accumulated profit/losses Total equity 2022 (Forecasted) $'000 400 1250 2250 100 4,000 300 100 400 4,400 150 160 10 80 400 1,300 1,700 2,700 2,300 50 350 2,700 2021 $'000 1100 1000 1600 50 3750 350 100 450 4,200 100 200 20 80 400 900 1,300 2,900 2,300 50 550 2,900 Sales Revenue Other income Total Income Dream Rock Watches Ltd Income Statement for the year ended 30 June Expenses Cost of goods sold Salaries Depreciation and Amortization expense Professional fees Other expenses Finance costs Rent expense Total Expenses Profit (Loss) before income tax expense Income tax expense Profit (Loss) after income tax expense 2022 (Forecasted) $'000 3,000 300 3,300 1400 620 100 125 200 800 215 3.460 -160 0 -160 2021 $'000 3600 100 3,700 1500 800 100 146.5 250 430 260 3,487 213.5 0 213.5 Required: 1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case. please identify three major inherent risks and explain why you believe they are inherent risks. 2. Perform an analytical review (i.e., ratio analysis) comparing the financial statements for 2022 and 2021, identify the key financial ratios and the key accounts that audit team should pay greater attention to. Explain why. 3. Identify three major control risks and explain why you believe they are control risks. 4. Identify and explain three internal control strengths in DRW. 5. Based on your assessment of the three components of the audit risk, what audit strategy would you adopt? Explain why. 6. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors. You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year ended 30 June 2022. The audit partner has asked you to assist in the planning of the audit. You gather the following information about DRW. DRW is a manufacturer of fine watches, specializing in gold pocket watches and wristwatches made with precious stones. Diamond engraved gold pocket watches are the most popular sales items. While some of the precious stones are purchased from Australian suppliers, others are purchased from overseas suppliers. All stones are purchased in US dollars regardless of the suppliers location. Due to environmental concerns, some of the African governments are considering closing down the diamond mines in their countries. The company employs two watchmakers who design and manufacture all the watches sold by DRW. The two watchmakers are nearing retirement age. The younger generation is less interested in learning the watchmaker trade and there are few watchmakers with the current employees' skill base. DRW manufacture classic watches and do not follow the latest trends. DRW's experience is that their inventory does not become obsolete. DRW operates a retail store in the heart of Melbourne's shopping district and employs two full- time and four part-time sales staff. The part-time sales staff are university students. Staff are nervous as there have been a number of recent violent thefts on high-end stores throughout Melbourne. As a preventative measure against theft, the store is kept locked. Customers now need to knock on the glass door to be admitted into the store. The watches are kept in locked display cases. Each of the sales staff has a copy of the keys, and a spare copy is kept in the back storeroom. DRW usually has two security guards, but one security guard has left the company and has not been replaced. At night all watches are removed from the display cases and locked in the safe. The store has a security alarm direct to the police station which is switched on at night when the last employee leaves. DRW maintains a point of sale (POS) computer system and therefore uses the perpetual inventory recording method. Most sales are made by credit, but some customers choose to pay by cash. As there is no bank nearby, DRW staff deposit cash into bank once a week, usually on Thursday afternoon. In the past, the manager of the retail store has conducted regular monthly stocktakes of the jewelry. However, the manager has been on intermittent sick leave during the past year, so stocktakes have become less frequent. DRW tries to provide good facilities for its staff. It provides a staffroom with tea and coffee supplies and biscuits. When the company runs low on these supplies, the staff take cash from the DRW register and purchase more tea, coffee and biscuits from the small supermarket nearby. In the past, the company has been very profitable. However, over the last few years, as the influence of Covid pandemic and the fact that the cost of living has increased, people have been less inclined to buy expensive watches and sales and profitability have fallen. This year for the first time, the company has recorded a loss. Key information from the financial statements on 30 June 2022 and 2021 are: Assets Dream Rock Watches Ltd Statement of Financial Position as on 30 June Current assets Cash Trade receivables Inventories Other receivables Total current assets Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets Liabilities Current liabilities Trade payables Bank overdraft Other Short term bank loans Expenses payables Total current liabilities Non-Current Liabilities Long term loan from Bank Total liabilities Net Assets/ (Liabilities) Equity Share Capital Reserves Accumulated profit/losses Total equity 2022 (Forecasted) $'000 400 1250 2250 100 4,000 300 100 400 4,400 150 160 10 80 400 1,300 1,700 2,700 2,300 50 350 2,700 2021 $'000 1100 1000 1600 50 3750 350 100 450 4,200 100 200 20 80 400 900 1,300 2,900 2,300 50 550 2,900 Sales Revenue Other income Total Income Dream Rock Watches Ltd Income Statement for the year ended 30 June Expenses Cost of goods sold Salaries Depreciation and Amortization expense Professional fees Other expenses Finance costs Rent expense Total Expenses Profit (Loss) before income tax expense Income tax expense Profit (Loss) after income tax expense 2022 (Forecasted) $'000 3,000 300 3,300 1400 620 100 125 200 800 215 3.460 -160 0 -160 2021 $'000 3600 100 3,700 1500 800 100 146.5 250 430 260 3,487 213.5 0 213.5 Required: 1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case. please identify three major inherent risks and explain why you believe they are inherent risks. 2. Perform an analytical review (i.e., ratio analysis) comparing the financial statements for 2022 and 2021, identify the key financial ratios and the key accounts that audit team should pay greater attention to. Explain why. 3. Identify three major control risks and explain why you believe they are control risks. 4. Identify and explain three internal control strengths in DRW. 5. Based on your assessment of the three components of the audit risk, what audit strategy would you adopt? Explain why. 6. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors. You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year ended 30 June 2022. The audit partner has asked you to assist in the planning of the audit. You gather the following information about DRW. DRW is a manufacturer of fine watches, specializing in gold pocket watches and wristwatches made with precious stones. Diamond engraved gold pocket watches are the most popular sales items. While some of the precious stones are purchased from Australian suppliers, others are purchased from overseas suppliers. All stones are purchased in US dollars regardless of the suppliers location. Due to environmental concerns, some of the African governments are considering closing down the diamond mines in their countries. The company employs two watchmakers who design and manufacture all the watches sold by DRW. The two watchmakers are nearing retirement age. The younger generation is less interested in learning the watchmaker trade and there are few watchmakers with the current employees' skill base. DRW manufacture classic watches and do not follow the latest trends. DRW's experience is that their inventory does not become obsolete. DRW operates a retail store in the heart of Melbourne's shopping district and employs two full- time and four part-time sales staff. The part-time sales staff are university students. Staff are nervous as there have been a number of recent violent thefts on high-end stores throughout Melbourne. As a preventative measure against theft, the store is kept locked. Customers now need to knock on the glass door to be admitted into the store. The watches are kept in locked display cases. Each of the sales staff has a copy of the keys, and a spare copy is kept in the back storeroom. DRW usually has two security guards, but one security guard has left the company and has not been replaced. At night all watches are removed from the display cases and locked in the safe. The store has a security alarm direct to the police station which is switched on at night when the last employee leaves. DRW maintains a point of sale (POS) computer system and therefore uses the perpetual inventory recording method. Most sales are made by credit, but some customers choose to pay by cash. As there is no bank nearby, DRW staff deposit cash into bank once a week, usually on Thursday afternoon. In the past, the manager of the retail store has conducted regular monthly stocktakes of the jewelry. However, the manager has been on intermittent sick leave during the past year, so stocktakes have become less frequent. DRW tries to provide good facilities for its staff. It provides a staffroom with tea and coffee supplies and biscuits. When the company runs low on these supplies, the staff take cash from the DRW register and purchase more tea, coffee and biscuits from the small supermarket nearby. In the past, the company has been very profitable. However, over the last few years, as the influence of Covid pandemic and the fact that the cost of living has increased, people have been less inclined to buy expensive watches and sales and profitability have fallen. This year for the first time, the company has recorded a loss. Key information from the financial statements on 30 June 2022 and 2021 are: Assets Dream Rock Watches Ltd Statement of Financial Position as on 30 June Current assets Cash Trade receivables Inventories Other receivables Total current assets Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets Liabilities Current liabilities Trade payables Bank overdraft Other Short term bank loans Expenses payables Total current liabilities Non-Current Liabilities Long term loan from Bank Total liabilities Net Assets/ (Liabilities) Equity Share Capital Reserves Accumulated profit/losses Total equity 2022 (Forecasted) $'000 400 1250 2250 100 4,000 300 100 400 4,400 150 160 10 80 400 1,300 1,700 2,700 2,300 50 350 2,700 2021 $'000 1100 1000 1600 50 3750 350 100 450 4,200 100 200 20 80 400 900 1,300 2,900 2,300 50 550 2,900 Sales Revenue Other income Total Income Dream Rock Watches Ltd Income Statement for the year ended 30 June Expenses Cost of goods sold Salaries Depreciation and Amortization expense Professional fees Other expenses Finance costs Rent expense Total Expenses Profit (Loss) before income tax expense Income tax expense Profit (Loss) after income tax expense 2022 (Forecasted) $'000 3,000 300 3,300 1400 620 100 125 200 800 215 3.460 -160 0 -160 2021 $'000 3600 100 3,700 1500 800 100 146.5 250 430 260 3,487 213.5 0 213.5 Required: 1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case. please identify three major inherent risks and explain why you believe they are inherent risks. 2. Perform an analytical review (i.e., ratio analysis) comparing the financial statements for 2022 and 2021, identify the key financial ratios and the key accounts that audit team should pay greater attention to. Explain why. 3. Identify three major control risks and explain why you believe they are control risks. 4. Identify and explain three internal control strengths in DRW. 5. Based on your assessment of the three components of the audit risk, what audit strategy would you adopt? Explain why. 6. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors. You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year ended 30 June 2022. The audit partner has asked you to assist in the planning of the audit. You gather the following information about DRW. DRW is a manufacturer of fine watches, specializing in gold pocket watches and wristwatches made with precious stones. Diamond engraved gold pocket watches are the most popular sales items. While some of the precious stones are purchased from Australian suppliers, others are purchased from overseas suppliers. All stones are purchased in US dollars regardless of the suppliers location. Due to environmental concerns, some of the African governments are considering closing down the diamond mines in their countries. The company employs two watchmakers who design and manufacture all the watches sold by DRW. The two watchmakers are nearing retirement age. The younger generation is less interested in learning the watchmaker trade and there are few watchmakers with the current employees' skill base. DRW manufacture classic watches and do not follow the latest trends. DRW's experience is that their inventory does not become obsolete. DRW operates a retail store in the heart of Melbourne's shopping district and employs two full- time and four part-time sales staff. The part-time sales staff are university students. Staff are nervous as there have been a number of recent violent thefts on high-end stores throughout Melbourne. As a preventative measure against theft, the store is kept locked. Customers now need to knock on the glass door to be admitted into the store. The watches are kept in locked display cases. Each of the sales staff has a copy of the keys, and a spare copy is kept in the back storeroom. DRW usually has two security guards, but one security guard has left the company and has not been replaced. At night all watches are removed from the display cases and locked in the safe. The store has a security alarm direct to the police station which is switched on at night when the last employee leaves. DRW maintains a point of sale (POS) computer system and therefore uses the perpetual inventory recording method. Most sales are made by credit, but some customers choose to pay by cash. As there is no bank nearby, DRW staff deposit cash into bank once a week, usually on Thursday afternoon. In the past, the manager of the retail store has conducted regular monthly stocktakes of the jewelry. However, the manager has been on intermittent sick leave during the past year, so stocktakes have become less frequent. DRW tries to provide good facilities for its staff. It provides a staffroom with tea and coffee supplies and biscuits. When the company runs low on these supplies, the staff take cash from the DRW register and purchase more tea, coffee and biscuits from the small supermarket nearby. In the past, the company has been very profitable. However, over the last few years, as the influence of Covid pandemic and the fact that the cost of living has increased, people have been less inclined to buy expensive watches and sales and profitability have fallen. This year for the first time, the company has recorded a loss. Key information from the financial statements on 30 June 2022 and 2021 are: Assets Dream Rock Watches Ltd Statement of Financial Position as on 30 June Current assets Cash Trade receivables Inventories Other receivables Total current assets Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets Liabilities Current liabilities Trade payables Bank overdraft Other Short term bank loans Expenses payables Total current liabilities Non-Current Liabilities Long term loan from Bank Total liabilities Net Assets/ (Liabilities) Equity Share Capital Reserves Accumulated profit/losses Total equity 2022 (Forecasted) $'000 400 1250 2250 100 4,000 300 100 400 4,400 150 160 10 80 400 1,300 1,700 2,700 2,300 50 350 2,700 2021 $'000 1100 1000 1600 50 3750 350 100 450 4,200 100 200 20 80 400 900 1,300 2,900 2,300 50 550 2,900 Sales Revenue Other income Total Income Dream Rock Watches Ltd Income Statement for the year ended 30 June Expenses Cost of goods sold Salaries Depreciation and Amortization expense Professional fees Other expenses Finance costs Rent expense Total Expenses Profit (Loss) before income tax expense Income tax expense Profit (Loss) after income tax expense 2022 (Forecasted) $'000 3,000 300 3,300 1400 620 100 125 200 800 215 3.460 -160 0 -160 2021 $'000 3600 100 3,700 1500 800 100 146.5 250 430 260 3,487 213.5 0 213.5 Required: 1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case. please identify three major inherent risks and explain why you believe they are inherent risks. 2. Perform an analytical review (i.e., ratio analysis) comparing the financial statements for 2022 and 2021, identify the key financial ratios and the key accounts that audit team should pay greater attention to. Explain why. 3. Identify three major control risks and explain why you believe they are control risks. 4. Identify and explain three internal control strengths in DRW. 5. Based on your assessment of the three components of the audit risk, what audit strategy would you adopt? Explain why. 6. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors. You are a senior auditor employed in a mid-tier accounting firm, working on the audit of Dream Rock Watches Ltd (DRW) for the year ended 30 June 2022. The audit partner has asked you to assist in the planning of the audit. You gather the following information about DRW. DRW is a manufacturer of fine watches, specializing in gold pocket watches and wristwatches made with precious stones. Diamond engraved gold pocket watches are the most popular sales items. While some of the precious stones are purchased from Australian suppliers, others are purchased from overseas suppliers. All stones are purchased in US dollars regardless of the suppliers location. Due to environmental concerns, some of the African governments are considering closing down the diamond mines in their countries. The company employs two watchmakers who design and manufacture all the watches sold by DRW. The two watchmakers are nearing retirement age. The younger generation is less interested in learning the watchmaker trade and there are few watchmakers with the current employees' skill base. DRW manufacture classic watches and do not follow the latest trends. DRW's experience is that their inventory does not become obsolete. DRW operates a retail store in the heart of Melbourne's shopping district and employs two full- time and four part-time sales staff. The part-time sales staff are university students. Staff are nervous as there have been a number of recent violent thefts on high-end stores throughout Melbourne. As a preventative measure against theft, the store is kept locked. Customers now need to knock on the glass door to be admitted into the store. The watches are kept in locked display cases. Each of the sales staff has a copy of the keys, and a spare copy is kept in the back storeroom. DRW usually has two security guards, but one security guard has left the company and has not been replaced. At night all watches are removed from the display cases and locked in the safe. The store has a security alarm direct to the police station which is switched on at night when the last employee leaves. DRW maintains a point of sale (POS) computer system and therefore uses the perpetual inventory recording method. Most sales are made by credit, but some customers choose to pay by cash. As there is no bank nearby, DRW staff deposit cash into bank once a week, usually on Thursday afternoon. In the past, the manager of the retail store has conducted regular monthly stocktakes of the jewelry. However, the manager has been on intermittent sick leave during the past year, so stocktakes have become less frequent. DRW tries to provide good facilities for its staff. It provides a staffroom with tea and coffee supplies and biscuits. When the company runs low on these supplies, the staff take cash from the DRW register and purchase more tea, coffee and biscuits from the small supermarket nearby. In the past, the company has been very profitable. However, over the last few years, as the influence of Covid pandemic and the fact that the cost of living has increased, people have been less inclined to buy expensive watches and sales and profitability have fallen. This year for the first time, the company has recorded a loss. Key information from the financial statements on 30 June 2022 and 2021 are: Assets Dream Rock Watches Ltd Statement of Financial Position as on 30 June Current assets Cash Trade receivables Inventories Other receivables Total current assets Non-current assets Property, plant and equipment Intangible Assets Total non-current assets Total assets Liabilities Current liabilities Trade payables Bank overdraft Other Short term bank loans Expenses payables Total current liabilities Non-Current Liabilities Long term loan from Bank Total liabilities Net Assets/ (Liabilities) Equity Share Capital Reserves Accumulated profit/losses Total equity 2022 (Forecasted) $'000 400 1250 2250 100 4,000 300 100 400 4,400 150 160 10 80 400 1,300 1,700 2,700 2,300 50 350 2,700 2021 $'000 1100 1000 1600 50 3750 350 100 450 4,200 100 200 20 80 400 900 1,300 2,900 2,300 50 550 2,900 Sales Revenue Other income Total Income Dream Rock Watches Ltd Income Statement for the year ended 30 June Expenses Cost of goods sold Salaries Depreciation and Amortization expense Professional fees Other expenses Finance costs Rent expense Total Expenses Profit (Loss) before income tax expense Income tax expense Profit (Loss) after income tax expense 2022 (Forecasted) $'000 3,000 300 3,300 1400 620 100 125 200 800 215 3.460 -160 0 -160 2021 $'000 3600 100 3,700 1500 800 100 146.5 250 430 260 3,487 213.5 0 213.5 Required: 1. ASA 315 requires auditors to understand the client for the purpose of assessing the risk of material misstatements in financial reports. Based on the provided information in this case. please identify three major inherent risks and explain why you believe they are inherent risks. 2. Perform an analytical review (i.e., ratio analysis) comparing the financial statements for 2022 and 2021, identify the key financial ratios and the key accounts that audit team should pay greater attention to. Explain why. 3. Identify three major control risks and explain why you believe they are control risks. 4. Identify and explain three internal control strengths in DRW. 5. Based on your assessment of the three components of the audit risk, what audit strategy would you adopt? Explain why. 6. Based on the results of the analytical review, perform an assessment of the ability of the company to continue as a going concern in the future. Justify your answer. If there are indicators of going concern issue, identify any mitigating factors.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Inherent Risks a Inventory Valuation DRW specializes in manufacturing highend watches that use precious stones The valuation of inventory is complex and requires significant judgment Additi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started