Question

You are a senior financial analyst of a firm based in Melbourne. You have been assigned with the task of training interns who recently joined

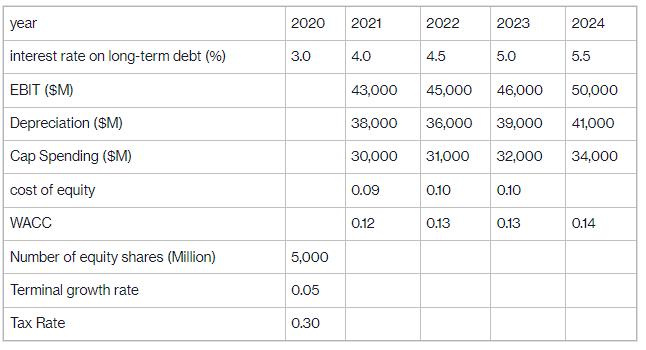

You are a senior financial analyst of a firm based in Melbourne. You have been assigned with the task of training interns who recently joined your firm on how to use the free cash flow model to estimate the value of a company. You have collected data on the following data:

The long-term debt in 2020 was $58000. The company plans an annual compound growth of 5% for the long-term debt. The working capital of the company in 2020 was $15,000. The company plans an

annual compound growth of 6% for the working capital. Using the information you have collected above, perform calculations to explain to interns as to how the following are calculated:

i. Free cash flow to firm

ii. Free cash to equity

iii. Value of the firm according to the free cash flow to firm method

iv. Value of the firm according to the free cash flow to equity method

v. Estimated price of an equity share according to the free cash flow to firm method and the free cash flow to equity method

A company must make a payment of $25,937 in 10 years. The market interest rate is 10%. The company's portfolio manager wishes to fund the obligation using four-year zero-coupon bonds and perpetuities paying annual coupons.

How can the manager immunize the obligation?

Suppose that three years have passed, and the interest rate remains at 10%. Is the position still fully funded? Is it still immunized? If not, what actions are required?

year interest rate on long-term debt (%) EBIT (SM) Depreciation ($M) Cap Spending ($M) cost of equity WACC Number of equity shares (Million) Terminal growth rate Tax Rate 2020 3.0 5,000 0.05 0.30 2021 4.0 43,000 0.09 2022 0.12 4.5 45,000 46,000 38,000 36,000 39,000 41,000 30,000 31,000 32,000 34,000 0.10 2023 0.13 5.0 0.10 2024 0.13 5.5 50,000 0.14

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various values and explain the calculations lets go step by step i Free cash flow to firm FCFF FCFF represents the cash generated by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started