Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a shareholder in Tyche Insurance plc and have been informed by the company that there are two larger companies interested in taking

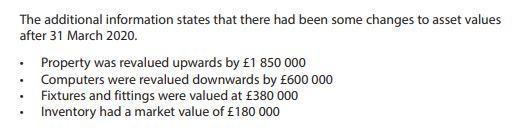

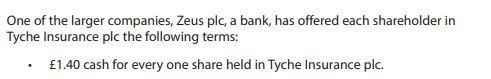

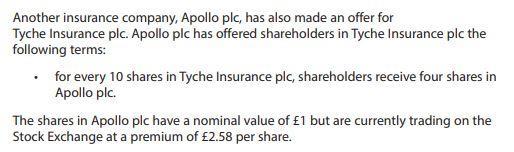

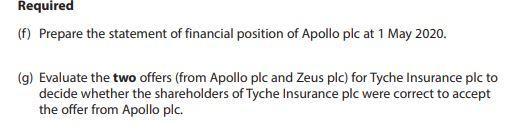

You are a shareholder in Tyche Insurance plc and have been informed by the company that there are two larger companies interested in taking over Tyche Insurance plc. You have received a copy of the Statement of Financial Position of Tyche Insurance plc at March 2020 with some additional information. Statement of financial position of Tyche Insurance plc at 31 March 2020 '000 '000 Assets Non-current assets Property, plant and equipment Computers Fixtures and fittings 9 500 2 200 600 Furniture 450 12 750 Current assets Inventory Trade receivables Cash and cash equivalents 220 3 370 1110 4 700 Total assets 17 450 Equity Ordinary shares of 0.80 each Retained earnings Total equity 10 000 3 800 13 800 Liabilities Non-current liabilities Mortgage Bank loan 2 300 500 2 800 Current liabilities Trade payables Other payables 660 190 850 Total liabilities 3 650 Total equity and liabilities 17 450 The additional information states that there had been some changes to asset values after 31 March 2020. Property was revalued upwards by 1 850 000 Computers were revalued downwards by 600 000 Fixtures and fittings were valued at 380 000 Inventory had a market value of 180 000 One of the larger companies, Zeus plc, a bank, has offered each shareholder in Tyche Insurance plc the following terms: 1.40 cash for every one share held in Tyche Insurance plc. Another insurance company, Apollo plc, has also made an offer for Tyche Insurance plc. Apollo plc has offered shareholders in Tyche Insurance plc the following terms: for every 10 shares in Tyche Insurance plc, shareholders receive four shares in Apollo plc. The shares in Apollo plc have a nominal value of 1 but are currently trading on the Stock Exchange at a premium of 2.58 per share. The shareholders of Tyche Insurance plc decided to accept the offer from Apollo plc. The takeover took place on 1 May 2020. The statement of financial position of Apollo plc at 30 April 2020 is shown below. Statement of financial position of Apollo plc at 30 April 2020 '000 '000 Assets Non-current assets Property, plant and equipment Computers Fixtures and fittings Furniture 52 700 9 500 3 100 1 860 67 160 Current assets Inventory 560 Trade receivables Cash and cash equivalents 18730 5130 24 420 Total assets 91 580 Equity Ordinary shares of 1.00 each General reserve Retained earnings Total equity 50 000 3 500 20 180 73 680 Liabilities Non-current liabilities Mortgage Bank loan 11 590 2 400 13 990 Current liabilities Trade payables Other payables 3 130 780 3910 Total liabilities 17 900 Total equity and liabilities 91 580 Required (f) Prepare the statement of financial position of Apollo plc at 1 May 2020. (g) Evaluate the two offers (from Apollo plc and Zeus plc) for Tyche Insurance plc to decide whether the shareholders of Tyche Insurance plc were correct to accept the offer from Apollo plc.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Appolo Plc I May 2020 Asset 000 000 Property plant and Equipment 52700 Add aquired 9500 62200 Comput...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started