Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a supply chain analyst working for a Japanese automotive company planning to introduce a new electric car model for the European market. The

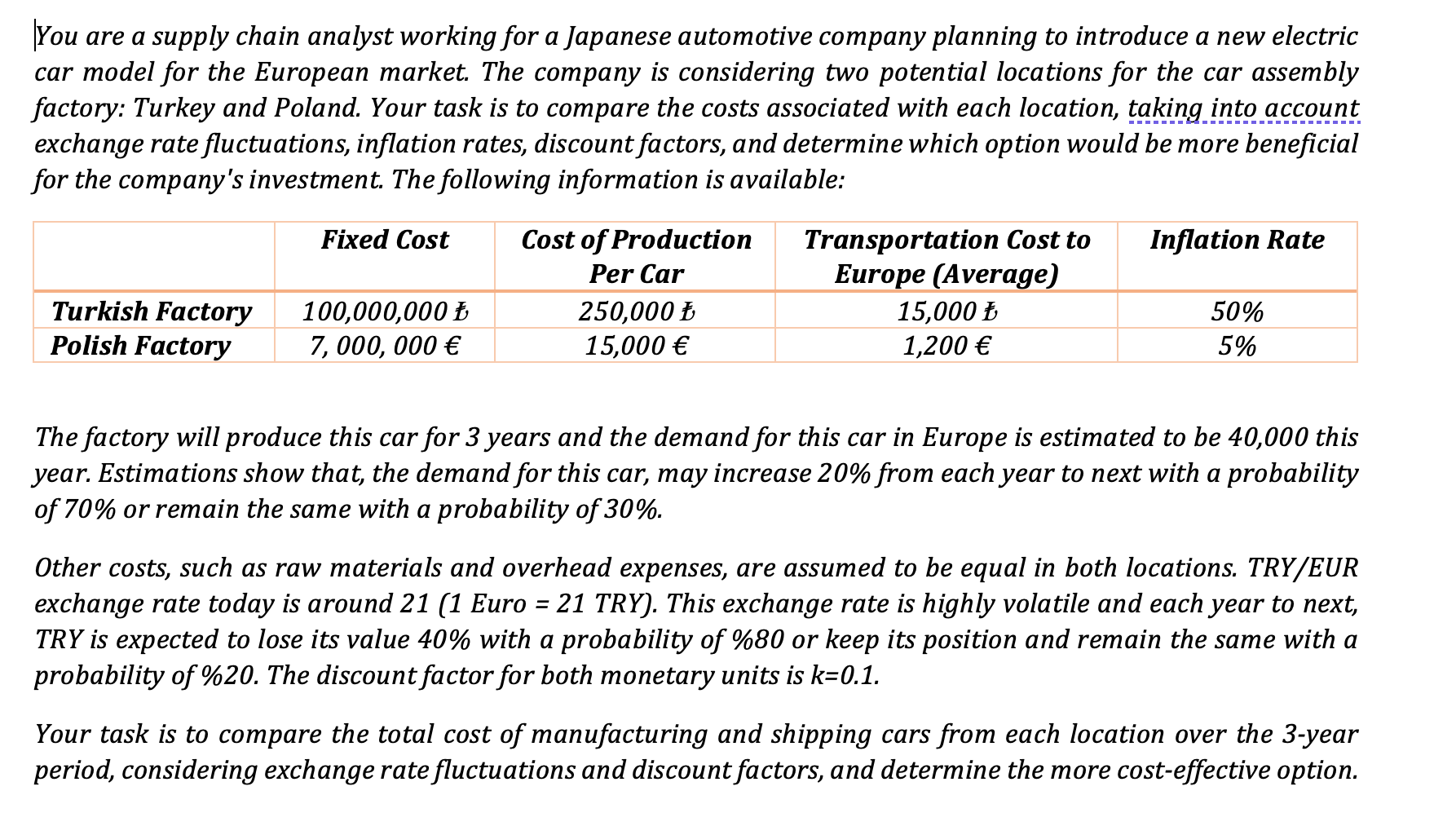

You are a supply chain analyst working for a Japanese automotive company planning to introduce a new electric car model for the European market. The company is considering two potential locations for the car assembly factory: Turkey and Poland. Your task is to compare the costs associated with each location, taking into account exchange rate fluctuations, inflation rates, discount factors, and determine which option would be more beneficial for the company's investment. The following information is available: The factory will produce this car for 3 years and the demand for this car in Europe is estimated to be 40,000 this year. Estimations show that, the demand for this car, may increase 20% from each year to next with a probability of 70% or remain the same with a probability of 30%. Other costs, such as raw materials and overhead expenses, are assumed to be equal in both locations. TRY/EUR exchange rate today is around 21 (1 Euro =21TRY ). This exchange rate is highly volatile and each year to next, TRY is expected to lose its value 40% with a probability of %80 or keep its position and remain the same with a probability of \%20. The discount factor for both monetary units is k=0.1. Your task is to compare the total cost of manufacturing and shipping cars from each location over the 3-year period, considering exchange rate fluctuations and discount factors, and determine the more cost-effective option

You are a supply chain analyst working for a Japanese automotive company planning to introduce a new electric car model for the European market. The company is considering two potential locations for the car assembly factory: Turkey and Poland. Your task is to compare the costs associated with each location, taking into account exchange rate fluctuations, inflation rates, discount factors, and determine which option would be more beneficial for the company's investment. The following information is available: The factory will produce this car for 3 years and the demand for this car in Europe is estimated to be 40,000 this year. Estimations show that, the demand for this car, may increase 20% from each year to next with a probability of 70% or remain the same with a probability of 30%. Other costs, such as raw materials and overhead expenses, are assumed to be equal in both locations. TRY/EUR exchange rate today is around 21 (1 Euro =21TRY ). This exchange rate is highly volatile and each year to next, TRY is expected to lose its value 40% with a probability of %80 or keep its position and remain the same with a probability of \%20. The discount factor for both monetary units is k=0.1. Your task is to compare the total cost of manufacturing and shipping cars from each location over the 3-year period, considering exchange rate fluctuations and discount factors, and determine the more cost-effective option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started